Oceancash Pacific - Story That Many Have Overlooked

livingston

Publish date: Tue, 03 Jan 2017, 02:31 PM

Company Profile

Oceancash is founded and led by Mr. Tan Siew Chin since year 1997 (Oceancash Felts Sdn Bhd) and listed on Bursa Mesdaq Market in year 2004. From 1997 to 2004, it is indeed a short 7 years to build a company from a Sdn Bhd to a Bhd.

What Oceancash do?

Extracted from Oceancash's Corporate Website:

Oceancash Felts Sdn. Bhd. (OFSB), a wholly owned subsidiary of Oceancash Pacific Berhad (OPB), is principally involved in the manufacturing of resinated felts and thermoplastic felts for heat insulation and sound insulation which include but not limited to; interior and exterior trims in automobiles, noise damper for compressors of split unit air conditioners as well as insulation in buildings including roofs, walls, partitions, and carpet underlay.

Oceancash Nonwoven Sdn. Bhd. (OCN), a wholly owned subsidiary of Oceancash Pacific Berhad (OPB), was incorporated on December 21, 1999 in Malaysia. The principal activities of OCN are in the manufacturing and trading of air-through bonded nonwoven, and thermal bonded nonwoven, which are widely used in the disposable hygienic products industry. Its application include top-sheets, second layer, acquisition distribution layer (ADL), and back-sheet for diapers, sanitary napkins, wet wipes, and surgical apparels including caps, masks, and gowns.

Why I like this company? She fulfilled the FA requirements that I am looking for and has a good growth story to tell.

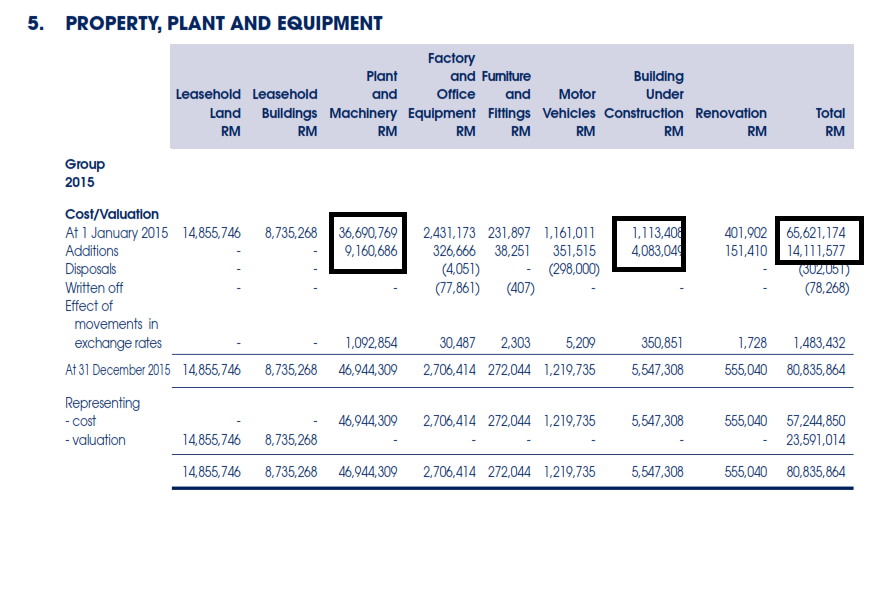

1st Growth Potential After Additional RM14m Spend on PPE

She has spend RM12.56m in year 2015 for PPE purposes (Figure 1). Talking about improving their upcoming revenue for the group level. =)

Key word : According to the Chairman, the PPE will be contributing postively in 2nd half of 2016. To look at the info in details, the breakdown for the 2 more signifinact investments for PPE are as per below:

RM9.1m for Plant and Machinery

RM4.1m for Building Under Construction

Under Accounting Treatment for Cash Flow, the column for 'Investing Activities' is good if it is in negative value. It means the company is spending monies to increase the potential income in the near future for Investment Activites via PPE. Definately it is fair for us to expect the company to achieve higher revenue and profits for 2nd half of 2016 onwards after much monies spend. By the way, we are waiting for 4th QR Report for 2016 right? =)

Additional note, receivables has gone down from Rm3.1m to Rm1.6m.

