Technical Tracker - EDGENTA: Grossly Oversold

HLInvest

Publish date: Mon, 27 Feb 2023, 10:26 AM

Margin to gradually recover in FY23-24. Given the revision of minimum wage in Malaysia as well as global inflationary pressures, EDGENTA, who is primarily involved in labour intensive facilities management (FM) business, has seen its GP margin contracted from 14.2% in 1Q22 to 11.4% in 3Q22. Nevertheless, we believe that a recovery in profitability margins is imminent in FY23f-24f, supported by the group's efforts in cost management and the burgeoning sales from the lucrative international market. HLIB projects that the EBIT margin will recover to 4.6% in FY24 from 3.4% in FY21, albeit still lower than the pre-pandemic level of 7-9%.

Prospect remains intact. Despite the cost pressures faced by EDGENTA, the outlook for its businesses remain promising. The group's order book as of 3Q22 stood at RM10.1bn. We expect the recovery of hospitals' business activities to benefit EDGENTA’s healthcare division, which accounted for 63% of the group's FY21 revenue. Additionally, the infrastructure division should also pick up due to higher maintenance works following the increased traffic on expressways.

To expand globally. Apart from its bread and butter Malaysia market, Edgenta will continue to diversify and expand its business internationally. Among the international markets where EDGENTA has a presence, Saudi Arabia stands out as a country with a larger FM market, estimated to be worth around USD65.5bn (compared to others valued at c.USD2.6-14bn). To tap into this market, EDGENTA recently acquired a 60% stake in MEEM (MASIC's facilities management company) with the goal of growing it into a tier-one facilities management company in Saudi Arabia. EDGENTA's expertise in the FM field will be instrumental in achieving this objective. As a first step, MEEM will take over and manage the 30 real estate assets currently under MASIC's wing. To recap, 79% of Edgenta's FY22 new contracts are for jobs outside of Malaysia.

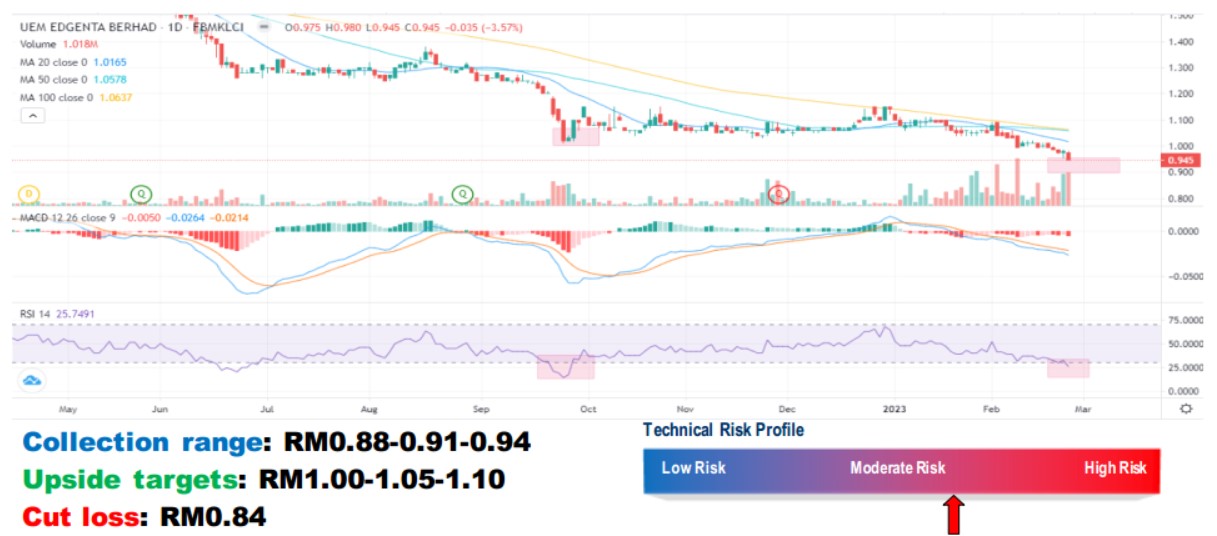

Grossly oversold. After correcting 43.5% from 52-week high of RM1.65 to RM0.94 last Friday, EDGENTA is trading at an undemanding 0.4x P/B (66% discount against its 5- year average of 1.2x) coupled with an attractive yield of 6%. A successful breakout above RM0.95 immediate resistance will spur prices toward RM1.00-1.05-1.10. Cut lost at RM0.84.

Source: Hong Leong Investment Bank Research - 27 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|