Traders Brief - Uptrend May Persist Amid Fed Dovish Stance and PEMERKASA Stimulus Package

HLInvest

Publish date: Wed, 24 Mar 2021, 05:14 PM

MARKET REVIEW

Global. Asian markets ended mixed as Fed takes centre-stage following recent spike in US10Y treasury yields, which have risen on bets of faster growth and inflation. Overnight, the Dow (+189 pts to 33015) and S&P 500 (+11 pts to 3974) closed at record highs whilst the Nasdaq 100 reversed from -199 pts to end +53 pts at 13525, after the Fed predicted a fast economic recovery from the Covid-19 and said it would maintain its interest rate at close to zero. Powell reiterated current monetary policy is appropriate and there’s no reason to push back against a surge in Treasury yields over the past month.

Malaysia. Ahead of the Fed meeting outcome, KLCI slipped as much as 7.1 pts to 1616.9 before recouping the losses at the eleventh hour with +1 pt gain to 1625. Trading volume was 12.6bn shares valued at RM4.8bn while market breadth turned positive again with 625 gainers outpaced 513 losers. The local institutional (-RM80m; 5D: -RM489m) investors were the major net sellers whilst local retailers (+RM67m; 5D: +RM475m) and foreign (+RM13m; 5D: +RM14m) were the net buyers.

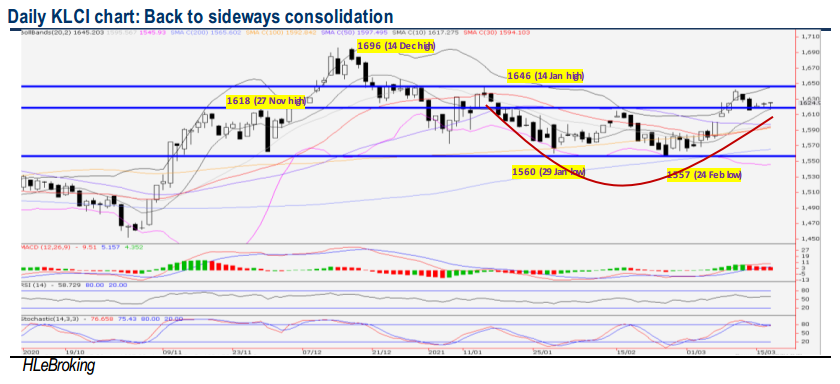

TECHNICAL OUTLOOK: KLCI

Barring a decisive fall below our envisaged 1600-1610 supports, the uptrend from the February lows at 1557 is likely still intact, targeting 1646-1660 (200W SMA) levels after a brief sideways consolidation, underpinned by the rounding bottom formation. On the flip side, failure to keep the support levels could result in more choppiness in the short term, pressuring the index to revisit 1592-1565 levels.

MARKET OUTLOOK

In the wake of the Fed’s dovish stance, PM’s PEMERKASA stimulus package, current high Brent oil and FCPO prices coupled with the progressive vaccination program in Malaysia, sentiment on the local bourse is likely to improve in the near term (key resistances 1646- 1660; supports 1565-1592) amid the rounding bottom formation. On stock selection, after tumbling from 52-week high of RM0.715 (5 Oct) to a low of RM0.48 (29 Dec), DNONCE is trending higher before closing at RM0.53 yesterday. To recap, DNONCE is a diversified engineering solutions provider with key customer base from healthcare, E&E and manufacturing sectors. Overall, DNONCE’s prospects remain bright as it continues to ride on growth from the healthcare and E&E sectors (likely to release its 3QFY21 results on 23 Mar).

As technical indicators are on the mend, the stock is envisaged to stage a bullish downtrend resistance breakout soon. A successful breakout above RM0.55 (downtrend line from RM0.715) will spur prices towards RM0.585-0.63-0.66 targets. Supports are pegged at RM0.50 and RM0.48. Cut loss at RM0.47.

Source: Hong Leong Investment Bank Research - 24 Mar 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024