Traders Brief - Extended Consolidation Amid Looming Fears of a Prolonged MCO

HLInvest

Publish date: Mon, 25 Jan 2021, 01:18 PM

MARKET REVIEW

Global. Tracking lower Dow overnight following recent record close, Asian bourses ended mostly lower as investors locked in profits after recent rally boosted by US coronavirus stimulus plan. Last Friday, the Dow slipped 179 pts to 30997 (+0.59% WoW), dragged down by a pullback in blue-chip technology stalwarts Intel and IBM following their quarterly results. Sentiment was also dampened by lofty market valuations give n the surging Covid- 19 cases and new variants coupled with the warning by Biden that there’s nothing we can do to change the trajectory of the pandemic in the next several months.

Malaysia. Last Friday, KLCI jumped as much as 10.9 pts to 1605.7 before narrowing the gains to 1.7 pts at 1596.7 amid fears of MCO 2.0 extensions will further delay economic recovery on the back of unabated Covid-19 cases and clusters. Trading volume decreased to 6.6bn (6.7bn previously) while the value rose to RM4.8bn (RM4.3bn previously). Local institutional (RM19m) and retail investors (RM71m) were the net buyers whilst foreign investors (-RM90m) remained the net sellers in the last five days.

TECHNICAL OUTLOOK: KLCI

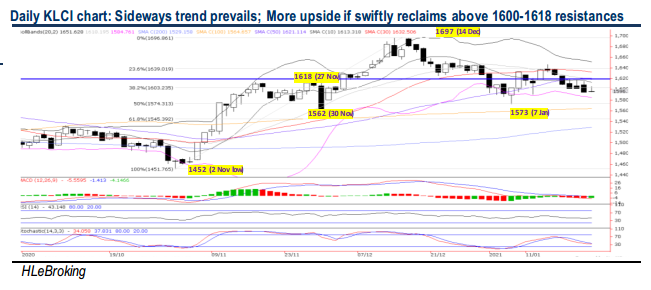

Despite rising 1.7 pts last Friday, KLCI tumbled 30.3 pts WoW to close at 1596.7. As long as the benchmark fails to reclaim above the congested 1600-1618 overhead resistances successfully, the bears seem to be in control again and further consolidation is expected, with major supports pegged at 1573-1562 territory. On the flip side, a decisive close above 1618 would augur well for resumption in uptrend towards 1633-1650-1666 hurdles.

MARKET OUTLOOK

After violating the key multiple SMAs and 1600 psychological supports, KLCI is expected to engage in further consolidation (supports 1562-1573; resistances: 1600-1618-1633) in extended holidays (Thaipusam on 28 Jan and Federal Territory Day on 1 Feb) as investors continue to weigh on the downside risks to the economy and corporate earnings growth from MCO 2.0 coupled with the start of the upcoming 4Q20 results season. Sentiment is also dampened by worries that in the wake of the reported Covid-19 cases stay protractedly high and with various bodies expressing concerns that manufacturing, aside from construction, is the sector that contributed to the surging cases and clusters, the threat of lockdown to be extended beyond 4 Feb is intensifying.

Source: Hong Leong Investment Bank Research - 25 Jan 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024