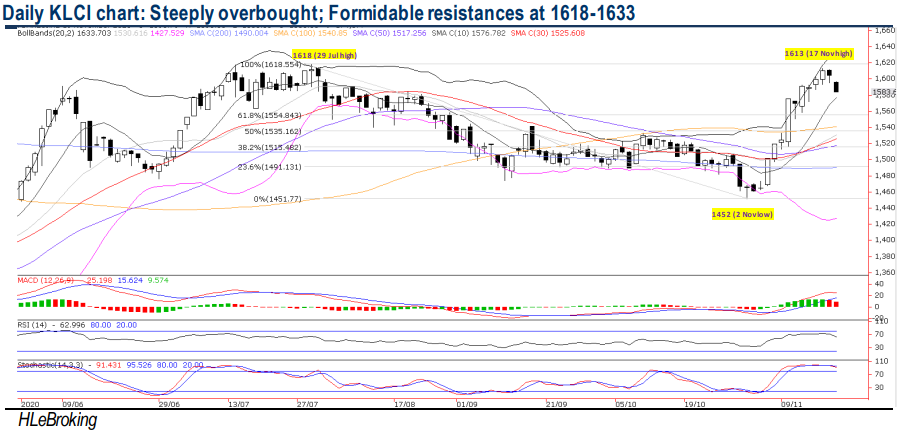

Traders Brief - Uptrend temporary halts; Eyeing key supports at 1535- 1576 levels

HLInvest

Publish date: Fri, 20 Nov 2020, 09:26 AM

MARKET REVIEW

Global. Asian markets ended mixed as vaccines’ optimism started to fizzle out as investors weighed the impact of a resurgence of Covid-19 cases worldwide and tougher virus curbs on economic growth along with the teething problems for widespread vaccine production and distribution. After tumbling as much as 210 pts amid worries over increasing lockdowns and layoffs linked to spiraling Covid-19 cases, the Dow staged a 45-pt technical rebound to end at 29483 on fresh stimulus hopes after Senate leaders agreed to revive talks to craft a new stimulus package.

Malaysia. KLCI slid 21.1 pts to 1583.7 due to extended profit-taking on value and cyclical stocks after enjoying a powerful rally from a low of 1452 to a high of 1613 recently. Market sentiment was bearish with 730 losers vs 462 gainers whilst total volume plunged 34% to 9.5bn shares worth RM4.5bn. Meanwhile, foreign investors resumed selling (net sold RM171m shares) while local institutional and retail investors net bought RM163m and RM8m in equities, respectively.

TECHNICAL OUTLOOK: KLCI

On the back of an overnight slump on Wall St and steeply overbought KLCI readings after rallying from a low of 1452 to a high of 1613, the index experienced a meaningful 21-pt retracement yesterday. We see an extended profit taking consolidation with immediate support at 1576 (10D SMA). A decisive breakdown below this support would confirm the return of the bearish bias towards 1555-1535-1515 levels. Stiff resistances are pegged at 1600-1618 territory. A successful breakout above these barriers would spur greater upside towards 1633 (upper BB) and 1669 (200W SMA) zones.

MARKET OUTLOOK

We reiterate our view the local bourse is ripe for further profit taking consolidation after rallying from a low of 1452 to a high of 1613, on the back of the lingering concerns about a fragile global economic outlook due to the surging Covid-19 infections and new lockdowns, expectations of weaker 4Q20 economy and corporate earnings in Malaysia (post CMCO 2.0), ongoing 3Q20 results season, and the Budget 2021 approval (expected to be held on 26 Nov). Key supports are pegged at 1576-1555-1535 levels whilst resistances are situated near 1600-1618-1633 levels.

Source: Hong Leong Investment Bank Research - 20 Nov 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024