Technical Tracker - UCHITEC: Expecting a Better 2H21; Poised for a Bullish Triangle Breakout

HLInvest

Publish date: Mon, 13 Sep 2021, 09:26 AM

Profile: UCHITEC is a renowned one-stop original design manufacturer (ODM) of electronic control modules, offering a wide spectrum of services that range from R&D, tools design and set up, and engineering support to the production of finished electronic control systems for household appliances (e.g. fully and semi-automated coffee machines) and appliances for office services sector (industrial scale, professional iron station, etc). With a range of customer base that includes prominent multinationals, majority (>90%) of their products are exported to the European market. Its products can be divided into 2 categories i.e. Art-of-living & Biotech.

Undemanding valuation. UCHITEC’s valuation appears undemanding, trading at 15.9x FY22E EPS (9% below its peers’ average), supported by attractive FY22E DY of 5.6% (vs peers’ 2.5%), strong net cash/share of RM0.39 and robust FY22E net margin of 52.6% (vs peers’ 5.5%). We like Uchi for its (i) stable earnings drivers being the sole supplier and R&D partner for its customers; (ii) involvement in indispensable market of coffee and biotech division that could serve as future catalyst in this pandemic era; (iii) attractive dividend yield, superb net profit margin and strong net cash (strong cushion to any downside risk); and (iv) expect a better 2H21 amid capacity normalisation given that more than 80% of Uchi's employees have completed 2 doses of vaccination as at end Aug.

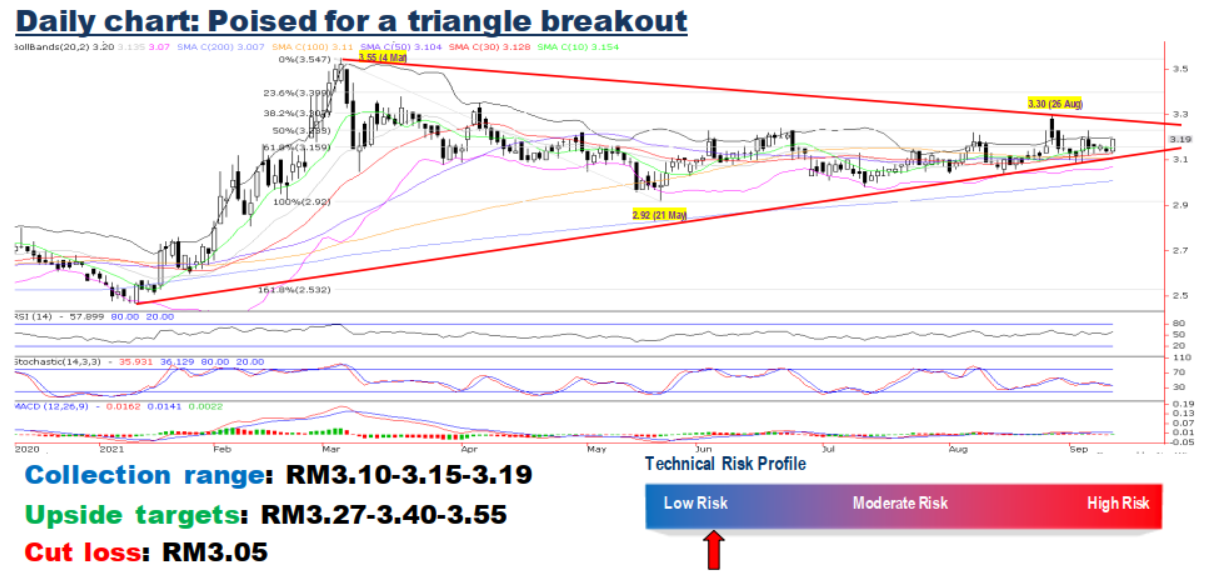

Poised for a bullish triangle breakout. After falling 17% from 52-week high of RM3.55 to a low of RM2.92, UCHITEC has rebounded steadily to close at RM3.19 last Friday. The stock is likely to break above RM3.27 (downtrend line from RM3.55) as share price has closed above multiple key SMAs, with higher upside targets at RM3.40 (76.4% FR) and RM3.55 zones. Collection range is RM3.10-3.19 whilst cut loss is pegged at RM3.05 levels.

Source: Hong Leong Investment Bank Research - 13 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024