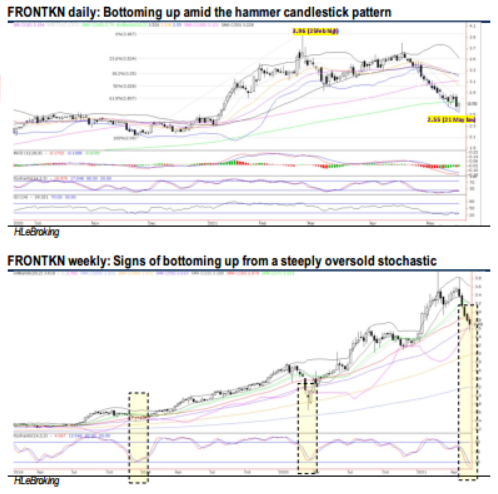

Frontken Corporation - Risk-reward Profile Turns Attractive After Recent Rout; Potential Downtrend Reversal

HLInvest

Publish date: Mon, 24 May 2021, 11:35 AM

After a 32% correction from its all-time high of RM3.96 to RM2.70, FRONTKN’s (HLIB Research – BUY – TP RM3.88) risk-reward profile is attractive, underpinned by 34.8x FY22 PE (13% lower than 2Y average) and promising FY20-23E EPS CAGR of 19%. We remain upbeat on FRONTKN’s outlook, supported by: (1) the upcycle of the global semiconductor industry (due to digitization of global economies, the deployment of 5G technologies, and robust investments in data centers and cloud services); (2) robust fab investments by major foundries and migration to advance nodes (16nm and below), which bodes well for FRONTKN (with leading-edge technology) who services major foundries in this region; (3) recovery in the O&G, and (4) strong balance sheet (net cash of RM323m or 20 sen per share) to support its Taiwan expansion.

Potential downtrend reversal amid a hammer candlestick formation. After plunging 36% from its all-time high of RM3.96 to a low of RM2.55 last Friday, FRONTKN has staged a relief rally to end at RM2.70. The hammer-like candlestick pattern and potential upticks in daily technical indicators coupled with soaring volume last Friday (8.2m shares vs 90D average 5.6m) could indicate potential downtrend reversal is around the corner. A successful breakout above RM2.81 (61.8% FR) could spur greater upward momentum to retest RM3.00 barrier and our LT target at RM3.25 (38.2% FR). Supports are pegged at RM2.55-2.48. Cut loss at RM2.45.

Source: Hong Leong Investment Bank Research - 24 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024