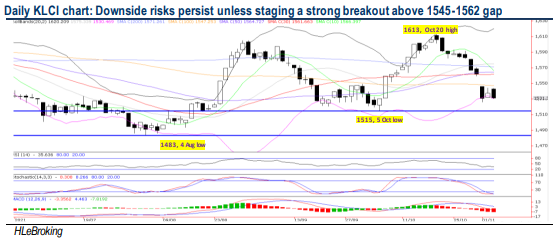

Traders Brief - Extended consolidation unless staging a strong breakout above 1545-1562 gap

HLInvest

Publish date: Fri, 05 Nov 2021, 09:54 AM

MARKET REVIEW

Global. Asia Pacific stocks were mostly up on Thursday as investors welcomed Fed’s tapering timeline and “patience” on interest rate hikes in the near term. Ahead of the key Oct jobs data tonight, the S&P 500 (+0.4% to 4680) and Nasdaq (+0.8% to 15940) closed at record highs whilst Dow reduced losses to 33 pts (from as much as -171 pts), led by consumer discretionary stocks and a chip-fueled jump in tech following a slew of positive quarterly earnings (Refinitiv: S&P 500 earnings is expected to jump 39% YoY in 3Q21 and another 22% in 4Q21).

Malaysia. Ahead of the Deepavali holiday, KLCI ended lower on 3 Nov (-6.3 pts to 1531.3), dragged down by selling pressures from heavyweights such as Top Glove and Maxis. Market breadth returned to negative as the G/L ratio was 0.50 vs 1.56 previously. Trade flows wise, local institutions (+RM14m; 5D: -RM444m) turned into net buyers as foreigners (-RM94m; 5D: -RM116) offloaded equities. On the other hand, retailers (+RM32m; 5D: +RM560m) continued to be the net buyers for the 8th consecutive session.

TECHNICAL OUTLOOK: KLCI

Despite a mild relief rebound of 6.3 pts to 1543.9 in early trades on Tuesday, KLCI surrendered all the gains to close at 6.3 pts lower at 1531.3. We expect KLCI to remain choppy as investors continue to assess the repercussions from the prosperity tax and higher stamp duty rate, as well as ongoing Nov reporting season. Stiff hurdles are pegged at 1545-1562 gap (1 Nov) and 1572 (200D MA) whilst crucial downside supports are situated at 1500-1515 territory.

MARKET OUTLOOK

As investors continue to assess the repercussions from the prosperity tax and higher stamp duty rate, coupled with the ongoing Nov reporting season, overall KLCI trend could remain choppy. However, severe downside risk may be cushioned near 1483-1500-1515 zones owing to the aggressive economic reopening activities with more states are moving to phase 3 and 4 of NRP, high vaccination rate (~96% of the adults had fully vaccinated on 4 Nov) and firm commodity prices. Stiff hurdles are pegged at 1545-1562 gap (1 Nov).

Source: Hong Leong Investment Bank Research - 5 Nov 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024