Co- Written By: Kar Jun & Humblepie

1.Company Profile:

It is a Malaysia-based company that was incorporated in Malaysia on 17 June 2013 as a public limited company lead by both its managing director Daniel Aik Swee Tong and executive director Johnson Aik Cwo Shing who have made it debuts in Bursa Malaysia in 2016.

2. Principal Activities of the Company:

The Group is engaged in the business of trading and distribution of process control equipment and measurement equipment such as valves, switches, actuators, bursting discs, float, gauges, recorders, pressure transmitters and so forth. Its products are either sourced from third party suppliers or original equipment manufacturers (OEM).

Pricing Analysis:

a) Growth Potential:

In January 2017, Dancomech announced that it ventures into the business of pumps manufacturing. The Group paid RM4.25mil to have its own pumps business along with a factory that produces the pumps via acquiring Chun Khong Engineering Works Sdn Bhd, a company which owns a 99-year leasehold industrial land with single-storey industrial buildings in Perak. The earnings are expected to grow as this acquisition is immediately earnings accretive. The pumps business is largely controlled by two main players and the Group is now buying one of them, hence instantly making them a pump player. Also, the pumping business in Malaysia has a market size of approximately RM30 mil to RM40 mil per annum which the Group is anticipating to record 20% from the market or RM6-8 mil of the new business in 2017. Thereby, the group can record a further 10-20% of the market yearly.

Source from: http://www.thestar.com.my/business/business-news/2017/01/09/dancomech-ventures-into-valve-manufacturing/

b) Financial Health Analysis:

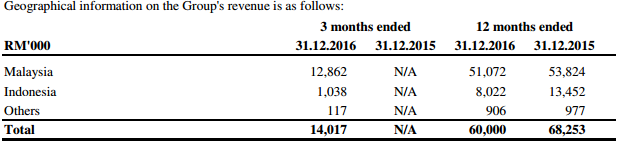

i. Income Statement:

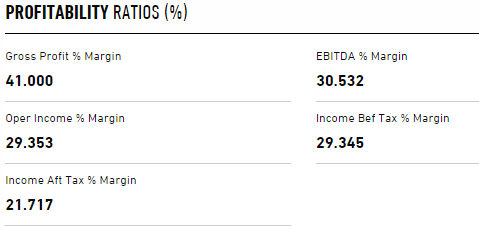

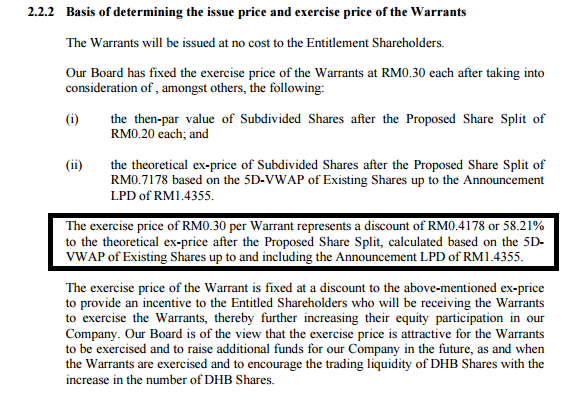

i. Net Profit Margin = 29.34%, - Very Good

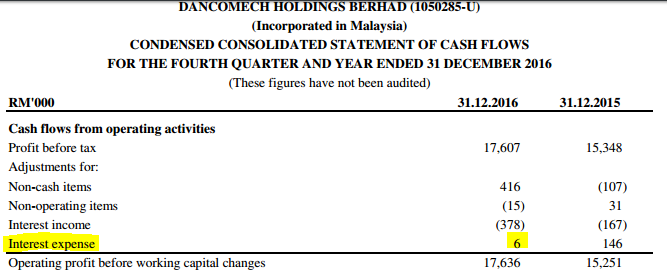

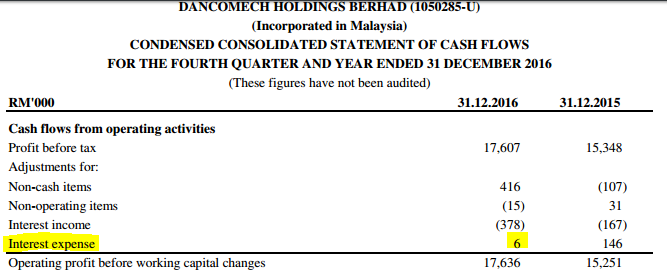

ii. Interest Coverage = 4,908 / 2 = 2,454x – Very Good !

