Tri-mode Systems - Long Term Growth Trajectory Remains Intact

HLInvest

Publish date: Mon, 08 Mar 2021, 11:10 AM

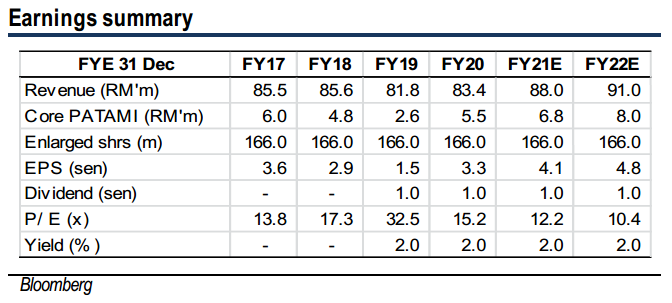

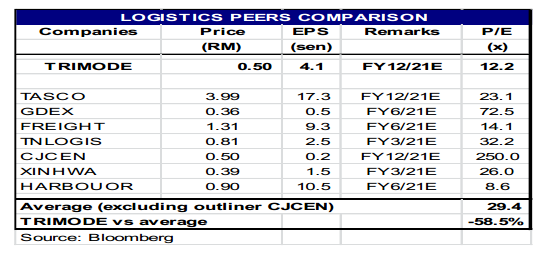

TRIMODE’s long term prospects remain promising with FY20-22 EPS CAGR of 21%, driven by the potential cost savings, efficient operations work flow and additional spaces for future business expansion from its newly completed HQ and Distribution Hub, as well as the new business income from warehousing services and its foray into the booming Vietnamese logistic market (via JV). Current valuation of 12.2x FY21 P/E is undemanding, which is trading at 58% discount vs its peers.

Long term uptrend remains intact. After hitting the all-time high of RM0.65 (23 Feb), TRIMODE corrected 26% to a low of RM0.48 (3 Mar) before ending at RM0.50 last Friday. As long as the stock is able to maintain its posture above the LT support trend (from all-time low of RM0.17 on 19 Mar 2020), TRIMODE’s uptrend line remains relatively intact. A successful breakout above the RM0.50 (50% FR) resistance could spur prices higher towards RM0.57 (upper BB) before reaching our LT objective at RM0.63 (upper channel). Supports are pegged at RM0.48 and RM0.45. Cut loss at RM0.445.

Source: Hong Leong Investment Bank Research - 8 Mar 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024