Traders Brief - Vaccines-led Rebound on the Cards?

HLInvest

Publish date: Mon, 22 Feb 2021, 04:25 PM

MARKET REVIEW

Global. Despite the Fed’s pledge of further accommodation to boost the pandemic-hit US economy, Asian markets ended mixed on investor concerns over policy tightening amid surging Treasury yields and lofty equity valuations. Led by a surge in industrials and energy amid an ongoing backdrop of positive vaccine rollouts, the Dow rallied as much as 154 pts to an all-time high at 31647. However, the benchmark erased its gains to end flat at 31494 as investors ditched their bets on bond-proxy sectors such as consumer staples and utilities following a jump in government bond yields.

Malaysia. Bucking weak regional markets, KLCI staged a 9.1 pts technical rebound after registering a 33-pt slump in the last three days, as sentiment was boosted by PM’s launch of the Malaysia Digital Economy Blueprint. Despite the headline gains, market breadth remained negative as losers 653 edged gainers 580 with a total of 14.4bn shares traded valued at RM6.4bn. Local retailers (+RM136m) were the main net buyers whilst the local institutional (-RM58m) and foreign investors (-RM78m) were the major net sellers. WoW, local retailers net bought RM699m whilst the local institutional and foreign investors net sold RM58m and RM466m in equities, respectively.

TECHNICAL OUTLOOK: KLCI

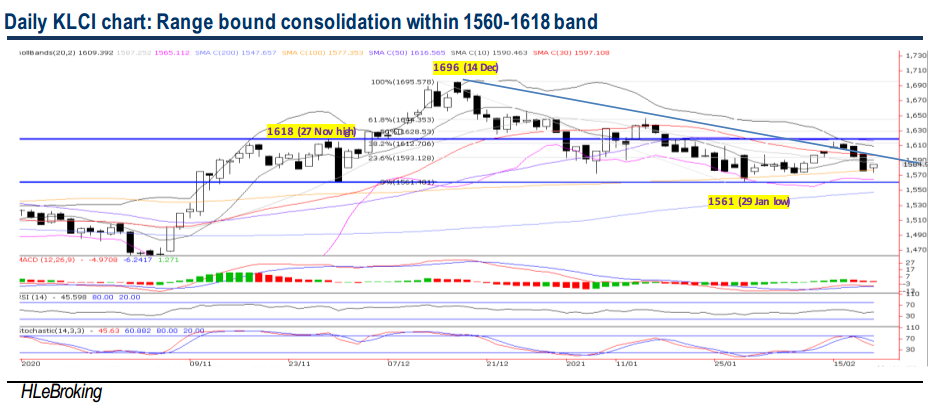

Despite Friday’s 9.1-pt rebound, KLCI still slipped 14.5 pts WoW to 1584.9, a tad below 1590 (the downtrend line from the 1696 peak). As long as the congested 1590-1618 hurdles are not taken out successfully, the index is expected to engage in a range bound consolidation mode, with key supports situated at 1573 (19 Feb low) and 1561 (29 Jan low) levels. Failure to hold at these supports could trigger further selloff towards 1545 (200D SMA) and 1500 territory. Conversely, a strong breakout above 1618 will spur the index higher towards 1628 (50% FR) and 1644 (61.8% FR) zones.

MARKET OUTLOOK

Tracking potential profit taking consolidation in Wall St and regional markets , and the ongoing 4Q20 reporting season, KLCI is vulnerable to further consolidation as the index is unable to surpass the 1590-1618 resistances. Nevertheless, downside risk seems limited near 1545-1561 on the back of the the planned vaccination programme in Malaysia starting 26 Feb. On stock selection, the launch of the Malaysia Digital Economy Blueprint last Friday may trigger follow-through trading interest on potential beneficiaries in the E services, cloud, 5G and E-government related companies such as TM, KRONO, REVENUE, GHLSYS, DNEX, K1, OPCOM, OCK, DSONIC, MYEG, IRIS, BINACOM, HTPADU, OMESTI, MSNIAGA, OCK, AWANTEC etc.

Source: Hong Leong Investment Bank Research - 22 Feb 2021