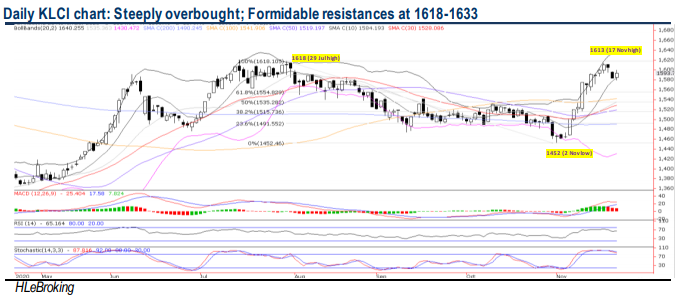

Traders Brief - Upside limited with formidable resistances at 1618-1640 levels

HLInvest

Publish date: Mon, 23 Nov 2020, 11:51 AM

MARKET REVIEW

Global. Despite the latest promising trials by Oxford-AstraZeneca’s, which showed strong immune responses in older adults in an early study, Asian markets ended mixed due to heightened economic damage by surging Covid-19 cases worldwide and dwindling US stimulus after Mnuchin’s plan to stop the emergency lending programs by end Dec. The Dow fell 220 pts last Friday at 29263 (-216 pts WoW) as sentiment was dampened by spiking Covid-19 infections and a conflict between the White House and Fed over the termination of emergency lending programs, eclipsed vaccine hopes by Pfizer’s application to FDA for emergency use of its Covid-19 vaccine.

Malaysia. KLCI staged a 10.1-pt technical rebound at 1593.8 after falling 26.5pts in two days as sentiment was lifted by the 21-APEC leaders’ pledge for free and open trade and investment, and to cooperate constructively to combat Covid-19. Market breadth was positive with 9bn securities traded for RM5.16bn and the G/L ratio returned to 1.37x after falling below 1 in the last three days.

TECHNICAL OUTLOOK: KLCI

Following last Friday’s 10.1 pts technical rebound, KLCI inched up 4.1 pts WoW to record its 3rd straight weekly gains. Following a 141-pt rally from 1452 low, KLCI is envisaged to engage in profit taking consolidation mode with immediate support at 1584 (10D SMA). A decisive breakdown below this support would confirm the return of the bearish bias towards 1555-1535-1515 levels. Stiff resistances remain near 1600-1618 levels. A successful breakout above these barriers would spur greater upside towards 1640 (upper BB) and 1669 (200W SMA) zones.

MARKET OUTLOOK

After a 141-pt surge from 1452, KLCI is ripe for further profit taking consolidation, given the overbought momentum and concerns over the huge amount of economic uncertainty created by Covid-19 despite vaccine optimism, expectations of weaker 4Q20 economy and corporate earnings in Malaysia (post CMCO 2.0), the peak of the 3Q20 results season, and the Budget 2021 approval on 26 Nov. Sentiment is also likely to be dampened by EPF’s CEO statement that the fund will have to liquidate its assets and rebalance its portfolio to make billions of ringgit available to contributors in need of funds to lessen the financial turmoil caused by the Covid-19 pandemic. Key supports are pegged at 1584-1555-1535 levels whilst resistances are situated at 1600-1618-1640 levels.

Source: Hong Leong Investment Bank Research - 23 Nov 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024