Traders Brief - Glove Stocks to Stay in the Limelight Amid the Resurgence of Covid-19 Cases

HLInvest

Publish date: Mon, 19 Apr 2021, 09:49 AM

MARKET REVIEW

Global. Asian markets ended mildly higher last Friday as strong US and China economic data bolstered expectations of a solid global recovery, overshadowed worries of renewed spike in Covid-19 infections worldwide, which may force more rolling lockdowns in global hotspots. Wall St ended in buoyant mode as the Dow (+164 pts to 34200) and S&P 500 (+15 pts to 4185) closed at record highs whilst the Nasdaq climbed 15 pts to 14052, following better-than-expected earnings from banks, retreating US10Y Treasury yield, and a strong April preliminary consumer sentiment index.

Malaysia. KLCI slipped as much as 8 pts to 1600.3 but recouped the losses to end 0.1 -pt higher at 1608.4, thanks to the bargain hunting interests on index-linked glove makers sparked by fears of another aggressive wave of Covid-19 infections worldwide. Market breadth turned positive as the G/L ratio (516/501) regained above 1 after falling below 1 in the last five consecutive sessions.

Local institutions were net buyers last Friday (RM68m; 46.6% of trading value) compared with net selling by retailers (-RM17m; 38.2% of trading value) and foreigners (-RM51m; 15.2% of trading value). In the week ending 16 April, foreigners were net sellers with net weekly outflows of RM235m (-RM78m previously) whilst local institutions (+RM137m vs - RM11m previously) and retailers (+RM98m vs +RM89m previously) were the net buyers during the week.

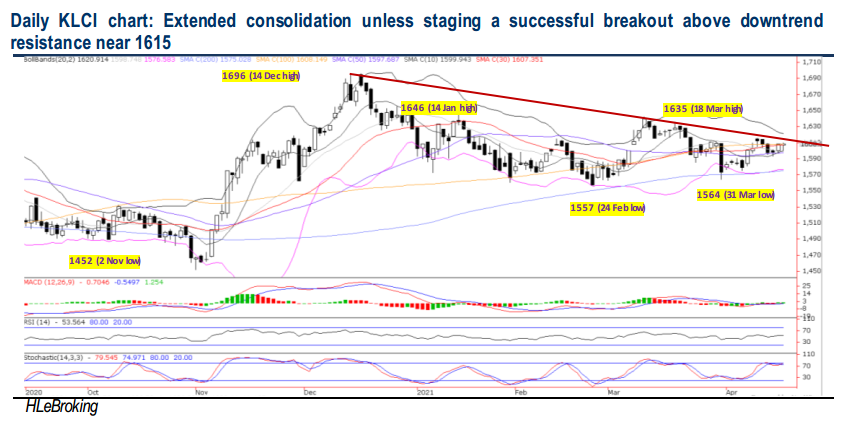

TECHNICAL OUTLOOK: KLCI

WoW, KLCI eased 4 pts at 1608 last Friday on mild profit taking after registering a 27-pt rebound in the week previously. We expect KLCI to extend its sideways consolidation but with an upside bias amid the formation of a small hammer candlestick last Friday. A successful downtrend resistance breakout above 1615 will spur the benchmark higher towards 1635-1646-1656 zones. On the flip side, a sharp fall below 1597 (50D SMA) will trigger downward pressures at 1585-1575 levels.

MARKET OUTLOOK

On the back of the renewed buying appetite on index-linked glove stocks (amid fears of another global Covid-19 wave) coupled with the buoyant Wall St performance, KLCI may attempt to break above the immediate downtrend line resistance near 1615 this week. However, we see stiffer hurdles situated at 1635-1646 levels due to the lack of domestic fresh catalysts and concerns of elevated local Covid-19 cases amid rising R-naught will derail a smoother domestic economic recovery. Meanwhile, weekly supports are pegged at 1597-1585-1574 zones.

On stock selection, we expect a slow and steady recovery for M-REITs, underpinned by a gradual domestic economic revival, the vaccine rollout plan, and the current low interest rates environment (bodes well for future acquisitions). Our top pick is AXREIT (TP: RM2.48; FY21E DY: 4.8%) with strong resiliency throughout the pandemic driven by increased demand in industrial properties, high occupant tenancy in its diversified portfolio and one of the few Shariah-compliant REITs. Other BUY ratings are IGB REIT (TP: RM1.91; FY21E DY: 4.9%), KLCC (TP: RM7.82; FY21E DY: 4.9%) and SENTRAL (TP: RM0.94; FY21E DY: 8%).

Source: Hong Leong Investment Bank Research - 19 Apr 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024