Dagang Nexchange - Strategic investments to drive future growth; Pending a double bottom formation

HLInvest

Publish date: Tue, 29 Jun 2021, 10:11 AM

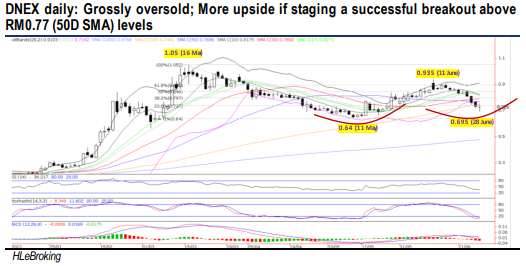

DNEX’s recent transformative deals in Silterra (right timing due to acute global shortage of semiconductor chips), PING Petroleum (strong cash inflow and riding on the high crude oil prices vs USD20/barrel of avg production cost), and strategic collaboration with TelkomInfra (Google & Facebook’s investment in Indonesia can create a big market for submarine cable business) are poised to drive the group’s future earnings to greater heights. Technically, a strong breakout above RM0.77 will confirm a bullish double bottom formation to spur prices towards RM0.82-0.935 territory.

Pending a double bottom formation. After correcting 39% from the all-time high of RM1.05 to a low of RM0.64, DNEX’s share price rebounded 46% to a high of RM0.935 before tumbling 22% on profit taking to RM0.725 yesterday. A bullish double bottom pattern could be formed in the near term if the share price is able to stage a successful reclaim above the RM0.77 (50D SMA) resistance soon. Clearing this hurdle will lift the stock towards RM0.82 (mid BB) and our LT objective at RM0.935 levels. Supports are pegged at RM0.695 and 0.64. Cut loss at RM0.63

Source: Hong Leong Investment Bank Research - 29 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024