MTAG Group - A Laggard Against Its EMS Customers

HLInvest

Publish date: Tue, 29 Dec 2020, 04:40 PM

MTAG’s future outlook remains promising, given its impeccable track record with reputable “Customer D” suppliers (i.e. ATA IMS, SKP Resources and VS Industry) as well as the multi-year secular uptrend from the ongoing supply chain rerouting out of China. The stock is trading at an appealing FY21 P/E of 12.5x (37% below EMS peers), underpinned by a strong EPS CAGR of 21% from FY20-22 on robust orders from EMS customers and expansion plans underway, attractive FY21-22 DY of 4.9- 5.6%, solid NCPS of RM93m or 13.9sen (after netting ~RM15m for capex in the next 24 months) and potential re-rating catalyst from the transfer of listing status to Main Market from ACE.

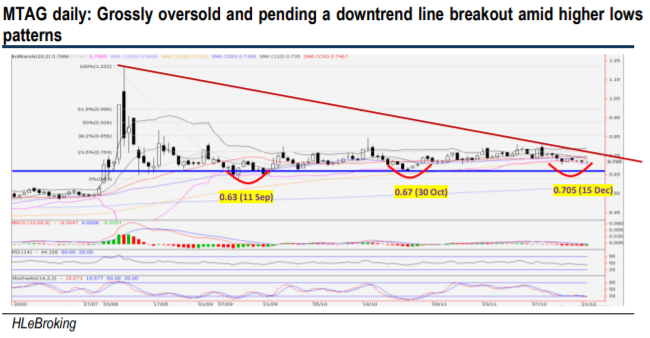

Pending a downtrend line breakout. After hitting all-time high at RM1.22 (7 Aug), MTAG price slid 48% to a low of RM0.63 (11 Sep) before consolidating higher to close at RM0.715 yesterday. Following the formation of higher lows pattern and grossly oversold technical readings, the stock is ripe for a technical rebound in the short term. A decisive breakout above RM0.75 (downtrend line) will spur prices higher to rechallenge RM0.80 levels before heading towards our LT objective at RM0.855 (38.2% FR). Supports are situated at RM0.70 and RM0.67. Cut loss at RM0.66.

Source: Hong Leong Investment Bank Research - 29 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024