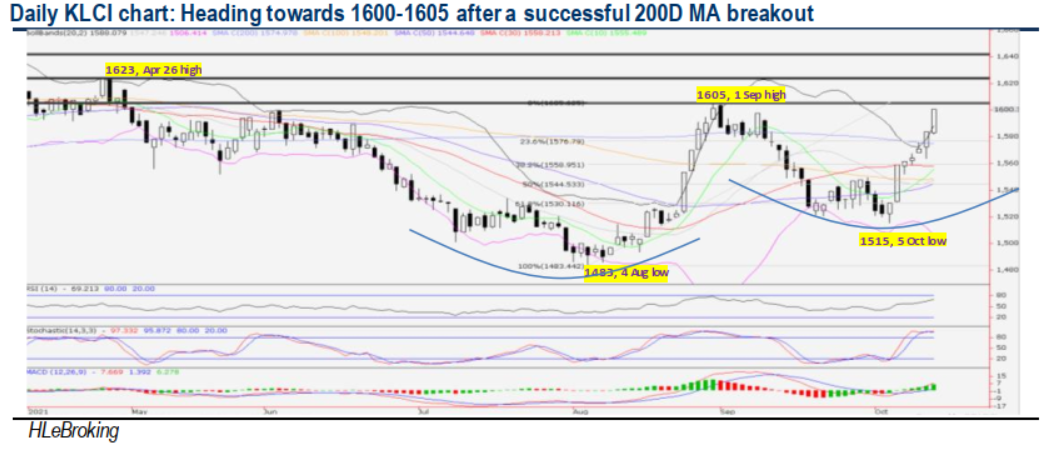

Traders Brief - More Upside Towards 1605-1623 Before a Meaningful Pullback Emerges

HLInvest

Publish date: Thu, 14 Oct 2021, 10:40 AM

MARKET REVIEW

Global. Asian markets ended mixed, as investors weighed on the run-up to the US 3Q21 earnings season and Sep FOMC minutes, coupled with the better-than-expected Sep trade data in China amid slowdown fears fanned by a power crunch and Evergrande’s debt crisis. The Dow tumbled as much as 263 pts following a higher-than-expected Sep CPI and profit-taking pullback in megabanks before ending flat at 34377, as investors viewed an imminent end to ultra-loose US monetary policy as a vote of confidence in the economy. The Fed's September minutes signalled the bond tapering program could start as soon as mid-Nov though they remained divided over how much of a threat high inflation poses and how soon they may need to raise interest rates.

Malaysia. Tracking higher ASEAN markets, KLCI rallied 16.5 pts to 1600.4, registering its 7th consecutive gains amid buying interests in banking, plantation and telco stocks. Market breadth remained positive for a 6th straight session with 577 gainers vs 460 losers. Trade flows wise, foreigners were the major net buyers for a 6th consecutive session (+RM262m; 5D: +RM797m) whilst retailers (-RM16m; 5D: +RM2m) joined local institutions as the net sellers (-RM246m; 5D: -RM796m).

TECHNICAL OUTLOOK: KLCI

As expected, KLCI finally retested our envisaged 1600 resistance following a successful breakout above 200D MA on 12 Oct. The long white candlestick coupled with the bullish MACD and RSI readings are likely to drive the benchmark higher to 1605-1623 territory before a meaningful pullback occurs (reflected by toppish stochastic reading). Key supports are now pegged at 1558-1576 territory.

MARKET OUTLOOK

In the wake of resumption in foreign inflows (~70% correlation between KLCI and foreign shareholding) and economic reopening gaining traction with interstate and overseas travels allowed for the fully vaccinated effective 11 Oct, as well as riding on elevated commodity prices, KLCI is expected to progress further as market risk appetite returns. However, further rally may be capped near 1605-1623 zones (key supports: 1558-1576 zones) amid lingering concerns that unpopular taxes could be mooted in Budget 2022 to boost revenue and overbought stochastic reading (+85 pts in 7 days).

Source: Hong Leong Investment Bank Research - 14 Oct 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024