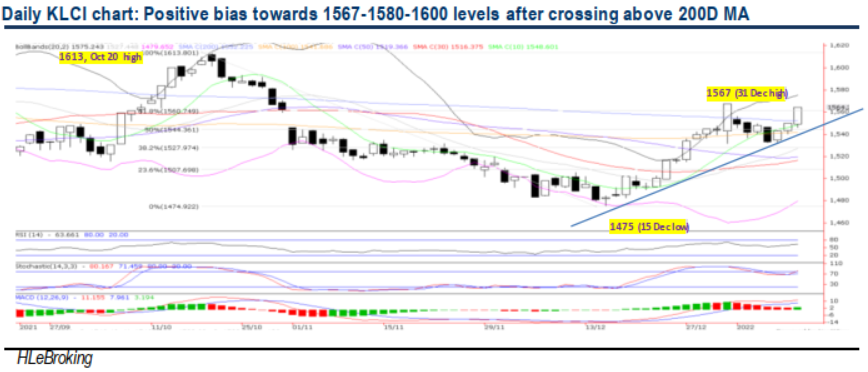

Traders Brief - Positive Bias After Breaking Above 200D MA; Marching Towards 1567-1580-1600 Zones

HLInvest

Publish date: Wed, 12 Jan 2022, 09:31 AM

MARKET REVIEW

Global. Ahead of the key speech from Powell overnight and the US inflation report tonight, and the upcoming 4Q21 results by Wells Fargo, Citigroup and JPMorgan (14 Jan). Asian markets were traded lower as investors kept an eye on Covid-19 virus mutations, supply chain disruptions, and more central banks tightening their monetary policies. Wall St rebounded from 5-day routs as tech surged after the US 10Y bond yields edged 0.02% lower at 1.74%, following Powell’s less hawkish than expected testimony, soothing fears of aggressive Fed policy tightening. Powell confirmed the Fed plans to begin normalizing policy including ending bond purchases, hiking rates, and letting bonds on its balance sheet mature later this year.

Malaysia. After sliding 34.1 pts from 3-6 Jan, KLCI continued its technical rebound for a 3rd straight session, rallying 14.1 pts to 1564.3 yesterday mid further shift in market leadership to financials as the combination of surging Omicron cases, rising inflation, and hawkish monetary policy signals has hit more significantly in the highly valued technology sector. Despite the headline gains, overall market breadth stayed negative as losers 639 outnumbered 357 gainers with turnover falling 37% to 4.15bn shares valued at RM2.84bn, led by losses in technology, healthcare and ACE counters.

TECHNICAL OUTLOOK: KLCI

Bucking overnight decline from Wall St and lower regional markets, KLCI jumped 14.1 pts at 1564.3 to record its 3rd consecutive gains. As the KLCI is now trading above the major 100D/200D MAs and support trendline from 1475, we expect the index to re-challenge 1567 (31 Dec high), followed by 1580 (76.4% FR) before heading towards the formidable 1600 psychological barrier. On the flipside, a decisive fall below the support trendline near 1538 may trigger renewed selling spree towards 1500-1516-1528 levels.

MARKET OUTLOOK

Barring any breakdown below the support trendline (near 1538), KLCI may retest the 1567- 1580-1600 hurdles following a strong reclaim above 1552 or 200D MA yesterday, boosted by aggressive economic reopening activities, declining domestic Covid-19 cases, high vaccination rates, and elevated FCPO and oil prices. Nevertheless, our mantra of continued cautious patience prevails (key supports: 1475-1500-1516) as the positives are partly offset by Covid-19 virus’ mutation, hawkish Fed, slowing China’s economy, domestic policy and regulatory risks, the return of intraday short selling, high inflation, and political fluidity.

Source: Hong Leong Investment Bank Research - 12 Jan 2022

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024