Traders Brief - Upside Bias Amid Potential 3Q Window Dressing

HLInvest

Publish date: Tue, 28 Sep 2021, 09:54 AM

MARKET REVIEW

Global. Asian markets ended mixed as China Evergrande’s debt woes continued to be a focal point with regards to the USD83.5m dollar-bond interest payments due last Thursday and another USD47.5m due on 29 Sep. The Dow gained 71 pts to 34869, boosted by a jump in energy and financial stocks whilst the Nasdaq slipped 77 pts to 14970, dampened by rising yields and inflation. Oil prices jumped 1.8% to USD79.5 on expectations for tighter crude supplies and recovery in global demand whilst the US 10Y Treasury yield gained 0.04% to 1.49% amid impending Fed’s pullback in stimulus.

Malaysia. KLCI ended flat (+1-pt to 1533.1) after fluctuating within the 1526.1-1533.5 tight range as investors dissect the 12MP announcement and the widely talked about windfall tax, capital gain tax and possible reintroduction of GST ahead of the Budget 2022 (29 Oct). Market breadth remained negative for a 2nd day as the losers edged the gainers by 587-to- 424 stocks. In terms of fund flows, retailers and foreign funds net bought RM67m and RM7m, respectively. After logging RM51m inflow last Friday, the local institutions resumed net their net selling pace amounting to RM74m.

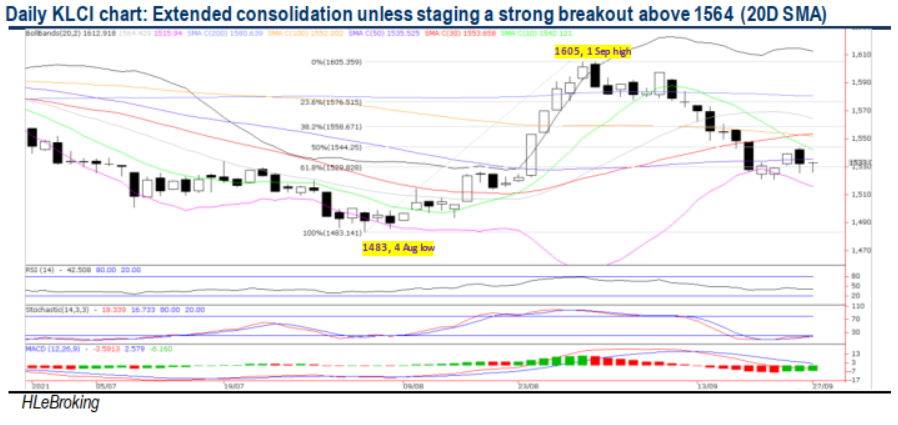

TECHNICAL OUTLOOK: KLCI

After plunging as much as 85 pts from 1605 to 1520 on 21 Sep, the benchmark staged a mild rebound to close at 1533 yesterday. The current rebound from the 1483 low may continue this week ahead of the potential 3Q21 window dressing activities but we expect stiff barriers at 1544-1558-1576 zones in the short term. A successful breakout above these hurdles may lift the benchmark out of the sideways consolidation mode to revisit 1581-1605 territory. On the downside, key supports are situated at 1500-1510-1520 levels.

MARKET OUTLOOK

Although the 12MP received a lukewarm response yesterday, the rebound from the 1483 low may continue this week ahead of the potential 3Q21 window dressing activities (driven by O&G and financial stocks amid surging oil prices and rising yields) coupled with further re-opening of economic sectors as the nation enters an endemic phase by year-end. Nevertheless, we expect stiff hurdles at 1544-1559-1568 zones in the short term pending more clarity on Evergrande’s bond interest payment schedule and the government’s proposals to boost its coffers with widely talked about windfall tax, capital gain tax and possible reintroduction of GST ahead of the Budget 2022.

Source: Hong Leong Investment Bank Research - 28 Sept 2021