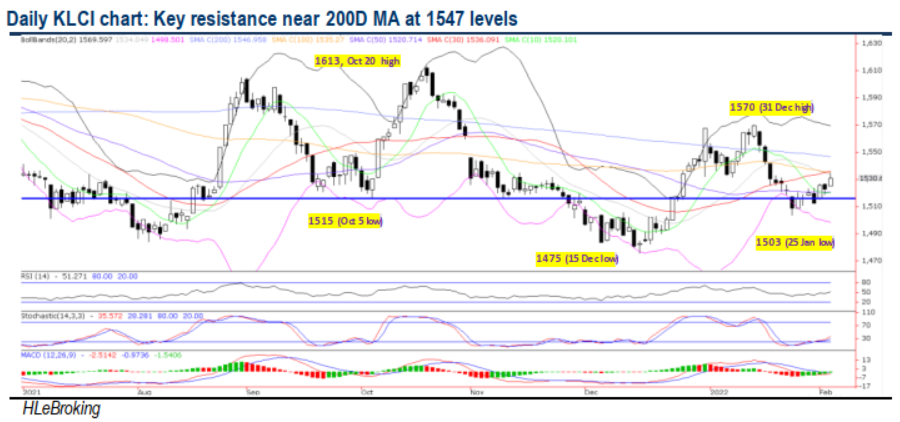

Traders Brief - Facing Critical Hurdle Near 200DMA at 1547 Levels.

HLInvest

Publish date: Tue, 08 Feb 2022, 08:59 AM

MARKET REVIEW

Global. Asian market ended mostly lower as investors bet the stunningly strong U.S jobs data will trigger further aggressive monetary policy by the Fed despite surging Omicron infections. Also, sentiment remains cautious ahead of the India, Indonesia, and Thailand central banks’ monetary decision week. Overnight, the Dow shed the earlier 236 pts gain to end +1.4 pts at 35091 whilst the Nasdaq lost 82 pts to 14016, as investors assessed the outlook of tighter monetary policy and awaited fresh inflation figures (10 Feb) coupled with the slump in Meta stock amid a threat of closing down its Facebook and Instagram in Europe over General Data Protection Regulation (GDPR) rules.

Malaysia. Bucking the soft regional markets and a resurgence of the local daily Covid-19 cases, KLCI ended 7.9 pts higher to close at 1530.6, led by selected heavyweights in glove and banking counters. Market breadth continued to stay positive with gainers overwhelmed losers by 539 to 383 whilst total turnover rose 25% to 3.0bn shares valued at RM2.30bn.

TECHNICAL OUTLOOK: KLCI

Following the slide from YTD high of 1570 to a low at 1503, KLCI has steadily rebounded to end at 1530 yesterday, above the key 1515 (neckline support) and 1520 (50D MA) levels. Tracking the bottoming up indicators, KLCI may retest the next critical 200D MA hurdle at 1547 levels. Only a strong breakout above 1547 will lift the benchmark from the current range bound consolidation towards the 1570-1600 territory. Immediate supports are pegged at 1500-1515-1520 levels.

MARKET OUTLOOK

Despite recent rebound from a low of 1503 to 1530 yesterday, we expect volatility to prevail with sticky hurdle near 200D MA at 1547 and YTD high of 1570 levels, clouded by hawkish Fed, elevated inflation, geopolitical tensions in Ukraine, Feb reporting season, Johor snap elections and the unfolding of Omicron waves in Malaysia. Nevertheless, KLCI’s downside could be cushioned at 1500-1515 levels due to the aggressive economic reopening activities, high vaccination rates, and high FCPO and crude oil prices.

Source: Hong Leong Investment Bank Research - 8 Feb 2022

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024