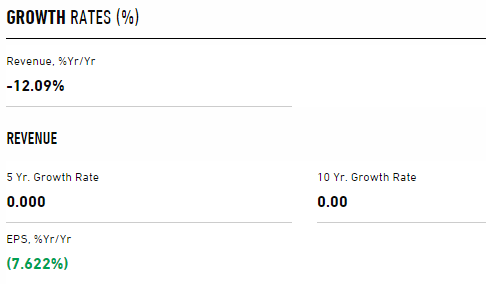

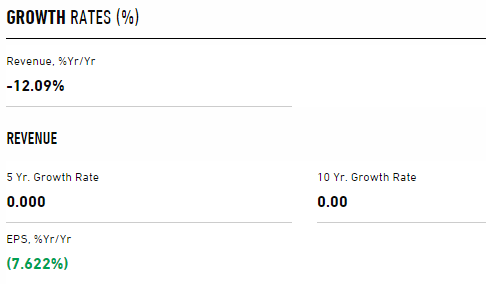

iii. Profit for the past 5 years= Not available, but by comparing 2 years’ revenue growth, it shows -12.09% year-to-year.

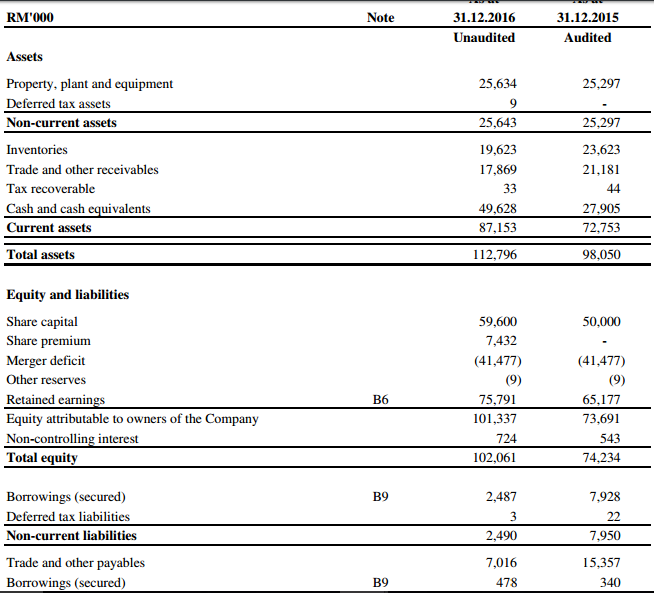

c) Balance Sheet:

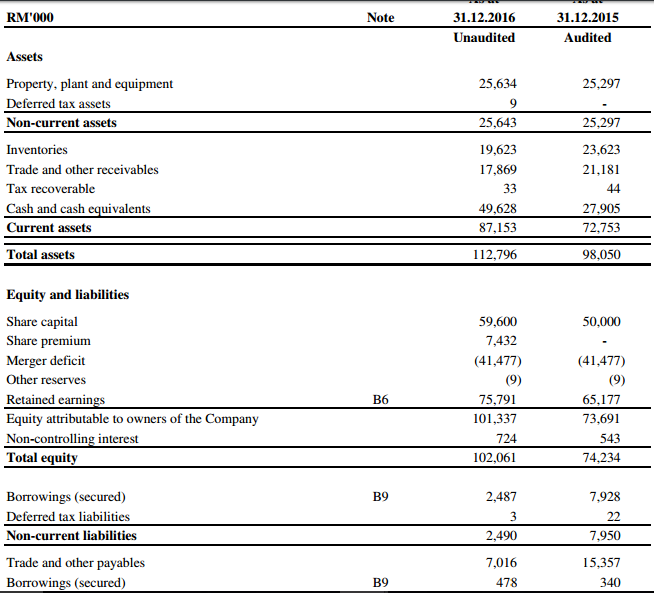

i. Current Ratio = 4.87, Healthy!

ii. Debts to Equity Ratio= 0.21, Healthy!

iii. Trade and other receivable= declined slightly (Positive Note)

iv. Bank borrowings= Declined (Positive Note)

d) Cash Flow:

i. Positive at least 1 year – Positive cash flow (Pass); Increased partly due to the net proceeds from issuance of shares

Therefore, Dancomech passed all my financial health ratios except for the revenue growth as only 4 quarters result are available.

e) Pricing Analysis:

i. Price to Book Value= 2.18 (high but acceptable as the company is growing)

ii. Dividend Yield= 1.01% (for a company in high expansion mode, any dividends payout is a bonus).

