Traders Brief - Brace for Further Consolidation as FMCO Phase One Extends

HLInvest

Publish date: Mon, 28 Jun 2021, 10:31 AM

MARKET REVIEW

Global. Asian markets ended higher (MSCI Asia ex-Japan +7.2 pts to 703.45) as sentiment was boosted by Biden‘s USD1.2 trillion bipartisan infrastructure deal and Powell’s reassured remark that the loose monetary policy would remain and bond withdrawal process would be gradual.

Wall Street ended higher last Friday, spurred by weaker-than-expected inflation data and Biden’s USD1.2 trillion bipartisan infrastructure agreement over eight years, of which USD579bn is new spending. The S&P closed 0.3% higher to record high at 4281 (+2.7% WoW) and the Dow jumped 0.7% to 34433 (+3.4% WoW) whilst the Nasdaq eased 0.06%, to 14360 (+2.4% WoW).

Malaysia. After hovering within the 1556.2-1563.5 band, KLCI inched up 4 pts to 1559.7 last Friday as investors continued to assess the fluid domestic politics and the possibility of further extension of FMCO Phase 1 due to Covid-19 flare-up. Market breadth was negative bearish with 657 losers vs 344 gainers. Overall, trading activity was 19% lower WoW with an average daily value of RM2.9bn compared with RM3.6bn previously. In terms of fund flows, local retail investors were the major net buyers last week with RM580m (vs +RM227m in the previous week) inflows whilst local institutions remained the net sellers for a 2nd week with RM110m outflows (vs –RM303m previously). Meanwhile, foreign investors turned net sellers with a massive net selling of RM470m (vs +RM76m previously).

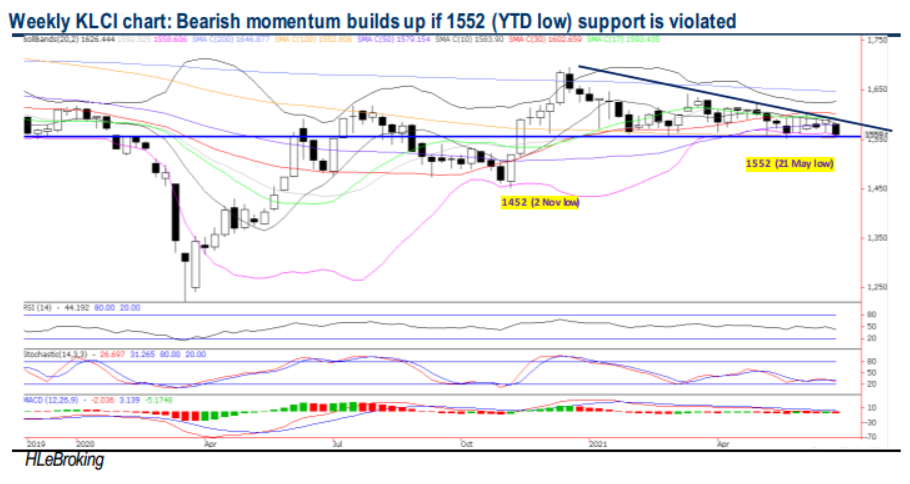

TECHNICAL OUTLOOK: KLCI

KLCI seesawed between 1580.7 and 1554.2 last week before settling at 1559.7, translating to a 29.4-pt weekly decline. Persistent selling sprees by foreign and local institutions have increased the chances of forming a bearish descending triangle pattern should the KLCI fail to defend the crucial YTD low support at 1552 levels in the coming days. A decisive breach may send the index lower towards 1545 (61.8% FR), 1533 (20M SMA) and 1500 levels. On the upside, only a strong breakout above the congested resistances at 1578 (200D SMA), 1587 (50D SMA) and 1600 levels can negate the current bearish momentum. Reiterate risk-off mode amid heightened market volatility.

MARKET OUTLOOK

Although last Friday’s Wall St’s rally may provide a boost to Bursa Malaysia today, multiple domestic headwinds could limit the gains (Resistances: 1578-1588-1600) as investors weigh on the fluid domestic politics and the extension of FMCO Phase 1 until the nation’s daily infections fall below 4000 cases (7D MA 5377). Nevertheless, acceleration of the nationwide vaccination programme, expectations of more comprehensive stimulus measures, and potential mid-year window dressing activities could cushion further slide, with key supports situated at 1552-1545-1533 levels.

Source: Hong Leong Investment Bank Research - 28 Jun 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024