Traders Brief - Critical Psychological Support Near 1,400 to Prevent Further Slide Towards 1,360-1,385

HLInvest

Publish date: Thu, 14 Jul 2022, 09:35 AM

MARKET REVIEW

Global. Ahead of the US June inflation report and China 2Q22 GDP print (15 July), Asian markets ended mixed, as the better-than-expected China trade data was overshadowed by a resurgence of Covid cases in Japan and China, and expectations of another 40Y high US inflation data which is expected to bolster the Fed’s aggressive tightening plans. Overnight, Dow plunged as much as 467 pts before paring off its decline to -208 pts at 30,773 as investors weighed another red-hot June CPI (9.1%, consensus: 8.8%, May: 8.6%), boosting speculation of an even more hawkish Fed of 100bps hike in 26-27 July FOMC meeting. Meanwhile, the inversion in a closely watched of the 10Y-2Y yield curve deepening (10Y yield: -2bps at 2.93%; 2Y yield: +9bps at 3.13%) as the gap is the most negative since Sep 2000 amid lingering worries over a recession.

Malaysia. Tracking the sluggish ASEAN markets, KLCI slid 14.8 pts or 1% to 1,411.32, led by broad-based selloff in most sector indices except consumer product & services (+0.06%). Market breadth (gainers/losers) retreated to 0.43 from 0.51 a day before, closing <1 for the 9th out of 10th sessions. Foreigners resumed their selling spree (-RM82m, 5D:- RM115m; YTD: +RM5.89bn), which was absorbed by buying trades from both the domestic institutions (+RM48m, 5D: -RM11m, YTD: -RM7.63bn) and local retailers (+RM34m, 5D: +RM126m, YTD: +RM1.75bn).

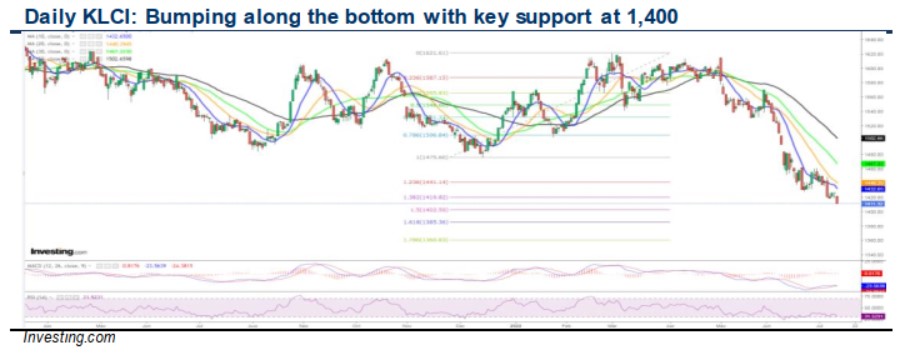

TECHNICAL OUTLOOK: KLCI

Following yesterday’s last minute selloff, KLCI’s technical has tuned increasingly negative after failing to reclaim above the 10D MA near 1,432 during its recent bounce. In line with recent Wall St rout, KLCI may drift toward the critical 1,400 psychological support soon. A decisive breakdown below 1,400 could drag the index lower towards 1360-1385 levels. Key resistances are situated at 1,420-1,432-1,460 levels.

MARKET OUTLOOK

KLCI could witness further selldown towards the critical 1,400 psychological support today in line with an overnight Wall St rout, given the persistent weak underlying sentiment amid multi-layered of headwinds i.e. elevated inflation, recession risks, further capital outflows, political overhang and a resurgence of Covid cases due to new variants. A decisive breakdown below 1,400 could drag the index lower towards 1360-1385 levels (resistances: 1,420-1,432-1,460).

VIRTUAL PORTFOLIO POSITION-FIG1

In the wake of the bearish sentiment, we decided to square off MYEG (7% loss) amid weakening technicals.

Source: Hong Leong Investment Bank Research - 14 Jul 2022

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024