Dnonce Technology - Riding on the positive healthcare and E&E growth

HLInvest

Publish date: Mon, 23 Nov 2020, 11:51 AM

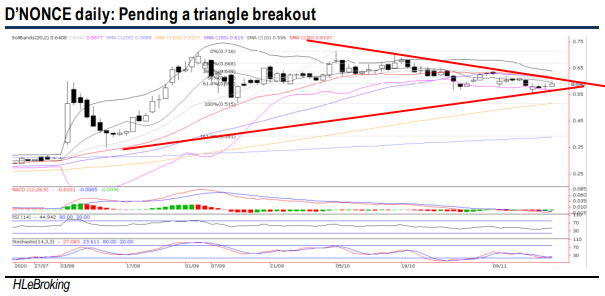

To recap, DNONCE recorded a strong earnings of RM3.8m in 1QFY4/21, which exceeded the RM0.6m in 16MFY4/20, primarily attributed to the robust results from glove packaging boxes, capacity expansion plans in the glove packaging business, coupled with the recovery in the E&E segment (amid global digitalisation trend and surging global datasphere). Following a 17.5% fall from RM0.715 (52W high) to RM0.59, valuation is undemanding at 11.6x FY21E P/E (about 28% below peers), capitalising on customers’ growth and capacity expansion coupled with promising prospects from the twin engines of growth (i.e. healthcare and E&E sectors). Technically, a successful triangle breakout will spur prices higher towards RM0.66- 0.715 upside targets.

Pending a bullish triangle breakout. After tumbling from its 52-week high of RM0.715 (5 Oct) to a low of RM0.56 (17 Nov), DNONCE is currently hovering above the RM0.57 support trendline (from Aug 12 low of RM0.35). As technicals are on the mend, the stock is envisaged to stage a bullish triangle breakout soon. A successful breakout above RM0.62 hurdle (downtrend line from RM0.715) will spur prices towards RM0.66 (23.6% FR) before hitting our LT target at RM0.715 levels. Supports are pegged at RM0.57 and RM0.56. Cut loss at RM0.54.

Source: Hong Leong Investment Bank Research - 23 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024