IQGROUP:

Please visit http://iq-group.com/.. thank you.

IQ-group is an established global leader in the design & manufacture of lighting, security and convenience products, working with some of the world’s major retail and professional brands.

Over our 25+ year history we have built up an enviable reputation for design, innovation, quality and value within our core technologies, encompassing motion sensors, LED lighting and wirefree door entry products.

Employing approximately 1300 people globally, we boast manufacturing operations in Malaysia and China, plus offices in Taiwan, Japan and the United Kingdom.

About IQGROUP:

At IQ-group our strategy is simple – to provide our customers with innovative products that offer outstanding features, fantastic quality and excellent value, all backed up by exemplary service and support.

Through R&D we aim to innovate, constantly striving to develop new ideas and breakthrough technologies. This ensures that our product offer remains highly differentiated, creating market demand and opening up new channels and new opportunities for our customers.

Our Manufacturing operations are focused upon bringing our ideas to life as efficiently as possible – tirelessly working to improve and simplify our processes to minimise waste, reduce lead times and drive-down costs. Alongside this we adopt a no-compromise attitude to quality at every level, and in whatever we do. This is reflected in the ISO 9001 accreditation held by both of our manufacturing facilities.

Our Business Development team exists to work alongside our customers, to understand their needs and requirements, and to ensure that these are fulfilled in an accurate, timely and professional manner. Be it working collaboratively on a project or simply meeting regular order requirements, the team aims to provide the support needed to ensure that both our customers and ourselves continue to lead the way, achieve growth and win market share.

IQGROUP Technology:

PIR Motion / Presence Sensors

Passive Infra Red (PIR) sensors operate by monitoring the background ‘temperature’ within their field of view and by responding to sudden changes, such as the approach or movement of a person or vehicle. When movement is detected, the sensor might switch on lighting, activate an alarm, open a door or a multitude of other applications.

PIR motion sensors are commonly found outdoors, controlling lighting to welcome visitors and deter intruders and typically respond best to larger movements.

A PIR presence sensor differs slightly from a standard motion sensor in that it is far more sensitive, designed to detect even the slightest movement; for example the movement of someone’s hand typing on a keyboard in an office environment. They are commonly used indoors to control lighting and/or heating & ventilation, ensuring they are only switched on when a room is occupied, thereby saving energy and money.

Both types of PIR sensor feature light sensing technology, and can be configured to only become active when there is insufficient light from either natural ambient daylight or from other sources, once again saving energy.

IQ-group has been at the forefront of PIR sensor technology for over 25 years, developing innovative signal processing techniques to minimise false activation, pioneering methods of expanding the detection area to eliminate ‘creep zones’, building-in intelligence to maximize performance & energy saving, alongside more general breakthroughs in overall quality and reliability. As a result, IQ-group is today rightly regarded as a global leader in this field.

Motion Controlled LED Lighting

A combination of an ultra-efficient LED luminaire with a motion sensor, providing instantaneous bright white illumination upon detection of an approaching person or vehicle. Advancements in the underlying solid-state technology now position LED as a viable and cost-effective alternative to traditional lighting, delivering better illumination whilst also eliminating concerns regarding energy usage and environmental impact.

LED’s are cool running and operate brilliantly in a broad range of environments and applications. LED’s are very controllable, offering instantaneous ON/OFF operation and smooth dimming. LED’s are significantly more efficient than older lighting technologies, and have inherently longer lifetimes, reducing the overall cost of ownership and minimizing maintenance requirements.

IQ-group benefits from a key partnership with SemiLEDs Optoelectronics Co. Ltd., a Taiwanese organization specializing in the manufacture of ultra high-brightness LED chips. The resulting joint venture, SILQ (Malaysia) Sdn Bhd, marries SemiLEDs solid-state expertise with IQ-group’s motion sensor/luminaire heritage, ensuring perfect harmony between the LED device and the associated sensor electronics and luminaire design.

All thermal and optical elements are optimized to deliver class-leading performance and rock solid reliability.

Motion Controlled Traditional Lighting

A combination of a motion sensor with a traditional light source, typically tungsten halogen or incandescent GLS. These products provide automatic lighting for security & courtesy purposes and have been a mainstay of the global outdoor domestic lighting market for in excess of 20 years.

Wirefree Door Entry & Chimes

A technology platform to provide a convenient wirefree link between a visitor at the door and the occupants inside the home. Whether just a simple door chime or a sophisticated video door entry system, the wirefree platform ensures ease of installation – no unsightly cables required – alongside flexibility in use and access to an array of added-value features.

IQGROUP Partnership:

IQ-group offers your business the flexibility to work with us in whichever way that suits you.

On an ODM (Original Design Manufacturing) basis you would work collaboratively alongside our in-house design team to develop the products your business needs. We then manufacture the products to your own specifications, package them in your own-brand livery and supply direct for you to take to market.

