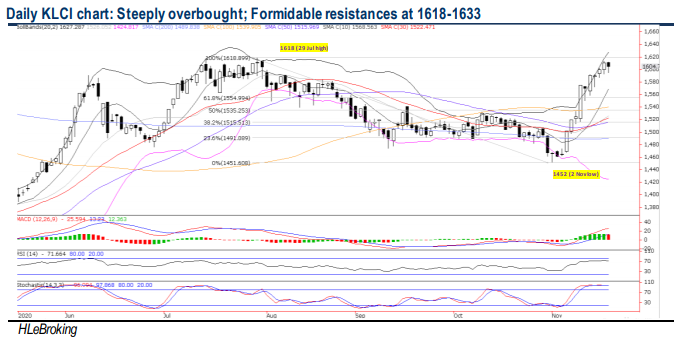

Traders Brief - Signs of lethargy with formidable resistances at 1618- 1633 levels

HLInvest

Publish date: Thu, 19 Nov 2020, 12:20 PM

MARKET REVIEW

Global. Asian markets ended mostly higher amid vaccine euphoria and the China government’s pledge for fresh policy measures to support a coronavirus -ravaged economy, despite threats of spiking Covid-19 cases worldwide, a fresh round of economic lockdowns and weak US retail sales data. Overnight, the Dow rose as much as 148 pts to 29931 after Pfizer said that its Covid-19 vaccine was 95% effective and plans to submit to FDA in days. However, the index surrendered all the gains to end 345 pts lower at 29438 amid worries that surging Covid-19 infections and mounting shutdowns could derail an uneven US recovery.

Malaysia. After rallying 161 pts from 1452 low to 1613 on 17 Nov, KLCI eased 5.4 pts on profit-taking on value and economically-sensitive stocks. There were 731 losers vs 473 gainers, supported by 14.4bn shares worth RM5.1bn. Meanwhile, foreign investors resumed buying (net bought RM169m shares) after two consecutive days of selling whilst local institutional and retail investors net sold RM62m and RM107m in equities, respectively.

TECHNICAL OUTLOOK: KLCI

The formation of three ‘Hanging man’ candlesticks (11, 13 & 18 Nov) and steeply overbought indicators could represent a potential reversal in an uptrend, with upside likely to be capped near 1618 and 1633 (61.8% FR from 1896 and 1208) zones. On the contrary, a decisive breakdown below immediate support at 1579 (76.4% FR) will trigger further selloff towards 1555-1535-1515 levels.

MARKET OUTLOOK

As technicals are turning grossly overbought now, a pullback is imminent in the wake of the lingering concerns about fragile global economic outlook due to the surging Covid-19 infections worldwide and new lockdowns, expectations of weaker 4Q20 economy and corporate earnings in Malaysia (post CMCO 2.0), ongoing 3Q20 results season, and the Budget 2021 approval (expected to be held next week). Key supports are pegged at 1579- 1555-1535 levels whilst resistances are situated near 1618-1633 levels.

Source: Hong Leong Investment Bank Research - 19 Nov 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024