Traders Brief - Sentiment to Remain Jittery Due to the Lack of Fresh Catalysts

HLInvest

Publish date: Wed, 27 Jan 2021, 11:12 AM

MARKET REVIEW

Global. Led by sharp falls on HSI (-2.5%), KOSPI (-2.1%) and SHCOMP (-1.5%), Asian markets were in a sea of red, as investors tempered hopes for the quick passage of USD1.9 trillion US stimulus and delays in vaccine supplies coupled with the threat of further Covid-19 restrictions amid surging Covid-19 cases. Overnight, the Dow was locked in profit taking consolidation mode (-23 pts to 30937) after hitting all-time high of 31272 (21 Jan), as investors paused their bullish bets on stocks amid a swath of quarterly reports and an update on monetary policy due early morning on Thursday.

Malaysia. Despite surging as much as 32.6 pts to 1609.2 following a strong rebound in banking and economic recovery stocks, KLCI surrendered its entire gains to end 1.3 pts lower at 1575.3, in line with sluggish regional markets and on concerns of possible stricter lockdowns post 4 Feb due to the surging local Covid-19 infections. About 5.9bn securities were traded for RM4.7bn, compared with 7.5bn securities worth RM5.2bn on Monday. Market breadth was positive as gainers led losers by 601 to 537. Local institutional (RM12m) and retail (RM287m) investors were the net buyers whilst foreign investors (- RM299m) remained the net sellers for the 7 straight sessions (-RM786m).

TECHNICAL OUTLOOK: KLCI

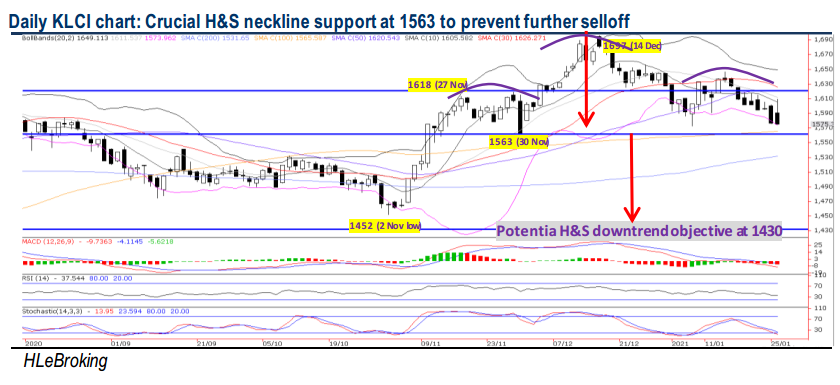

The index has now fallen for the 8 days in the last 9 sessions, closing below its key multiple SMAs and 1600 psychological supports. We may see KLCI succumb to further consolidation as the trend and momentum oscillators continue to hook down. A decisive breakdwon below the Head & Shoulder (H&S) neckline support at 1563 would be damaging, as the KLCI may slide further towards 1531 (200D SMA) and 1500 psychological supports. Failure to hold at these levels would add to the selling spree to our bearish H&S objective 1430 zones in the mid to long term. On the flip side, only a decisive close above 1600-1618 could arrest the downtrend for resumption in upward momentum towards 1626-1649-1666 hurdles.

MARKET OUTLOOK

Extended profit-taking consolidation may prevail after KLCI violated the key multiple SMAs and 1600 psychological levels (supports 1530-1563; resistances: 1600-1618-1630) ahead of extended holidays (Thaipusam on 28 Jan and Federal Territory Day on 1 Feb), as investors continue to weigh on the downside risks to the economy and corporate earnings growth from MCO 2.0 coupled with the start of the upcoming 4Q20 results season.

On stocks selection, we may see trading interests on PHARMA and DPHARMA after both have signed deals to bring 18.4m Covid-19 vaccine doses to the Malaysian people. Bottoming up technical momentum should attract buying interests on PHARMA to retest higher resistances at RM5.25-5.60 zones whilst key supports are pegged at RM4.90-4.80- 4.75 levels. Meanwhile, the positive downtrend line breakout yesterday could see DPHARMA to advance further to RM3.90-4.10-4.38 targets, while the retracement supports are situated at RM3.60-3.45-3.35 levels.

Source: Hong Leong Investment Bank Research - 27 Jan 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024