Focus Point Holdings - Strong Growth Ahead Amid Promising F&B Segment; Potential Downtrend Reversal

HLInvest

Publish date: Wed, 07 Apr 2021, 10:22 AM

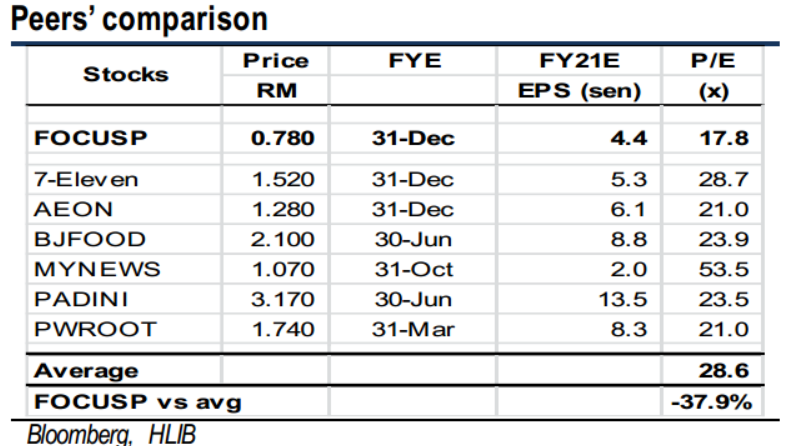

HLIB Research maintains a BUY rating on FOCUSP with RM1.11 TP, ascribing a 22x P/E on FY21 EPS (+42% upside). After a 20% correction from the all-time high of RM0.98, its risk-reward profile is attractive amid undemanding 17.8x FY21 PE (38% lower than industry), strong FY20-22E EPS CAGR of 25% and decent DY of 2.6%. We remain sanguine on the stock, encouraged by the reopening of optical stores post MCO, increased orders from existing F&B customers as well as new corporate clients (as the 2nd central kitchen utilisation rate is expected to surpass 30% by year-end), thanks to the buoyancy of stimulus packages, low interest rate environment, and vaccination rollout.

Potential downtrend reversal amid the Morning Doji Star formation. After plunging 33% from all-time high of RM0.98 to YTD low of RM0.655, FOCUSP has been trapped in range bound consolidation mode within RM0.75-0.94 band before closing at RM0.78 yesterday. The Morning Doji Star pattern and bottoming up indicators coupled with soaring volume yesterday at 1.06m (1.5x above 20D average) are expected to spur prices towards RM0.83 (30D SMA) zones. A successful breakout above RM0.83 would signal that a new uptrend has begun to retest RM0.92 (18 Mar high) and our LT target at RM0.98 levels. Supports are pegged at RM0.75 and RM0.70 levels. Cut loss at RM0.69.

Source: Hong Leong Investment Bank Research - 7 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024