Figure 1

Figure 2:

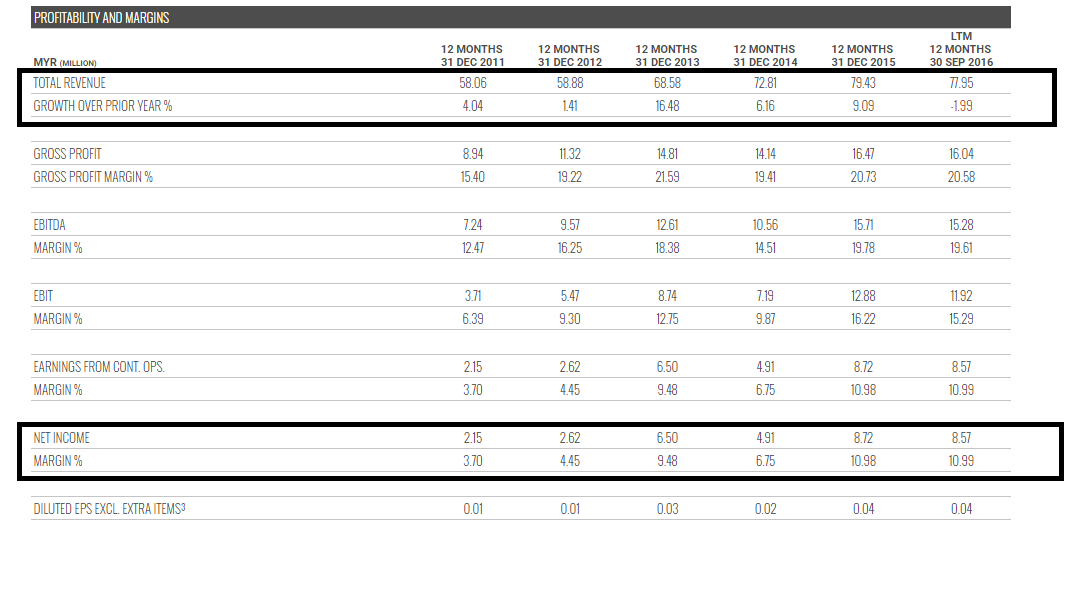

2nd Financial Health Analysis

Figure 3:

Income Statement

Profit Margin = 8.57% - pass (<5% fail)

3.7% in year 2011 to 11% in year 2016 – It is in an increasing manner for the past 5 years (A job well done). From here i can see a good growth pattern.

CAGR of 19.9% from 2011 to 2016. (N =5, PV = 3.7, FV = 11)

Interest Cover = 8.7x - pass (<3x fail)

Profit for the past 5 years = Yes, steadily grow from RM2.15m in year 2011 to RM8.57m year LTM 12 months of 2016. Profits are compounded at 38.6% for the last 5 years. The profits are compunded at a slow and steady position.

Balance Sheet

Current Ratio = 1.88x – pass (<1x fail)

Debts to Equity Ratio = 0.4x – pass (>3x fail)

Don't see the company is having liquidity problem for now.

Cash Flow

Positive at least 1 year = Pass

OCEANCASH PASSED ALL MY FINANCIAL HEALTH RATIOS !

