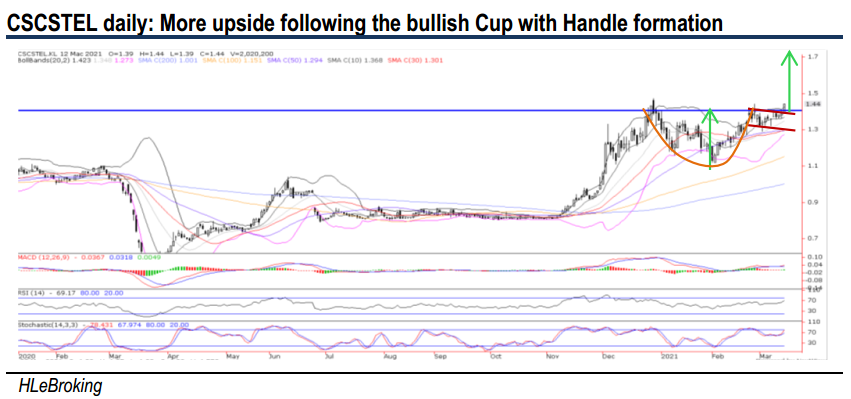

CSC Steel Holdings - Top of Its Class; Bullish Cup With Handle Pattern

intelligenttrade

Publish date: Mon, 15 Mar 2021, 09:50 AM

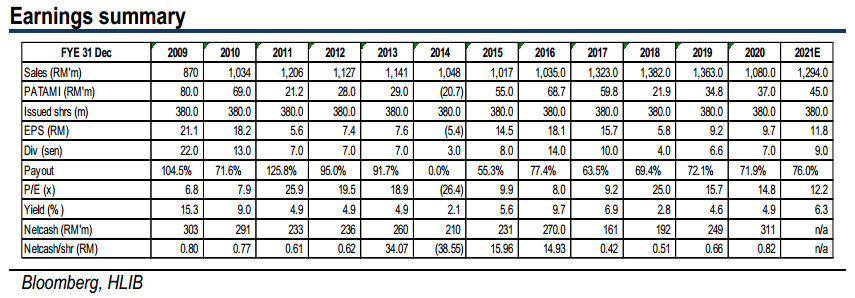

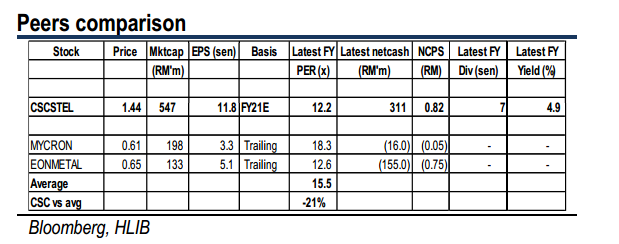

Being the largest player in the local flat steel market, CSC is in a strong position to reap the demand recovery from both manufacturing and construction sectors, underpinned by the current cyclical recovery in steel prices due to pent up demand as the global economy recovers from Covid-19 pandemic and the worldwide supply chain tightness. Ex-NCPS of RM0.82, it is only trading at 5.2x FY21E P/E (vs peers 15.6x), supported by higher 6.3% FY21E DY and solid financial muscles. CSCSTEL is also in a sweet spot to capture a bigger share and plug into the industry supply gap following the government’s progressive policies actions (i.e. import duty & anti-dumping duty structure, enforcement vs unscrupulous importers, and buy Malaysian-made-first).

Bullish Cup with Handle formation. After breaking above the RM1.40 neckline resistance last Friday, the long-awaited Cup with Handle (CWH) pattern was formed. The CWH formation is a bullish continuation pattern that marks a consolidation period followed by a breakout. Reading from the technical indicators showed that the buying momentum is gradually turning up again. We expect CSCSTEL to test the RM1.50- 1.60 upside targets before heading towards our CWH objective at RM1.70. Supports are pegged at RM1.40 and RM1.35 (mid BB). Cut loss at RM1.32.

Source: Hong Leong Investment Bank Research - 15 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|