Dancomech has a 30% dividend payout policy.

iii. PE Ratio = 17.29, high pricing as at 13/03/2017

iv. Forecast future pricing by taking the average of 4 quarters and multiply on its growth rate as mentioned in the below:

Forecast Future Price= PE ratio divided by EPS * Growth rate

Averaged EPS (2.20+3.5+1.8+2.4) * 15% growth rate = 11.385 sen

|

P/E Ratio

|

Forecasted Price

|

|

X14

|

RM1.59

|

|

X15

|

RM1.70

|

|

X16

|

RM1.82

|

|

X17

|

RM1.93

|

v. What is the main catalyst that driving the company to score such earnings?

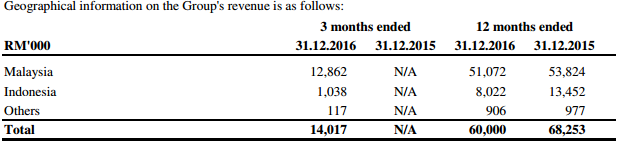

The Group is expected to add an additional gross profit of RM1.8mil to RM2.4mil that derived from 30% typical margins of RM6-8mil of the new pumping business venturing for 2017. The Group aims to have a revenue growth of 5-10% at least for Indonesia this year. With a strong net cash position of RM44.9mil as at Sept 30 coupled with an annual operating cashflow of RM12-17mil, this allows management the flexibility to meet its annual capex requirement of RM3-4mil while maintaining a consistent dividend payout of 30%.

The Group is eyeing to register its growth of about 15% this year.

4. Conclusion & Personal Opinion:

The 2 main catalysts of 2017 for the Group have identified by the management which are 1) venturing into pumping business thereby selling it to local and Indonesia market where it aims to capture 5-10% revenue growth this year; 2) Catering potential customers from oil and gas players in Johor (Peninsular Malaysia) for RAPID project and, Lahad Datu and Bintulu (East Malaysia) by setting up distribution hub that is proximity to the key areas.

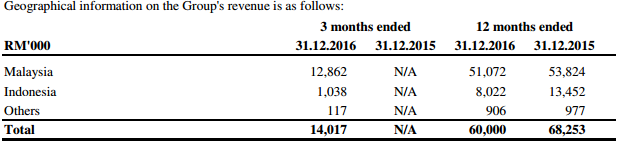

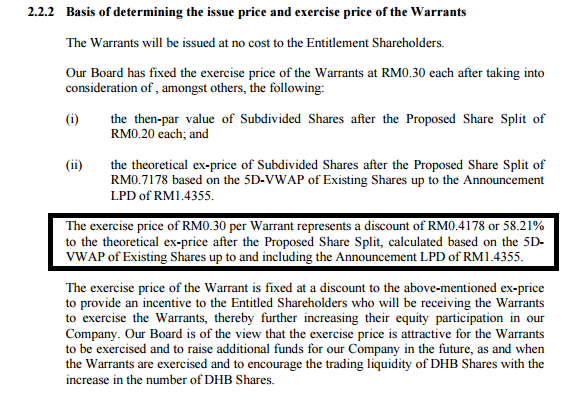

Warrants will be given for free on 18 May with the exercise price of RM0.30. Without the info of Implied Volatility, Effective Gearing and Delta, I am not able to calculate the Fair Value for the warrants. But looking at the current situation, the first trading should be able to hit limit up for the warrants follow by the next day trading range of 40 cents plus minus. The assumption for FV can’t be determined clearly as information is incomplete. For the shareholders, maybe you can look forward for the free warrants rather than to sell to market now!

Please like us at our facebook page - Bursa Blue Ocean and complete the survey form and join out telegram group chat room!

https://www.facebook.com/myinvestcoach

Disclaimer and Declaration

The information is meant for the members of Bursa Blue Ocean (BBO). Disclosure and distribution of the message without the permission of BBO is prohibited. The full content of the article and write ups are for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss.

valuelurker

Without implied volatility cant calculate options price what a bunch of donkeys dont know anything about options pricing dont simply say cant calculate or use the terms la damn obvious nuubs download some free model with inputs with no inkling of options models

2017-05-11 00:08