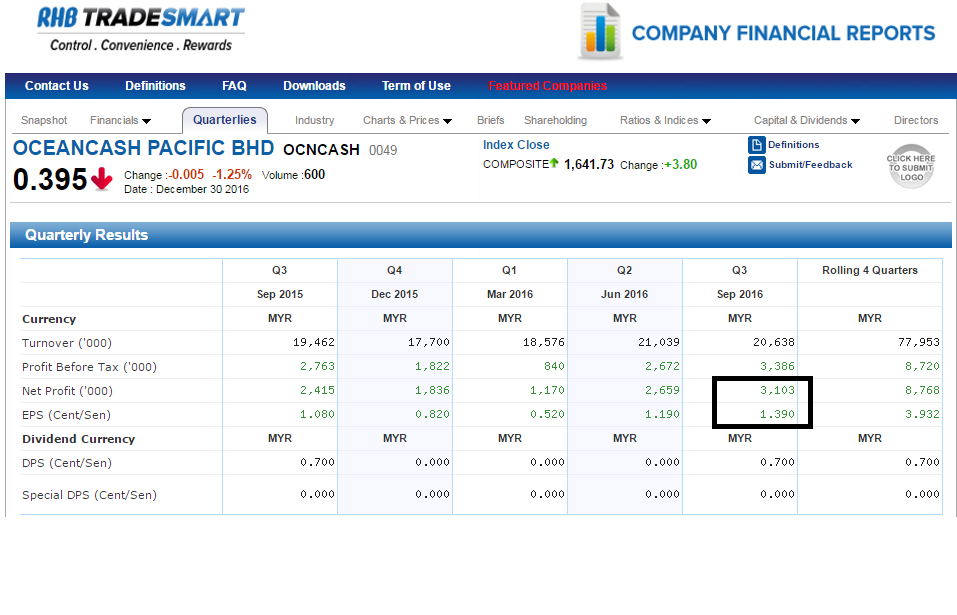

3rd. Pricing Analysis (Acceptable low PE!)

Price to Earnings or PE Ratio for 2016 =

Using the Rolling 4 Quarters EPS: 3.932 = 0.395/3.932 = PE 10x (affordable and acceptable)

Forecast Future PE by using EPS 3 Quarters for 2016 and annualized it =4.13

Forecast Future P/E = 0.395/4.13 X 100 = 9.5x (slightly lower than rolling 4 QR PE)

Let's look at the potential plus point:

The projection of increase of EPS for final Quarter 2016 is doable. Why I say so?

Historical numbers:

