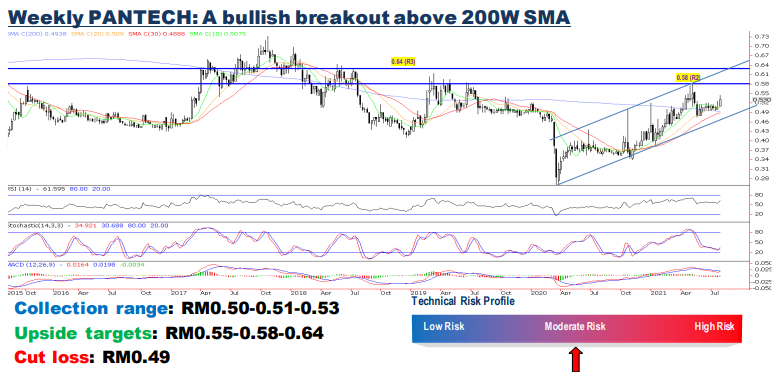

Technical Tracker - PANTECH - Beneficiary of buoyant crude oil prices; Bullish 200W SMA breakout

HLInvest

Publish date: Wed, 28 Jul 2021, 06:10 PM

Pantech (listed in Feb 07) is a one-stop centre for steel PVF (pipes, valves and fittings), commanding ~40% market share in Malaysia. The group has a diversified clientele from offshore & marine, refinery, energy, petrochemical & chemical industries, palm oil refining, and other related industries. More than 65% of its revenues are derived from customers in the upstream and downstream of the O&G industry.

The group is engaged primarily in: (i) the trading of steel-related pipes, valves, fittings and flow control (PVF solutions); and (ii) the manufacture of butt-welded carbon steel, copper nickel & nickel alloy pipes & fittings. In FY21, the trading and manufacturing divisions contributed 55% and 45% to revenue, respectively.

In 1QFY22, the group recorded RM15.2m net profit (4Q21: RM13.1m; 1Q21: -RM5.6m) on the back of RM149m revenue (4Q21: RM136m; 1Q21: RM81m). Overall, management is optimistic about its FY22 performance amid the resumption of the global economic activities, thanks to the rising O&G prices and the availability of Covid-19 vaccines. At RM0.53, the stock is trading at 8.3x trailing P/E (24% discount against peers) and 0.6x P/B (39% lower than its peers), supported by an attractive 4.7% DY (49% higher than its peers).

Technically, Pantech may trend higher after breaking the RM0.52 neckline resistance and hit its 3-month high yesterday. Together with the positive close above the key daily and weekly SMAs, short to medium term bullish bias is enhanced, underpinned by bottoming up daily and weekly indicators. A strong breakout above immediate RM0.55 resistance will lift the stock towards RM0.58-0.64 territory. The collection range is pegged at RM0.50-0.53. Cut loss at RM0.49.

Source: Hong Leong Investment Bank Research - 28 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024