Media Prima - A good turnaround and ESG investing proxy, with solid NCPS of 13.5sen

HLInvest

Publish date: Thu, 10 Dec 2020, 04:40 PM

Despite a challenging outlook in the media industry, we are encouraged by the group’s initiative in streamlining its operations and at the same time proactively improving their integrated advertising solutions. MEDIA’s risk-reward profile is attractive after sliding 46% from a 52-week high of RM0.385 to RM0.205. Valuation is undemanding at 41% discount to BVPS of RM0.50 (also 41% below its 5Y mean), supported by 13.5sen NCPS (or 66% to share price). Moreover, current share price is considerably lower against major shareholders’ entry costs i.e. Syed Mokhtar (bought 31.9% stake back in Oct 2019) and Morgan Stanley (12.8% stake accumulated in Apr 2017).

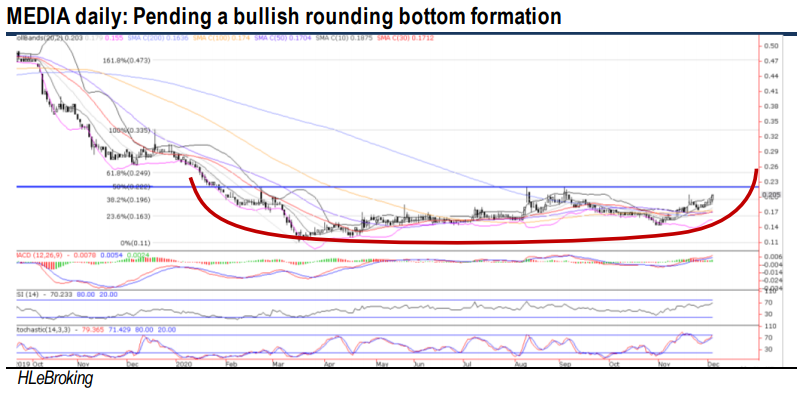

Pending a bullish rounding bottom formation. The rounding bottom or a saucer bottom is a long-term reversal pattern, representing a long consolidation period that turns from a bearish bias to a bullish bias. Following the 1st and 2nd bottoms on 11 March (RM0.11) and 2 Nov (RM0.145), MEDIA’s share price has rebounded above all key SMAs. Given the bullish technicals and a huge 26.3m shares done yesterday (vs 90D average of 4.9m shares), the stock is expected to break the long-awaited neckline resistance of RM0.22 soon. Clearing this hurdle will lift prices higher towards RM0.25 (61.8% FR) before reaching our LT objective at RM0.28 (76.4% FR). Supports are pegged at RM0.195 (38.2% FR) and RM0.18 (20D SMA). Cut loss at RM0.17.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024