Alternatively, let IQ-group take control of the manufacture of your existing products on an OEM (Original Equipment Manufacturing) basis. We take your design, manufacture to your own specification, apply your own brand livery and supply to you direct from our factory.

If a supply-only relationship suits you best, select from our existing range of motion sensor, lighting or wirefree door entry products and take them to market under our established IQ-group brand.

Why not get in touch to explore how we could work together?

Fundamental Analysis

IQGROUP - Growth?

Author: Olga |

Publish date: Mon, 5 Sep 2016, 11:41 PM

|

Total Revenue |

190.01 |

193.99 |

171.39 |

141.32 |

|

|

|

Cost of Revenue, Total |

132.85 |

136.35 |

118.28 |

110.05 |

|

Gross Profit |

57.16 |

57.64 |

53.11 |

31.27 |

|

Total Operating Expenses |

162.15 |

166.69 |

158.66 |

138.35 |

|

|

|

|

|

|

|

Depreciation / Amortization |

6.29 |

5.9 |

6.76 |

6.88 |

|

Interest Expense (Income) - Net Operating |

-0.86 |

-6.83 |

-0.09 |

2.63 |

|

Unusual Expense (Income) |

- |

-0.01 |

0.18 |

-0.04 |

|

Other Operating Expenses, Total |

23.87 |

31.28 |

33.53 |

18.83 |

|

|

Operating Income |

27.86 |

27.29 |

12.73 |

2.96 |

|

|

|

|

|

|

|

Net Income Before Taxes |

27.86 |

27.29 |

12.73 |

2.96 |

|

Provision for Income Taxes |

7.23 |

6.44 |

1.76 |

2.34 |

|

Net Income After Taxes |

20.63 |

20.85 |

10.96 |

0.62 |

|

Minority Interest |

0.23 |

0.15 |

0.25 |

- |

|

|

|

|

|

|

|

Net Income |

20.86 |

21 |

11.22 |

0.62 |

Group chief executive officer Daniel Beasley (pic) toldStarBiz after an AGM that the goal was achievable because the Lumiqs brand had started to receive orders from South-East Asian countries, Japan, Australia, and Switzerland.

“We expect orders to grow rapidly from the South-East Asian region, Japan, and Switzerland.

“By 2018, it is targeted that the Lumiqs brand should contribute about 10% to the group’s revenue,” he added.

Launched in early 2015, Lumiqs lighting solutions enable industrial users to save up to 90% of energy, as the solutions, equipped with wireless transceivers, can be programmed to grow dimmer or brighter according to the movement of people in an area.

“We have established distribution channels for Lumiqs in South-East Asia.

“Now we are working on creating additional sales channels in Europe and other continents,” he said.

IQ is now developing and designing a new sensor lighting offering for release under a new business model by 2018.

“This product is for use in small commercial premises and residential households.

“Both Lumiqs and the new product will help drive the group’s growth over the next five years,” he said.

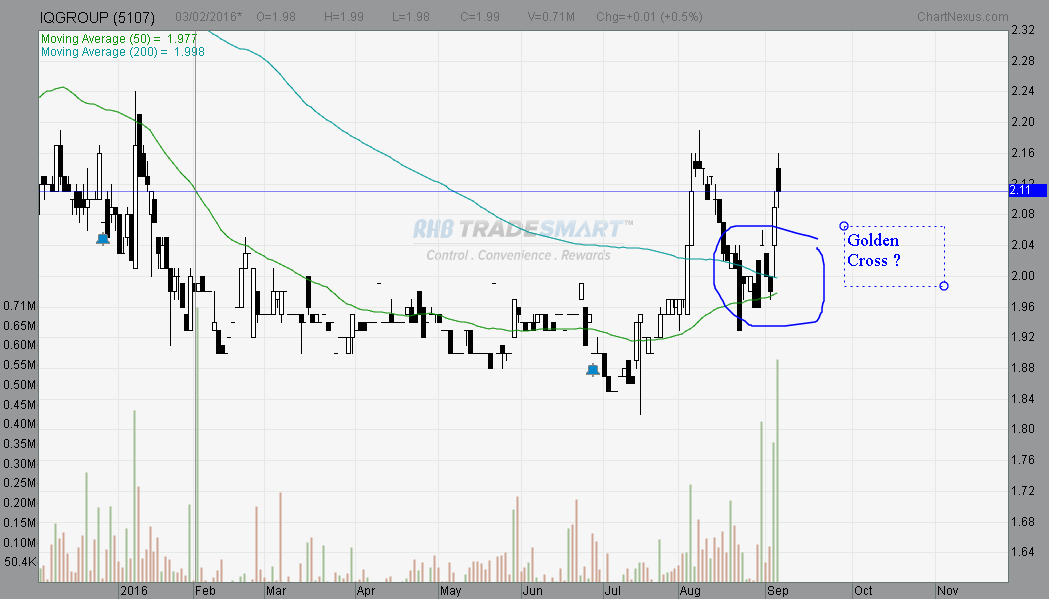

Technical Analysis

Some say Technical Analysis comes first, for others Fndamental Analysis, a hybrid of school of thoughts now says both..

