Traders Brief - KLCI in consolidation mode but lower liners’ interests pick up

HLInvest

Publish date: Tue, 06 Jul 2021, 05:47 PM

MARKET REVIEW

Global. Asian markets ended marginally higher (MSCI Asia ex-Japan: +1-pt to 691.2) as the US June jobs data last Friday was not seen as strong enough to respite the Fed hawks. Wall St was closed overnight due to the US Independence Day holiday. The Dow futures rose 50 pts to 34729 (at the point of writing) as investors await the release of June FOMC minutes due Wednesday for clues about the central bank’s timeline on winding down its QE program. Meanwhile, Brent prices surged USD0.9 to USD77.1 after OPEC+ talks yield no production deal.

Malaysia. Ahead of the upcoming BNM meeting on 8 July, KLCI eased 1-pt to 1532.4 after hovering between 1525.4 and 1,535.9, as sentiment was dampened by the implementations of EMCO over most parts of Klang Valley (contribute ~40% of GDP) to contain the persistently high daily Covid numbers. Market breadth was mixed 526 gainers vs 503 losers. Total volume was 6.5bn shares valued at RM3.6bn against 5.5bn shares worth RM2.9bn last Friday. Foreign investors net sold RM26m securities (its 11 th consecutive day ) followed by local institutions (-RM4m; net buying RM190m last week). Meanwhile, retail investors remained the major net buyers (RM30m) for the 15th consecutive day.

TECHNICAL OUTLOOK: KLCI

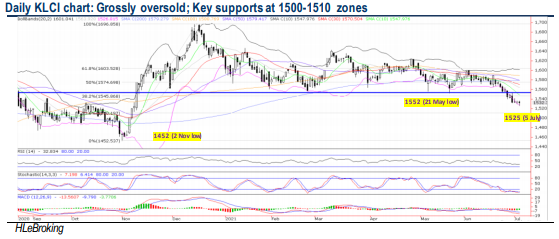

KLCI plunged 10% from 52-week high of 1696 to a fresh YTD low at 1525 before rebounding to end 1-pt lower (after falling as much as 9 pts intraday) to 1532. The 1500- 1510-1525 zones may act as a magnet to draw prices lower but the long-legged Doji pattern yesterday may signal potential downtrend reversal in the coming days once the key resistances near 1545-1552 levels are taken out successfully, supported by the mild bottoming up technical indicators.

MARKET OUTLOOK

In the near term, lingering domestic headwinds i.e. the fluid domestic political scene, a delayed economic recovery, and elevated local Covid-19 cases may continue to dampen sentiment, with key supports pegged at 1500-1510-1525 levels. Nevertheless, the bearish sentiment would improve amid the aggressive vaccination rollouts and more states could move into Phase Two of the National Recovery Plan (as highlighted by PM yesterday). Meanwhile, Penang will join the other five states (Kelantan, Pahang, Perak, Terengganu and Perlis) to move into Phase Two of the NRP on 7 July.

Source: Hong Leong Investment Bank Research - 6 Jul 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024