Karex - Safety First

livingston

Publish date: Sun, 20 Dec 2015, 02:18 PM

Newly acquired One Condom brand will enhance the portfolio of both value and premium brand. One condom is a marketing success in North America and will be launched in Malaysia on 1st Dec 2015 (in conjunction with World Aids Day). The ONE Brand was acquired on Oct 2014 by Karex.

Average USD/MYR for 2014: 3.24 (source Annual Report)

Average USD/MYR for 2015: 3.45 (source Annual Report)

Average USD/MYR for 2016: What do you think?

Currently is 4.3x smile emoticon

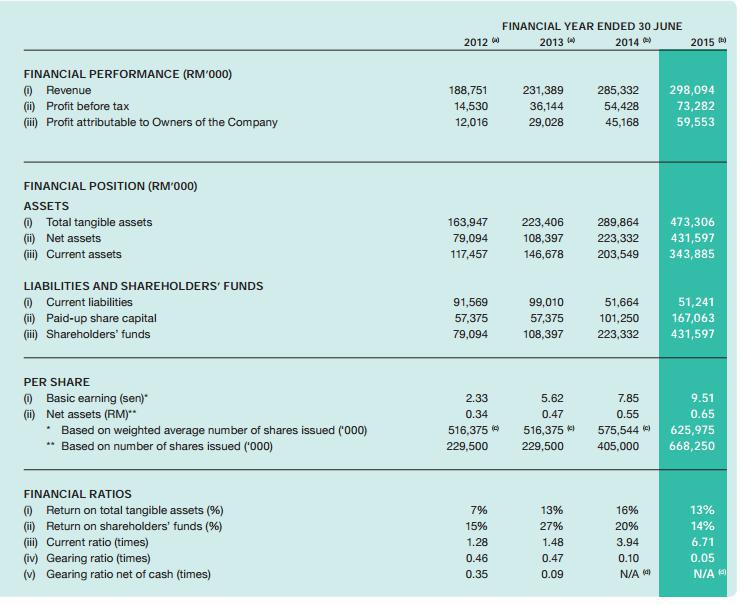

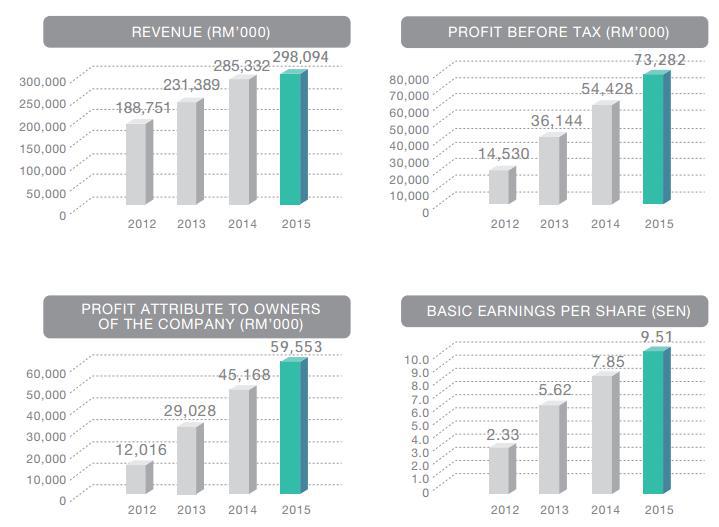

Revenue for the past 4 years : Up

PAT for the past 4 years: Up

NTA for the past 4 years: Up

Current liabilities is at 4 years low

EPS for the lastest 4 years: 2.33 , 5.62, 7.85, 9.51

The set back is she is trading at PE 39x which is at a very high premium.

From my humble opinion, the share price has factored in the new incoming revenue from the plant at Hatyai.

The next QR you shall see higher contribution sales from Hatyai's plant which will be adding in 2.2billion pieces of condom per year making the total capacity to 5 billion per year. The Hatyai's plant was forecasted to be operational by end of 2015.

Pontian Plant - 2 billion pcs / annum

Port Klang Plant - 0.8 billion pcs / annum

Hatyai's Plant - 2.2 billion pcs / annum.

The private placement amount of 158m raised earlier this year is their warchest for Hatyai's plant and the new launching of One Condom - Their Own Brand. Karex should be doing well for 2016 but currently the Mother Price is not cheap. If you wishes to buy the shares, be prepared to hold for long term.

No contra / short term please. Personally I believe she will do quite well for 2016.

P/S: I am not sure the One Condom by Karex is being sold in Malaysia yet. For those who are curious how their One Condom looks like, I have attached a picture for your own analysis.

Disclaimer and Declaration

The full content of the article is for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss. Examples of specific shares is citied for illustration purposes.

Regards,

Humblepie

FB Page: Bursa Blue Ocean

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Humblepie188

Created by livingston | May 10, 2017

Created by livingston | Aug 08, 2016

Created by livingston | Jan 03, 2016