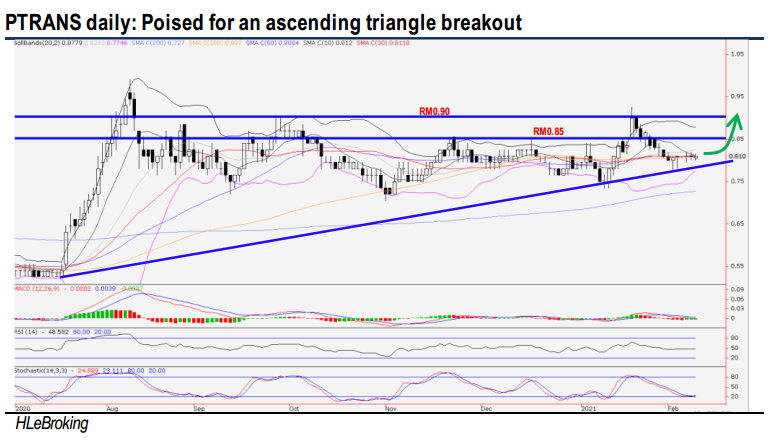

Perak Transit - Higher Growth Trajectory Ahead; Potential Ascending Triangle Breakout

HLInvest

Publish date: Thu, 11 Feb 2021, 11:59 AM

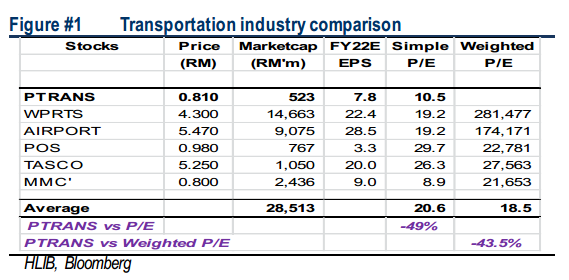

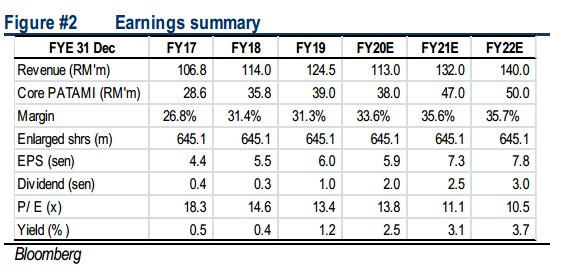

PTRANS is a leading integrated public transportations terminal (IPTT) operator in Perak. Its flagship Terminal Meru Raya (TMR) is a successful model premised on good margins supported by recurring income since its operations in 2012. Given PTRANS excellent track record in IPTT business, it can replicate its business model on Terminal Kampar Putra Sentral. Meanwhile, its maiden venture into third party terminal management services (TMS) to operate Terminal Sentral Kuantan (TSK) marks a strategic move towards higher growth and recurring earnings with minimal capital expenditure of ~RM10m (vs conventional develop, own and operate capex of over RM100m). The stock is trading at an undemanding 10.5x FY22E P/E (about 49% lower than peers), supported by a strong FY20-22 EPS CAGR of 15% and a decent 3.7% DY.

Potential ascending triangle breakout. PTRANS has been holding up well above the support trend line near RM0.785 since July 2020. Overall, the uptrend is still intact given the higher lows sequence, thereby increased the likelihood of the resumption of further advance. The buying momentum will further accelerate pending an ascending triangle breakout above RM0.85 neckline resistance. A successful breakout above this barrier will lift share prices higher towards RM0.90 (29 Sep high) and our LT target at RM0.99 (10 Aug high). Meanwhile, key supports are situated at RM0.785 and RM0.75 (10M SMA). Cut loss at RM0.74.

Source: Hong Leong Investment Bank Research - 11 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024