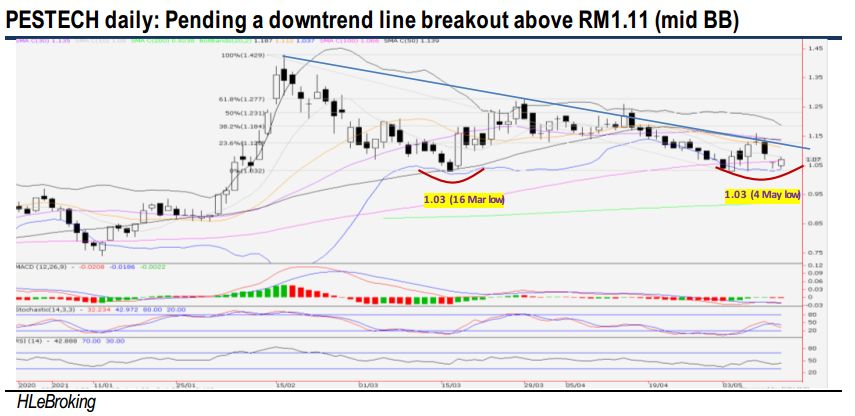

Pestech International - On a Roll; Pending a Bullish Downtrend Line Breakout

HLInvest

Publish date: Mon, 17 May 2021, 08:54 AM

We like PESTECH’s (HLIB Research-Non-rated-TP RM1.78) unique business proposition, given that it rides on the fast-growing regional demand for electricity and rail related infrastructure. In our opinion, PESTECH’s earnings have bottomed in FY06/20 and is likely to rebound by a 32.9% CAGR for FY06/21-23 from (1) a superior orderbook of RM2.2bn (>2x revenue coverage) coupled with large job tenders worth RM1.0-1.2bn (namely rail infrastructure/RV/EV etc); (2) solid recurring cash flow from concessions via Build-Operate-Transfer (BOT) and Build-Own-Operate (BOO) as well as contracted Build transfer (BT) projects; (3) strong growth potential of Malaysia and regional ASEAN power and rail infrastructure investments; and (4) solid startup of RE and EV infrastructure developments, in line with Malaysia and regional ASEAN’s green energy roadmap. The stock is trading at undemanding valuations of 8.7x FY22 P/E (40% below 5Y average 14.6x) as well as 1.2x P/B (52% below 5Y average of 2.5x).

Potential downtrend reversal. After correcting from a 52-week high of RM1.43 (16 Feb high), PESTECH has found a strong base at RM1.00-1.03 zones before closing at RM1.07 on 12 May. With prices trading above lower BB and technical indicators are on the mend, the stock is poised for a LT downtrend line breakout soon. A successful breakout above this hurdle near RM1.11 augurs well for share prices to rebound further towards RM1.23 (50% FR) before reaching our LT target at RM1.33 (76.4% FR). Cut loss at RM0.97.

Source: Hong Leong Investment Bank Research - 17 May 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024