Inari Amertron - Rosy Growth Prospects Overshadow Proposed Private Placement and FMCO Concerns

HLInvest

Publish date: Wed, 02 Jun 2021, 11:26 AM

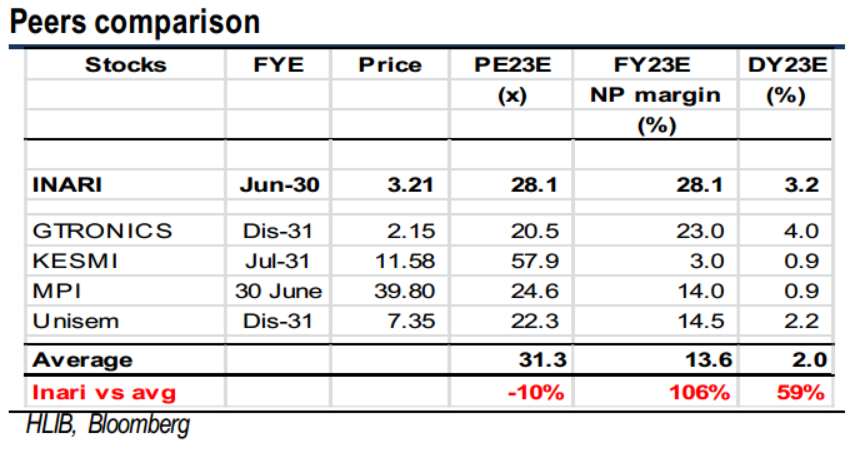

After a 14% correction from its all-time high of RM3.75 to RM3.21, we believe INARI’s (HLIB Research – BUY – TP RM3.81) risk-reward profile is attractive, underpinned by 28.1x FY22 PE (10% lower than peers), supported by a promising FY20-23E EPS CAGR of 39%, superior net profit margin and decent FY21-23 dividend yields (2.6- 3.2%). Besides, the recovery in global growth, sustained strong global semiconductor demand coupled with 5G adoption, above industry average margins, expanded capacity and robust balance sheet (net cash/share of RM0.23) are all positive catalysts for Inari. On the other hand, new earnings-accretive acquisitions, stronger USD, and new customer wins are potential re-rating catalysts for the stock.

Potential downtrend reversal following the double bottom patterns. After plunging 22% from its all-time high of RM3.75 to a low of RM2.92, INARI has staged a mild rebound to end at RM3.21 yesterday. The double bottoms and upticks in technical indicators could signal more upside towards critical neckline resistance at RM3.35. A successful breakout above this hurdle would spur greater upward momentum to retest RM3.62-3.75 zones. Supports are pegged at RM2.92-3.02. Cut loss at RM2.90.

Source: Hong Leong Investment Bank Research - 2 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|