Traders Brief - Choppy Amid Local and External Headwinds

HLInvest

Publish date: Fri, 09 Dec 2022, 09:10 AM

MARKET REVIEW

Asia/US. Most Asian markets fell as investors weighed on China’s further relaxation of movement curbs in most major cities whilst grappling with a record -high daily spike in COVID-19 cases, which could spur uncertainty over when the country will announce a full reopening. Sentiment was also dampened by potential US hard landing amid fresh recessionary fears. The Dow rose 183 pts to 33,781 (off intra-day high +301 pts) as investors continued to assess the outlook for growth and the trajectory of monetary policy while awaiting key economic data tonight (i.e. Nov PPI and the Michigan consumer sentiment) and the Nov CPI data on 13 Nov. Meanwhile, the steep inversion in the 10Y-2Y Treasury yield curve (-0.01 to -0.84, the lowest since 1981), a harbinger of a recession, continued to keep fears of a Fed-led recession alive.

Malaysia. KLCI eased 1-pt to 1,465.9 on lack of fresh catalysts, in line with the downbeat performance in most regional peers prior to the 13-14 Dec FOMC meeting. Market breadth (gainers/losers ratio) turned negative for 2nd straight session at 0.65 vs 0.68 a day ago. Foreigners continued its net selling spree for the 14th sessions out of 16 (-RM100m; Dec: - RM862m) followed by retailers (-RM9m; Dec: -RM77m) whilst local institutions (+RM109m; Dec: +RM939m) were the major net buyers.

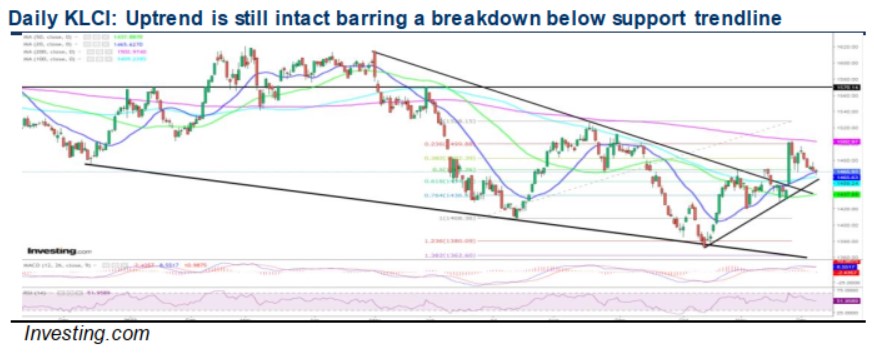

TECHNICAL OUTLOOK: KLCI

KLCI’s near term consolidation will persist as investors await more policy leads from the unity government and weigh on external volatility fuelled by inflation and interest rate jitters ahead of the 13-14 FOMC meeting. As long as the index is able to maintain its posture above 1,454 or support trend line (from 2Y low of 1,373), we remain optimistic that KLCI could resume its upward momentum after a brief consolidation. Key supports are pegged at 1,436-1,454 whilst resistances are situated at 1,482-1,502-1,528 zones.

MARKET OUTLOOK

As investors await more domestic reform policies from the unity government, KLCI may consolidate ahead of the 13-14 Dec FOMC meeting and a vote of confidence on PM when Parliament convenes on 19 Dec. However, downside risk (support: 1,436-1,454; resistance: 1,482-1,504) may be cushioned by expectations of further economic reopening in China, Bursa’s depressed valuation (CY23 P/E 13x vs 10Y mean 16x), strengthening political stability as a coalition agreement involving all parties in the unity Government will be signed soon, coupled with the expectations of year-end window dressing activities. Technically, profit-taking dips on TENAGA (HLIB-BUY-TP RM11.65) after rebounding from a low of RM7.99 (3 Oct) to recent peak at RM9.50 (1 Dec) should attract buyers for further recovery towards RM9.50-9.80 levels, while key supports are pegged at RM8.80-9.00 territory.

Source: Hong Leong Investment Bank Research - 9 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-11

TENAGA2024-11-11

TENAGA