DPI Holdings - Anticipate a strong growth in FY21, backed by a solid NCPS of 11sen

HLInvest

Publish date: Fri, 18 Dec 2020, 08:53 AM

With a reputable track record over 38 years as an aerosol manufacturer, DPIH is wellpositioned to compete more aggressively in the international markets (export sales only accounted for 19% in FY20) in anticipation of rising demand for aerosol paint products, which is spurred by continuous urbanisation and motorisation, trade diversion from China to SEA, as well as rising outsourcing amid the high compliance cost related to the manufacturing of aerosol products in developed countries. Overall, Management is cautiously optimistic of stronger FY21 earnings (1QFY21 earnings already accounted for 55% of FY20 earnings) amid rebranding and expanding OBM product lines, improving OEM prospects amid rising exports growth coupled with improving operating efficiency and cost control. Valuation is undemanding at 16.3x trailing P/E (39% below peers). Ex-cash of 11sen, PE is only at 9.7x.

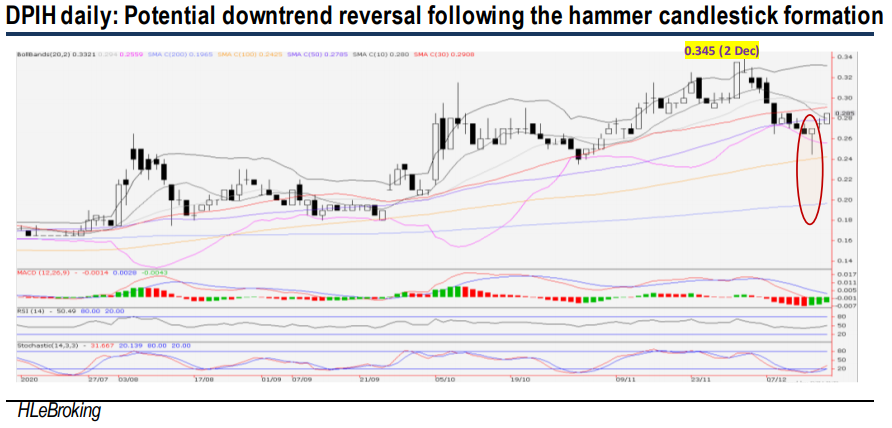

Potential downtrend reversal following a hammer formation. After hitting 52-week high at RM0.345 (2 Dec), DPIH corrected 29% to a low of RM0.245 (15 Dec) before rebounding at RM0.285 yesterday. The hammer candlestick signals a potential capitulation by sellers to form a bottom, accompanied by higher share prices and bottoming up technical indicators. A decisive breakout above RM0.30 will spur prices higher to re-challenge RM0.33 (upper BB) before advancing to our LT objective at RM0.37 (123.6% FR from 0.245-0.345). Supports are situated at RM0.275 (50D SMA) and RM0.255 (lower BB). Cut loss at RM0.25.

Source: Hong Leong Investment Bank Research - 18 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024