Traders Brief - Renewed Foreign Buying Lifts KLCI But May Face Stiff Resistances at 1618-1635 Levels

HLInvest

Publish date: Thu, 08 Apr 2021, 09:52 AM

MARKET REVIEW

Global. Asian markets ended mixed as markets headed towards record highs following IMF’s bullish upgrade of 2021 global economy and central banks’ ultra-low interest rates but the gains were capped by concern of the 3rd wave of Covid-19 infections and disruptions in vaccinations. Overnight, the S&P 500 closed at a record high on tech strength but the gains were capped by an uptick in US 10Y bond yields despite the dovish Fed’s March meeting minutes to support a full economic recovery. The Dow and S&P 500 ended +16pts and +6 pts at 33446 and 4080, respectively whilst the Nasdaq eased 9 pts to 13689.

Malaysia. Bucking the muted regional markets, KLCI rallied 21.7 pts to 1600.6 amid a massive push in the final hour of trade (with 29 out of the 30 index components ended higher), mainly driven by the renewed buying interests from foreign investors (+RM151m; 5D: +RM61m; 18.9% of trading value) whilst the local institutions (-RM114m; 5D: -RM87m; 43% of trading value) and local retailers (-RM37m; 5D: +RM26m; 38.1% of trading value) turned net sellers. Trading volume was 6.3bn shares valued at RM3.6bn while market breadth was positive as the G/L ratio climbed to 1.33 from 0.58 previously.

TECHNICAL OUTLOOK: KLCI

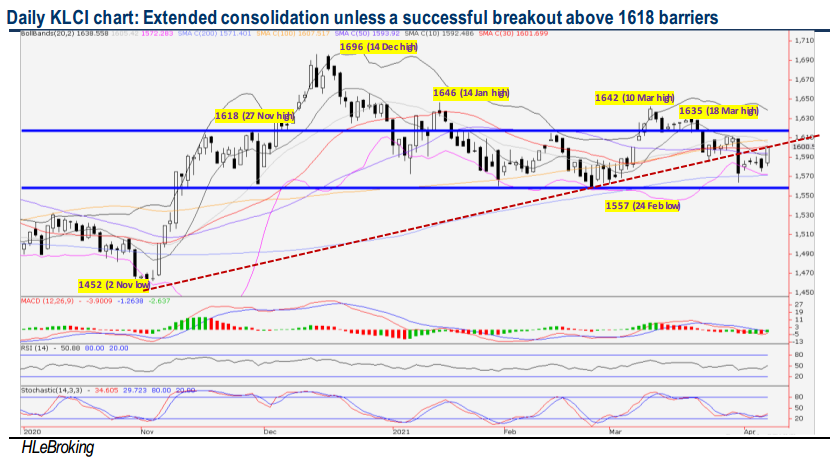

Despite a 21-pt relief rally yesterday, KLCI could still stuck in a range bound consolidation mode unless the 1607 (100D SMA) and 1618 barriers are taken out decisively today. A successful breakout these levels will spur KLCI higher towards 1635 -1642-1656 zones whilst a fall below 1593 (50D SMA) will witness further range bound consolidation towards 1571 (200D SMA) and 1557 territory.

MARKET OUTLOOK

On the back of renewed foreign buying interests, KLCI should attempt to rebuild stronger support platform at current levels, pending more concrete local impetus to lift investor sentiment from the present range bound consolidation mode. Key supports are situated at 1593-1571-1557 whilst stiff resistances are pegged at 1607-1618-1635 zones.

For stock selection, we believe Tasco’s (RM1.15, Not-rated) recent rounding bottom formation may spur prices higher in the medium to long term towards RM1.24-1.34-1.48 levels, barring a decisive breakdown below RM1.00-1.06 supports. Tasco is a total logistics solutions provider with services including contract logistics, air freight forwarding, trucking, ocean freight forwarding and cold supply chain logistics (a beneficiary of vaccine roll-outs). The stock is trading at 19x FY22E P/E (vs 5Y mean 18x).

Source: Hong Leong Investment Bank Research - 8 Apr 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024