Ho Hup Construction Company - Positive Downtrend Line Breakout; Downside Cushioned by Private Placement Price at RM0.38

HLInvest

Publish date: Mon, 08 Feb 2021, 11:42 AM

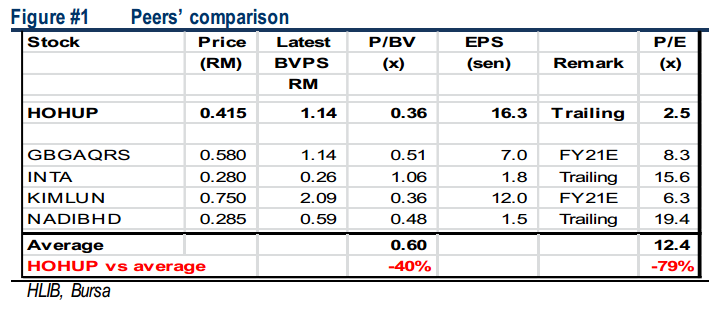

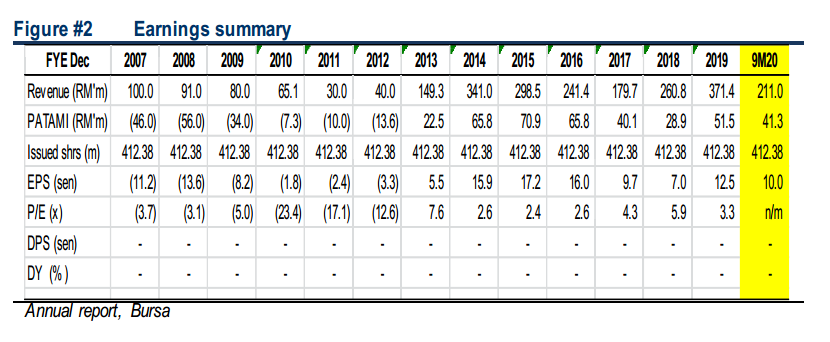

HOHUP was categorised as a PN17 company in July 2008 after making consecutive losses but was uplifted in May 2014 following the completion of its regularisation plan. Since then, the group has recorded commendable earnings, focusing on selective government infrastructure projects that provide reasonable margin and undertook the development progress for landbanks located in Bukit Jalil, Kulai and Kota Kinabalu. We reckon HOHUP’s earnings visibility over the next 2-3 years remains decent, underpinned by the progressive billings from its ongoing Bukit Jalil City under the joint development agreement of Phase 2 & 3 as well as the KK Crown development units, outstanding local construction orderbook (~RM250m), whilst its property development GDV is estimated at RM1.5bn. Following the finalisation of its private placement price at RM0.38, the stock has appreciated 9.2% to RM0.415 last Friday, trading only at 2.6x trailing P/E (-79% against peers and 53% below 10Y mean) and 0.36x P/B (-40% vs peers and 67% below 10Y mean).

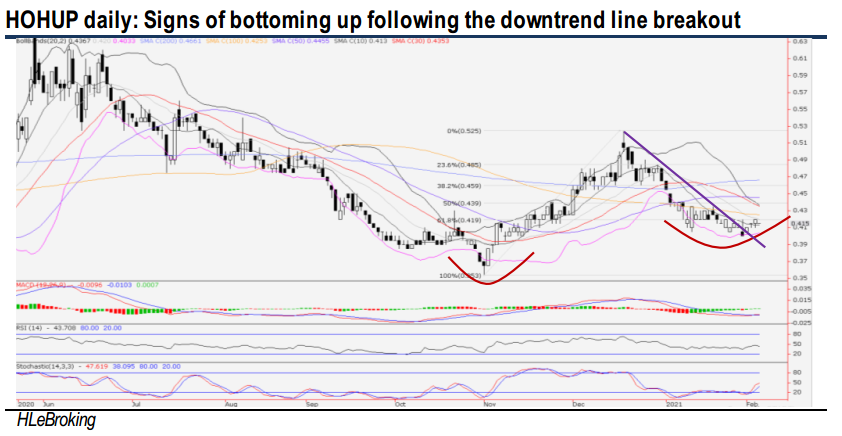

Signs of bottoming up. From a 2M high of RM0.525 (17 Dec), HOHUP share price tumbled 23.8% to a low of RM0.40 (29 Jan) before ending at RM0.415 last Friday. Following the higher lows formation and downtrend line breakout, the stock is poised for a potential downtrend reversal in the near term. A decisive breakout above RM0.46 (38.2% FR) will spur prices higher towards RM0.485 (23.6% FR) before advancing further to our LT objective at RM0.525. Key supports are situated near RM0.40 and RM0.38 (private placement price fixed on 29 Jan, about -7.9% from 5D VWAP of RM0.412). Cut loss at RM0.365.

Source: Hong Leong Investment Bank Research - 8 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024