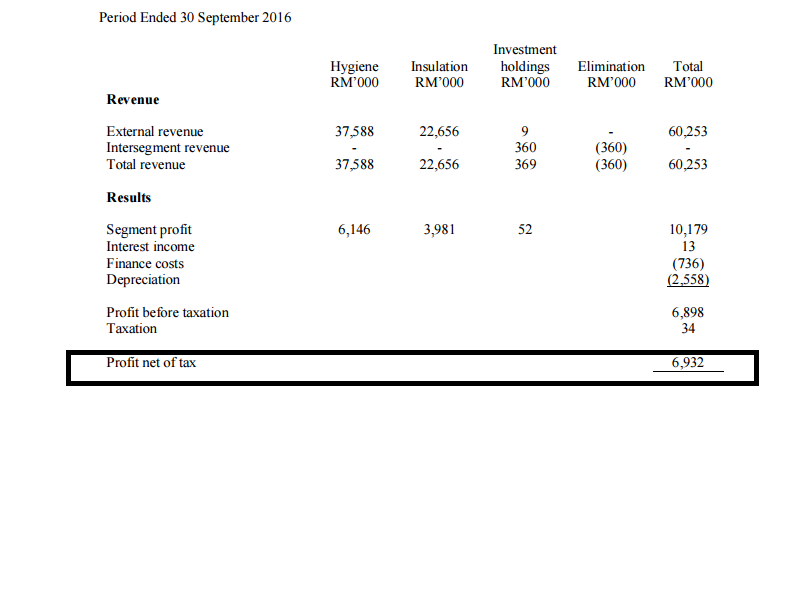

9 months PAT for 2016 (Figure 4) = RM 6.932m

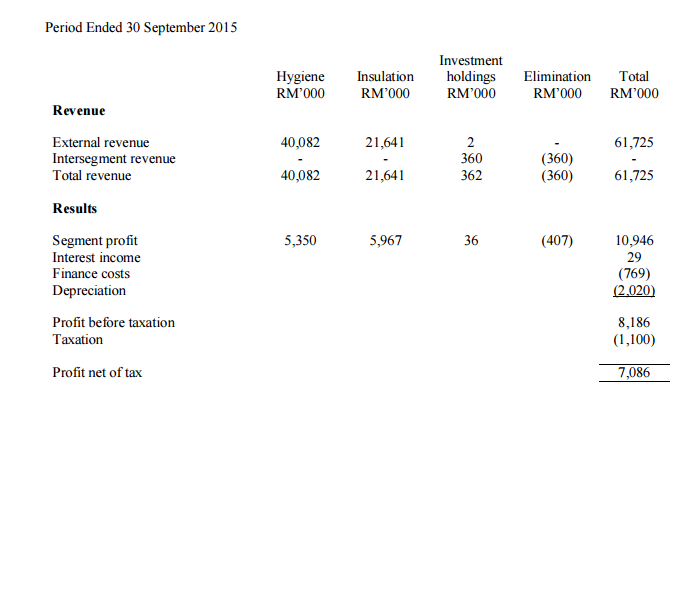

9 months PAT for 2015 (Figure 5) = RM 7.086m

A shortfall of RM0.154m for year 2016 compared to year 2015.

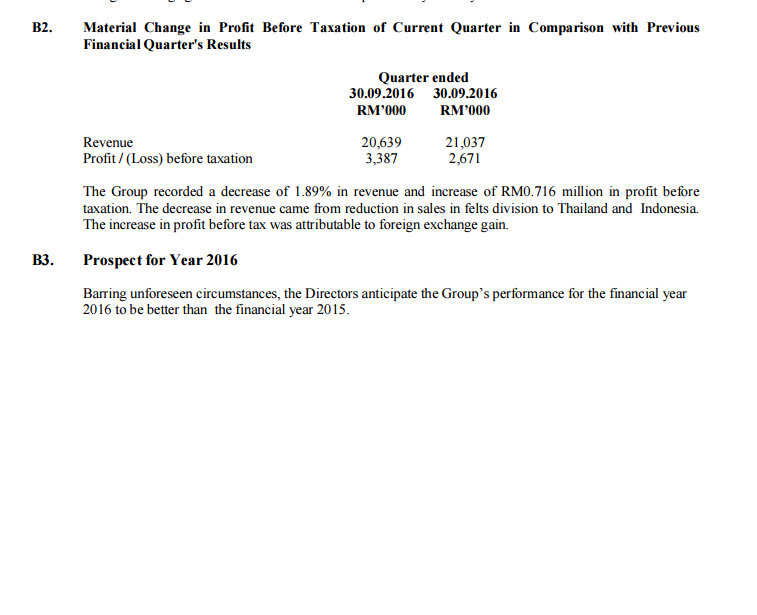

THE BEST PART MOST OVERLOOK IS AT FIGURE 6, item B3:

Figure 4:

Figure 6:

Look at what the Management Team said:

Baring unforeseen circunstances, performance for FY 2016 to be better than FY 2015.

Current 9 months of P&L, PAT for year 2016 is lower than 2015 at RM154k!

Assuming worst case scenario: If the Management guidance/projection is correct, the forecasted Final Quarter of 2016 should be AT LEAST to match the same earnings as 2016 (4th QR 2015) RM 1.836 + RM 0.154 (short fall of 9 months 2016 VS 2015)= RM1.99m

BY RECORDING A PAT OF MINIMUM RM 1.99M FOR 4TH QR 2016: The 4th QR 2016 results will be better than 4th QR 2015.

