Traders Brief - Technical Rebound in the Offing But Expect Stiff Hurdles Near 1,460-1,476 Zones

HLInvest

Publish date: Fri, 08 Jul 2022, 09:38 AM

MARKET REVIEW

Global. Asian markets ended broadly higher as investors digested the hawkish June FOMC minutes and better-than-expected June PMI services data. In addition, sliding commodities prices such as oil, copper and metal have partially relieved the fear of high inflation. Ahead of the key June jobs report tonight, Dow rallied 347 pts to 31,384 as it is trying to form a bottoming process after plummeting from all-time high of 36,952 to recent low of 29,653. Still, cautious sentiment prevails as the US 10Y Treasury yield (+7bps to 2.99%) and the 2Y yield (+6bps to 3.02%) curve remained inverted amid looming recession fear and bets for another 75 bps rate hike on 26-27 July FOMC meeting, which was supported by both Governor Waller and President Bullard speeches.

Malaysia. Bucking regional market, KLCI eased 2 pts lower to 1,418 due to the sell down in PCHEM, PMETAL and banks despite a strong rebound in plantation and healthcare heavyweights after recent rout. Market breadth (gainers/losers) continued to hover <1 for a seven straight days, but the ratio recovered from 0.29 a day before to 0.84. Foreign institutions remained as net sellers (-RM5m, 5D: -RM145m, YTD: +RM5.94bn) vis-à-vis net buying trades by local institutions (+RM 1m; 5D: +RM21m; YTD: -RM7.62bn) and retailers (+RM4m, 5D: +RM124m; YTD: +RM1.68bn).

TECHNICAL OUTLOOK: KLCI

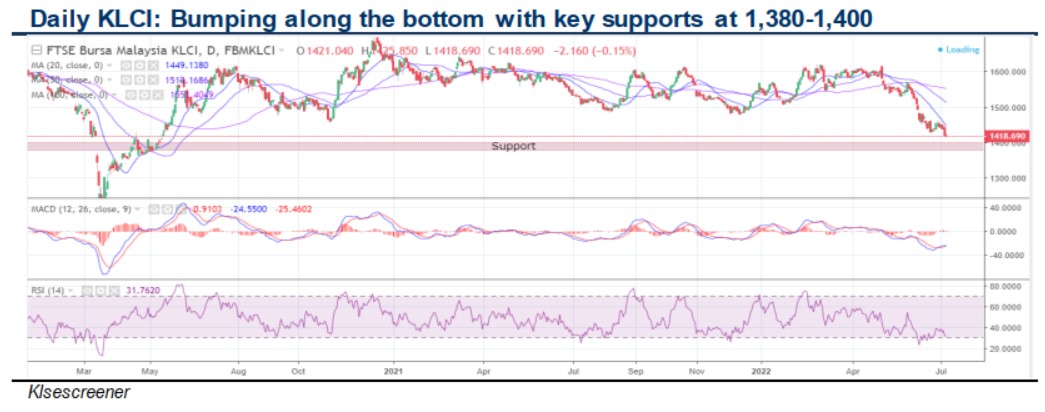

After breaking below 1,428 (2Y low) and 1,440 (10D MA) support, KLCI may slide further towards 1,380-1,400 levels before staging a relief rally. A successful relief rebound above 1,428-1,440 barriers would spur the index towards 1,460 (1M high) and 1,476 neckline resistance, before heading to the formidable resistances at 1,500 levels. Conversely, a further breakdown below 1,380 could drag the index lower towards 1320-1355 levels.

MARKET OUTLOOK

Weighed by the multi-layered of challenges such as (i) elevated inflation, (ii) capital outflows amid aggressive Fed, (iii) protracted Russia-Ukraine war, (iv) political overhang amid speculation of GE15 in 2H22, (v) looming US recession and (vi) paucity of earnings and GDP growth in 2H22, underpinned by recent government’s economic rationalization measures, soaring inflation and interest rates upcycle, we expect KLCI to stay in a choppy mode in July (supports: 1,380-1,400; resistances: 1,460-1,476-1,500). Nevertheless, we continue to like sectors such as banks and media, underpinned by undemanding valuations and attractive FY22 dividend yields >5%. Our top picks include MAYBANK (BUY- TP: RM9.70), RHB (BUY – TP: RM7.00), ASTRO (BUY – TP: RM1.34) and MEDIA (BUY – TP: RM0.67).

Source: Hong Leong Investment Bank Research - 8 Jul 2022

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024