Traders Brief - Under-siege by nagging local headwinds

HLInvest

Publish date: Thu, 01 Jul 2021, 10:19 AM

MARKET REVIEW

Global. Asian markets fell as sentiment was spooked by a resurgence of Covid-19 cases triggered by the more virulent Delta+ variants could undercut an economic recovery, while awaiting the crucial June nonfarm payroll report due on Friday, which could influence Fed policy. Wrapping up the 2Q, the Dow notched a 210-pt gain to 34502 (June: -0.08%; 2Q: +4.6%), boosted by a rebound in cyclical stocks amid signs of an improving private jobs data and strong confidence in the US economy, shrugging off the Delta variants outbreaks in Asia and a key June nonfarm payroll report (tonight).

Malaysia. KLCI tumbled 15.7 pts to 1532.6 (June: -3.2%; 2Q: -2.6%) amid nagging concerns on the fluid domestic politics (after Agong has decreed that parliamentary sittings should reconvene before 1 Aug) and a delayed economic recovery owing to FMCO Phase 1 extension and unabated local Covid-19 cases. Market breadth was sluggish with 661 losers vs 309 gainers. Foreign investors continued their net selling for the 8th consecutive day (-RM206m; 5D: -RM469m) whilst local institutions (+RM137m; 5D: -RM33m) and retail investors (+RM69m; 5D: +RM502m) were the net buyers in equities.

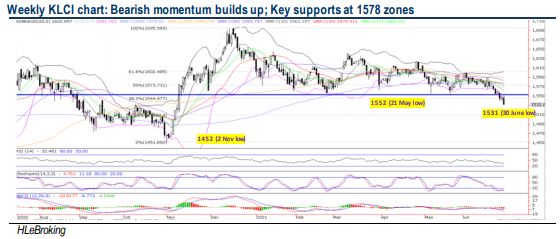

TECHNICAL OUTLOOK: KLCI

Following the recent slump (-3.2% in June and -2.6% in 2Q), KLCI is under-siege as the bears are in total control. We continue to see lower prices towards 1500-1510 levels in the coming days if the benchmark fails to reclaim above the crucial 1552 neckline resistance successfully. A strong breakout above this hurdle may lift index higher towards 1566-1578 zones. Reiterate risk-off mode amid heightened market volatility.

MARKET OUTLOOK

In the wake of recent multiple bearish supports’ breakdown, the bears are gaining an upper hand now amid heightened concerns on the fluid domestic politics, a delayed economic recovery owing to FMCO Phase 1 extension and elevated local Covid-19 cases (R0 rose to 1.05 from a monthly low of 0.90). We continue to see lower prices towards 1500-1510 levels in the coming days if the benchmark fails to reclaim above the crucial 1552 neckline resistance successfully. Nevertheless, we expect some market recovery in July-Aug (vaccination ramp up and transition to NRP Phase 2) but this should be more significant in Sept-Oct (migration to Phase 3). We advocate a more balanced portfolio proposition with a lean towards recovery plays. These include Maybank, Tenaga (broad recovery proxies), UWC, VS, MBM (Phase 2 reopening), MrDIY, FocusP (Phase 3 retail beneficiaries), TM, SENTRAL (defensives), Bursa (recovery amid volatility play), Armada and Sunway (value and value unlocking).

Source: Hong Leong Investment Bank Research - 1 Jul 2021