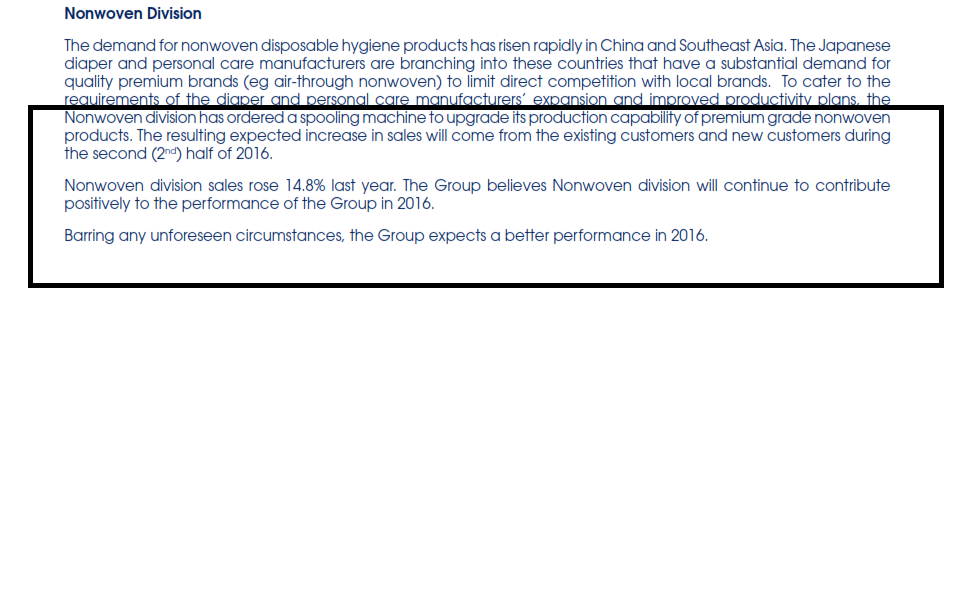

4. Catalysts for 2017:

There are 2 catalysts which catches my eyes for possible medium term investment. I have boxed it in black on Figure 7:

CATALYST 1: Potential good 4th QR 2016 Report

'Nonwoven division has ordered a spooling machine to upgrade its production capability'

'Expected increase in sales during the 2nd half of 2016'

From Figure 8: We can see that the QR Report for Q3 2016 is the highest Recorded which matches the statement given as per Figure 7. What do you think about the upcoming Q4 2016 Results?

Figure 7:

Figure 8

Catalyst 2: Meeting the Profitability Test Record for Transfer to Main Market

Under Bursa Listing Requirement for Main Market, a company is qualified to be transferred to Main Board if the company is able to achieve an aggreagate of RM20m PAT from the lastest cumulative 3 years of annual report.

PAT 2014 = RM 4.91m (Figure 3)

PAT 2015 = RM 8.72m (Figure 3)

9 Months PAT 2016 = RM 6.932 (Figure 4 & 8)

Total PAT = RM 20.562m

The good part is, the RM20.562m has already being achieved without adding the final 4th QR 2016 report ! Any profits recorded in 4th QR 2016 Report will be a bonus.

Conclusion & Personal Opinion:

I like the solid fundamental numbers recorded since the year 2011 and having a continuous growth every year for the past 5 years. It has both Healthy Financial Ratios and Good Pricing. Involvement in overseas business has help her in increasing the forex gain in year 2016. The catalyst to be upgraded from ACE to Main Market entitles this company a chance to be a potential good stock to watch in 2017. It is a company suitable for low risk takers and medium investors. You can bank on the growth stories from her enlargement of PPE and Nonwoven business. Introduction of Bezza and Pesona in 2nd half of 2016 might potentially help this company too but I do not have the statistics of contribution to be added in to support this point.

The bad side is the company is exposed to the currency risk. If RM is strengthening in 2017, then it will impact and reduce their P&L. The slow growth of vehicles sales in 2017 might dampen the growth for the Felts Division.

Another limitation is the forecast for 4th QR 2016 is based on personal opinion from the guidance from the Annual & Quarterly Report.

Please like us at our facebook page - Bursa Blue Ocean and complete the survey form and join out telegram group chat room!

Sincerely,

Humble Pie

Disclaimer and Declaration

The information is meant for the members of Bursa Blue Ocean (BBO). Disclosure and distribution of the message without the permission of BBO is prohibited. The full content of the article and write ups are for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss.

More articles on Humblepie188

Created by livingston | May 10, 2017

Created by livingston | Aug 08, 2016

Created by livingston | Jan 03, 2016