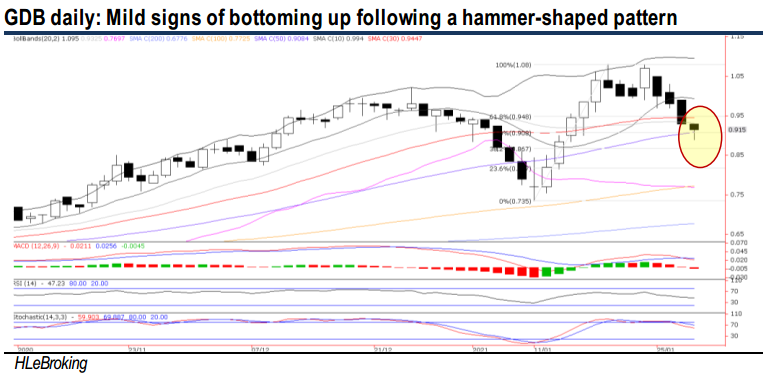

GDB Holdings - Mild Signs of Bottoming Up Amid Hammer Shaped Pattern

HLInvest

Publish date: Tue, 02 Feb 2021, 12:52 PM

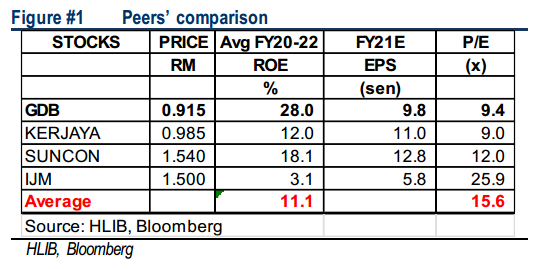

While the building construction industry is facing headwinds (such as labour shortages, rising raw material prices etc.), we see that GDB would be able to sail through the challenging time, underpinned by (i) a record outstanding order book of ~RM2.2bn (a superior cover of 6.8x on FY19 revenue and provide earnings visibility till 2023), (ii) strong execution capability and (iii) a net cash position of 19sen/share end 2021. Management is confident in achieving total RM2bn revenue cumulatively for 2021 and 2022 (vs HLIB RM1.6bn target), with the caveat on no strict lockdowns ala MCO 1.0. The stock is trading at undemanding 9.4x (ex-cash 7.4x) FY21E P/E (about 40% lower than peers), supported by strong sector-leading robust FY20-22E ROE of 28% (vs peers: 11.1%) and a decent 3.3% DY.

Signs of bottoming up following the hammer-shaped pattern formation. After hitting an all-time high of RM1.08 (19 & 22 Jan), GDB share prices slipped 15.3% on profit taking to RM0.915 on 29 Jan. As long as the stock is able to maintain its posture near 50D SMA or RM0.89-0.90 zones, the stock is poised for a potential downtrend reversal following the formation of hammer-shaped candlestick, accompanied by a high volume of 4.3m shares transacted (1.1x higher than average 90D volume of 3.9m). A decisive breakout above RM0.95 (61.8% FR) will spur prices higher towards RM1.00 barrier before advancing further to our LT objective at RM1.10 (upper BB). Key supports are situated near RM0.89 (29 Jan low) and RM0.86 (38.2% FR). Cut loss at RM0.835.

Source: Hong Leong Investment Bank Research - 2 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024