Traders Brief - Range bound mode prevails ahead of the BNM meeting (20 Jan) and elevated Covid-19 cases

HLInvest

Publish date: Tue, 19 Jan 2021, 10:22 AM

MARKET REVIEW

Global. Despite rising SHCOMP (+0.84% to 3596) and HSI (+1% to 28862), most of the Asian markets wavered on Monday as soaring COVID-19 cases offset investor hopes of a quick economic recovery, even after data showing that the Chinese economy grew 6.5% in the 4Q20 (above consensus 6.1%). Overnight, the Dow was closed in conjunction with the Martin Luther King Jr. Day.

Malaysia. Despite the RM15bn PERMAI stimulus package announcement, KLCI tumbled 17.5 pts at 1609.5 to record its 3rd straight decline, mainly driven by profit taking pullback on glove makers and selling pressures on banking stocks on fears of potenital OPR cuts when BNM meets on 20 Jan. Market breadth was negative with 458 gainers vs 716 losers. Trading volume increased to 7.2bn (5.8bn previously) while the value rose to RM4.3bn (RM4.1bn previously). After net bought in the last seven sessions, foreign investors turned net sellers (-RM57m) yesterday whilst the local institutional investors (RM41m) and retailers (RM16m) were the buyers in equities.

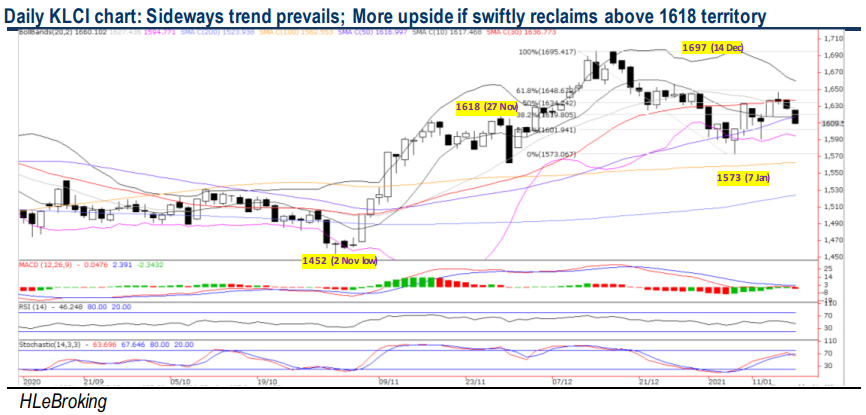

TECHNICAL OUTLOOK: KLCI

As expected, KLCI continued its consolidation after rebounding from 1573 (7 Jan) to a high of 1646 on 14 Jan, as the becnhmark slid 17.5 pts at 1609.5 yesterday due to the lack of fresh catalysts. We may see further range bound consolidation this week but as long as the index is able to close above 1600 levels, KLCI is likely on course for the next rebound to retest 1636-1650-1667 hurdles. On the flip side, a breakdown below 1600 may trigger further selloff to revisit 1573 and 1562 (100D SMA) levels.

MARKET OUTLOOK

Overall, the RM15bn PERMAI stimulus package is likely to be Neutral to the market as the stimulus seems to be largely targeted at both the rakyat and SMEs that have been hit by the negative ramifications of Covid-19. We reiterate that KLCI to trade range bound in the near term (supports 1562-1573; resistances: 1636-1650-1667) as investors continue to weigh on the economic impact of the MCO 2.0 and the state of emergency declaration coupled with the upcoming BNM meeting on 20 Jan (OPR stood at the lowest level of 1.75% after four cuts of 1.25% in 2020).

For stocks selection, the acceleration of Micro SME e-Commerce Campaign and Shop Malaysia Online campaign (RM300m) announced in the RM15bn PERMAI stimulus measures yesterday would trigger some trading interests for courier logistics companies (eg GDEX, TRIMODE, TNLOGIS and FREIGHT) and players that facilitate online transactions (e.g. REVENUE and GHLSYS)

Source: Hong Leong Investment Bank Research - 19 Jan 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024