Malayan Flour Mills - A Full-fledged Regional Consumer Play; Pending a Bullish Flag Breakout

HLInvest

Publish date: Fri, 07 May 2021, 09:23 AM

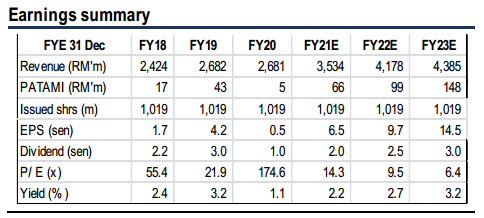

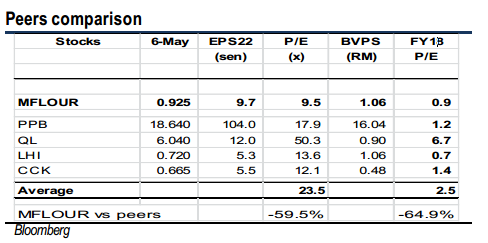

We see further rerating in MFM as the group is benefitting from the eventual recovery in consumption due to its dominant position in the flour market in Malaysia, as well as riding on its expansions over the last few years in Vietnam (at 16kg per capita consumption) and Indonesia (at 21kg) to ride on the huge growth potential in terms of consumption of flour per capita against Malaysia’s 35kg. The recent strategic disposal of its 49% stake in its poultry unit to Tyson Foods (NYSE:TSN, one of the world’s largest food companies) is a boon for earnings as MFM is reaping the synergies from producing more value-added Tyson-branded products, offtake agreements with Tyson Foods’ entities and expand its geographical reach via the latter’s global distribution capabilities. Valuation is undemanding at 9.5x FY22EP/E (vs peers 23x), supported by a 36% EPS CAGR from FY19-23.

Potential flag breakout. After building a base near RM0.90 in the last one month, MFM is ripe for a bullish flag breakout as the technical indicators are on the mend. Taking out the RM0.95 upper channel will spur prices towards RM1.06 before reaching our LT target at RM1.16 (38.2% FR) levels, underpinned by the bullish weekly rounding bottom pattern. Supports are pegged at RM0.85-0.90. Cut loss at RM0.845.

Source: Hong Leong Investment Bank Research - 7 May 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024