HSS Engineering - Poised for a Bullish Ascending Triangle Breakout

HLInvest

Publish date: Thu, 10 Jun 2021, 11:37 AM

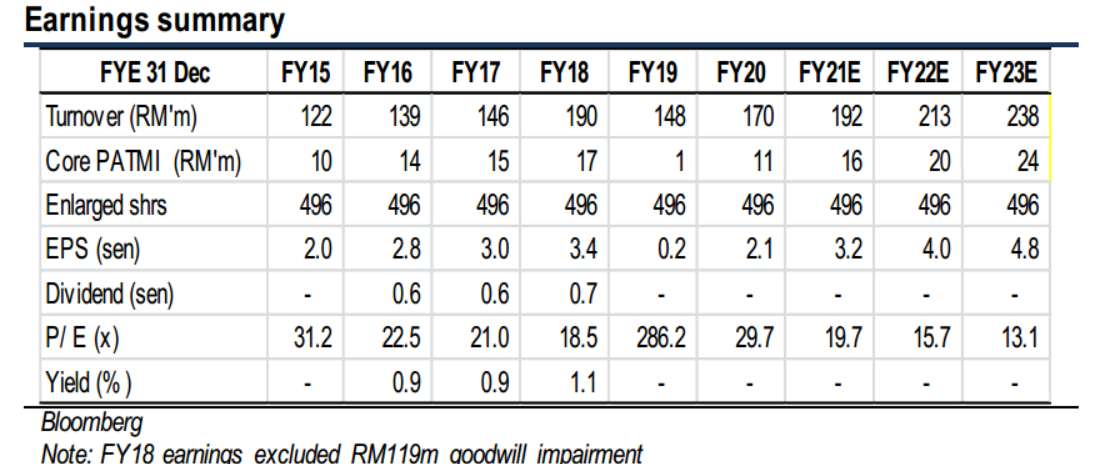

As a reputable engineering consultancy firm with diversified expertise in the power & water, railway & transit, highway, ports, etc., HSSEB is potentially a major beneficiary of the post Covid-19 recovery cycle, as government and contractors restart infrastructure projects. Valuation is undemanding at 15.7x FY22E P/E (52% below 1Y mean of 33x), supported by ~RM574m order book (sustainable for 2-3 years) and a strong 31% EPS CAGR from FY20-23.

Poised for a bullish ascending triangle breakout. After hitting an all-time high at RM1.93 (15 Feb 2018), HSSEB plunged 87% to a low of RM0.25 (23 Mar) before gradually consolidating upward to settle at RM0.64 yesterday, closing well above multiple key SMAs. In the wake of the MACD golden cross, bottoming up RSI and slow stochastic indicators, buying momentum may further accelerate to stage a long awaited ascending triangle breakout above RM0.68 neckline resistance. A successful breakout above this barrier will lift share prices higher towards RM0.76 (50% FR) and our LT target at RM0.80 psychological levels. Key supports are situated at RM0.61 and RM0.60 levels. Cut loss at RM0.57.

Source: Hong Leong Investment Bank Research - 10 Jun 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024