Invest Made Easy

FIXED DEPOSIT of 4% per Annum, Now Available!

Shane My

Publish date: Mon, 04 Feb 2013, 11:30 PM

While Fixed Deposit is a not a favorite form of investment for many investors, there are still many of us including myself who have a percentage of savings kept in FD for security purposes and immediate liquidity.

A basic rule of financial management is to have at least 6 months worth of salary available. In a unlikely scenario where you lose your job, you might need immediate liquidity to pay off my existing commitments such as insurance, loan repayment, etc.

The question is, are you leaving your savings to rot by inflation or are you smart enough to grow it?

In my case, 6 months salary saving that I have is not meant for long term investment and neither do I wish that money to be exposed to high risk investment.

Hence, the only option available (that I know of) is Fixed Deposit. Similar to investing in unit trust, choosing the right bank that offers the best Fixed Deposit rate is vital to ensure that I get the best bang for my savings. I managed to obtain a few existing "normal" fixed deposit rate offer by our local banks as shown below:

|

| Conventional FD Rate for 12 months tenure as of 4 Feb 2013 |

Not included here is the tenure for Bank Rakyat which offer 4.01% rate. Being a Cooperative Banking Institution, your FD savings in Bank Rakyat is not protected by PIDM.

Find out more about Bank Islam FD rates HERE.

If you look at the Fixed Deposit rates above,AmBank has the best conventionl FD rate for a 12 month tenure at 3.40%. Now you can increase the FD rate from AmBank to 3.60% per annum via an ongoing current promotion from AmBank:

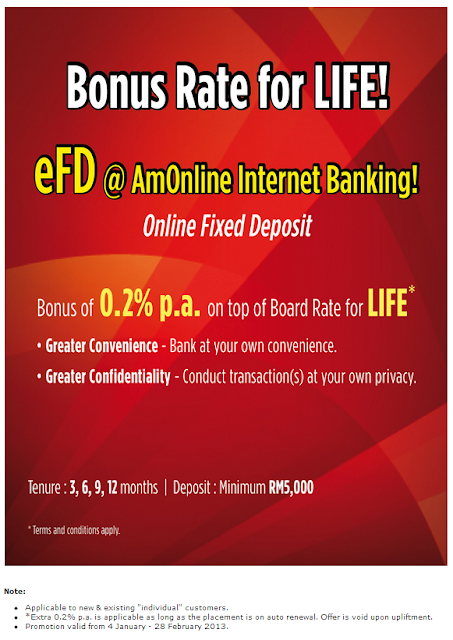

Promotion Propoganda : Bonus Rate for Life

Bank : Am Bank

Promotion Period : 4th January 2013 - 28 February 2013

Key Terms & Conditions:

- The Campaign is open to all new customers who opened an eFixed Deposit ("eFD") via AmOnline with a minimum placement of RM 5,000 (in a single transaction) and existing customers who made a new placement of not less than RM 5,000 in eFD (in a single transaction) via AmOnline during the Campaign Period ("Eligible Customers").

- The eFD placement must be for the tenure of 3, 6, 9 or 12 months.

- The following persons / entities are NOT eligible to participate in this Campaign:-

- (a) Sole-proprietorships, Partnerships, Companies, Charitable / Non-profit Organizations / Societies, Government / Statutory Bodies, Corporate Customers and other non-natural persons; and/or

- (b) Employees (either permanent and/or contract) of the AmBank Group (including its subsidiaries and related Companies) ; and/or

- (c) Individuals below the age of eighteen (18) years old.

Cons:

- The eFD rate is only available for one tenure only. Once the tenure of your FD end say after 12 months, you will only enjoy the existing FD rate without the additional 0.2%.

If you're interested, head on over to the your local AmBank to find out more!

Now what about the 4% per Annum Fixed Deposit Rate?

Read the rest HERE

More articles on Invest Made Easy

IME versus Market Analyst - Fun with Predicting UWC's Target Price

Created by Shane My | Dec 06, 2020