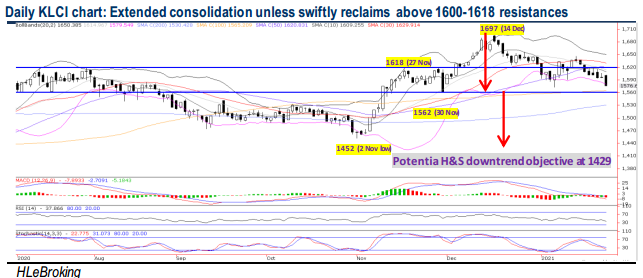

Traders Brief - A Prolonged Consolidation Unless Reclaiming Above 1600-1618 Overhead Resistance Successfully

HLInvest

Publish date: Tue, 26 Jan 2021, 10:48 AM

MARKET REVIEW

Global. Asian markets ended moderately higher as optimism over a USD1.9 trillion US stimulus plan outweighed rising Covid-19 cases and delays in vaccine supplies. Sentiment was also boosted by UN data that China (USD163bn) had surpassed the US (USD134bn) as the world’s largest recipient of FDI. Overnight, the Dow plunged as much as 433 pts to 30564 on profit taking after hitting all-time high of 31272 (21 Jan) amid concerns over prolonged path for further stimulus and the threat of further Covid-19 restrictions due to surging Covid-19 cases and new variants. However, Apple-led strength in technology (the Nasdaq Composite finished 0.69% higher to a fresh new high at 13636) ahead of a busy week of mega technology earnings release.

Malaysia. Despite a strong rebound by index-linked glove stocks, KLCI slid 20.1 pts to 1576.6 (led by declines in 25 KLCI stocks) amid speculation of MCO2.0 to be extended beyond 4 Feb due to acute local Covid-19 transmissions. Across Bursa Malaysia, 7.5bn securities were traded for RM5.2bn, compared with 6.6bn securities worth RM4.8bn last Friday. Market breadth was bearish as losers thumped gainers by 1119 to 231. Local institutional (RM73m) and retail (RM127m) investors were the net buyers whilst foreign investors (-RM200m) remained the net sellers for the six straight sessions (-RM488m).

TECHNICAL OUTLOOK: KLCI

The index has now fallen for the 7 days in the last 8 sessions, closing below its key multiple SMAs and 1600 psychological supports. We may see KLCI succumb to further selling pressures as the trend and momentum oscillators continue to hook down. A decisive break below the 1563 could see the index sliding further towards 1530 (200D SMA) and 1500 psychological support, and forming a Head & Shoulder (H&S) pattern. The bearish H&S formation could further lead the index slumping lower towards the 1429 zones in the mid to long term. On the flip side, only a decisive close above 1600-1618 could arrest the downtrend for resumption in upward momentum towards 1630-1650-1666 hurdles.

MARKET OUTLOOK

After violating the key multiple SMAs and 1600 psychological supports, KLCI is expected to engage in further consolidation (supports 1530-1563; resistances: 1600-1618-1630) in extended holidays (Thaipusam on 28 Jan and Federal Territory Day on 1 Feb) as investors continue to weigh on the downside risks to the economy and corporate earnings growth from MCO 2.0 coupled with the start of the upcoming 4Q20 results season.

Source: Hong Leong Investment Bank Research - 26 Jan 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024