Traders Brief - Lackluster Trading Ahead of the Melaka Polls and Ongoing Results Season

HLInvest

Publish date: Fri, 19 Nov 2021, 10:30 AM

MARKET REVIEW

Global. Ahead of Biden’s decision on the next Fed’s Chairman this week (incumbent Powell’s term will expire in Feb 2022), the MSCI Asia ex Japan index fell 4.9 pts to 649.73, led by declines in technology and O&G stocks amid heightened inflation and rate hike concerns. Both the S&P (+18 pts 4706) and the Nasdaq (+175 pts to 16483) eked out record closing highs whilst Dow lost 60 pts to 35870 (from as much as -277 pts), as investors focused on upbeat retail and technology earnings as well as the Nov Philly Fed manufacturing index (hit its highest level since Mar 73), overshadowed hawkish comment from New York Fed’s Bank President John Williams.

Malaysia. In line with lower regional markets, KLCI eased 1.3 pts to 1523.8, bogged down by losses in glove, banking, and leisure stocks, ahead of the Melaka state polls (20 Nov), ongoing results season coupled with rising R-Naught and Covid-19 cases recently. Market sentiment was tepid as decliners surpassed gainers 560 to 387 while turnover fell to 2.81bn shares worth RM2.12bn from Wednesday’s 3.15bn shares valued at RM2.46bn.

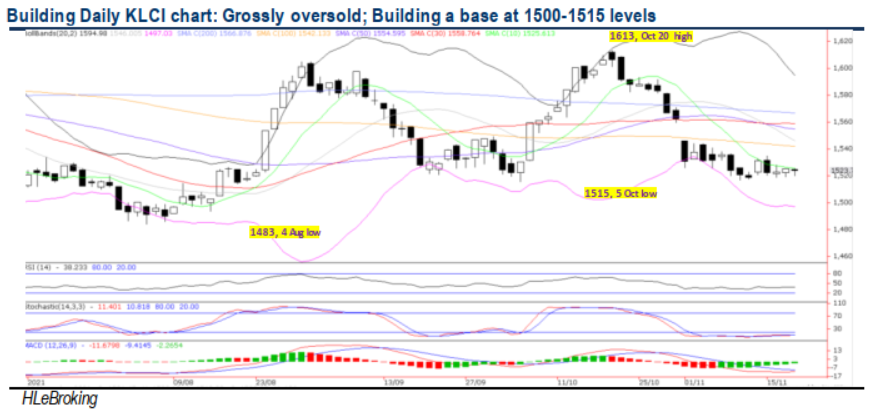

TECHNICAL OUTLOOK: KLCI

We reiterate our view that KLCI will continue to trend sideways unless the benchmark can break above the key 1545-1560 levels successfully. Clearing these hurdles will lift the index towards 1568-1576-1590 territory. On the flip side, severe downside seems limited at 1500- 1515 zones amid grossly oversold technical indicators.

MARKET OUTLOOK

We expect the KLCI would continue its sideways consolidation mode for the time being (stiff resistances: 1545-1560), ahead of the Melaka state polls (20 Nov) and ongoing Nov results season coupled with the revival in Covid-19 cases recently. Nevertheless, the downside risk seems limited (key supports: 1500-1515 zones), supported by grossly oversold indicators, aggressive economic reopening activities with most states are moving to phase 4 of NRP, high vaccination rate (76.4% of the total population fully vaccinated on 18 Nov), the reopening of KLIA and Changi Airport (29 Nov) and firm commodity prices.

Source: Hong Leong Investment Bank Research - 19 Nov 2021

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024