Golden, silver or bronze? Happening in coming days..

Where are we now?

*Golden Cross Completed. Good.

Some say support and resistance.. for others the volume.. some say candlesticks.. and others elliot waves..

Where are we now?

*The Volume is Continuous..

*Breakout of its resistence..

Platforms like ChartNexus Trading View TradeSignum for your convenience.. Now systems with complicated indicators are sold at a price.. some include Bollinger band or RSI.. etc.. while others don't.. even High Frequency Trading for Artificial Intelligence (AI)..

*Bollinger Band is expanding again..

*No Oversold on RSI..

Once again.. has your "special" or "unique" system triggered a Buy Call?

*A Powerful Bullish Candelstick..

*A establishment of an Uptrend..

*A Bullish RSI..

*An accumulative continuous surge in volume..

*Breakout of its resistence..

*Are the signs here?

*Buy Call Triggered?

TIY - Think it yourself

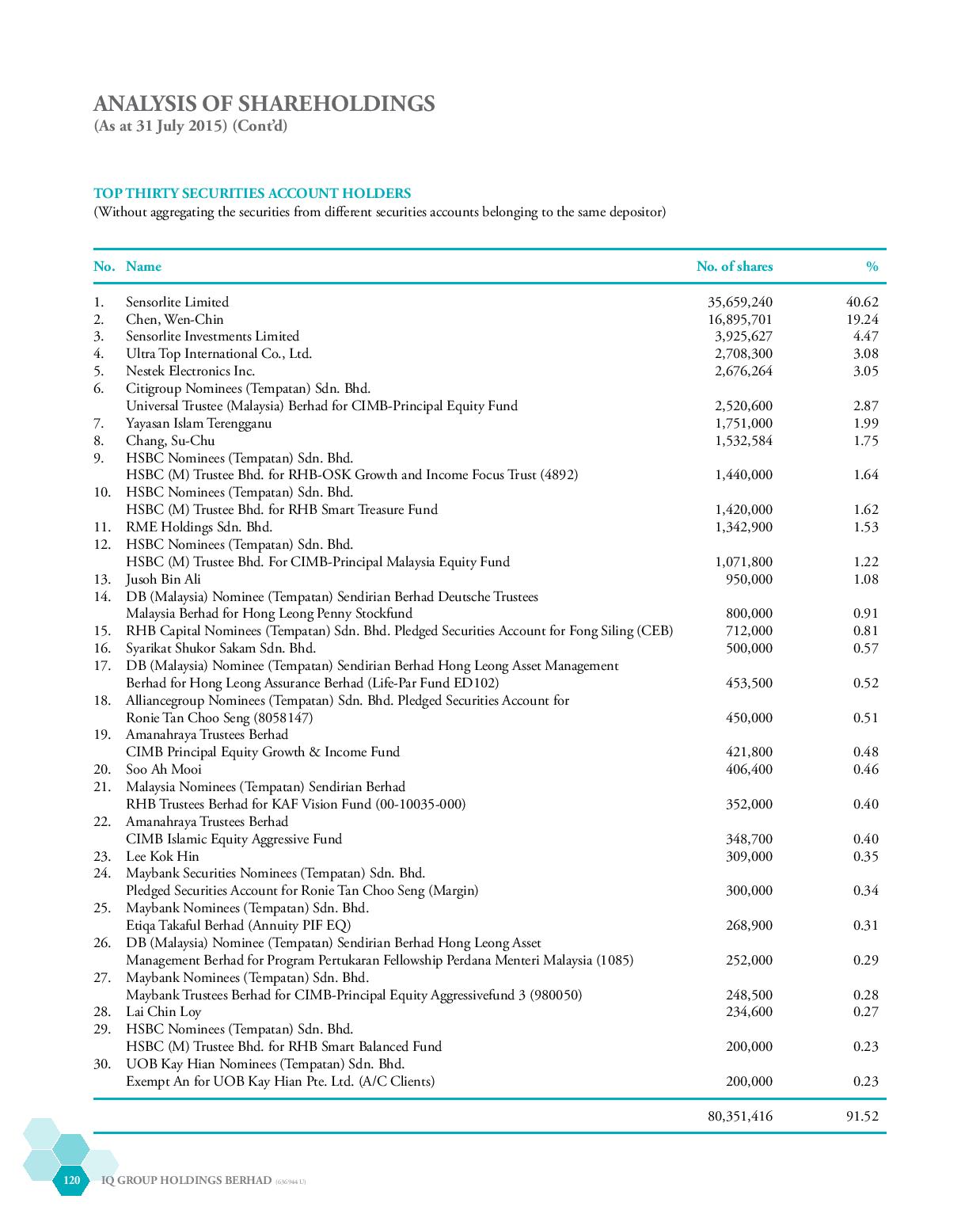

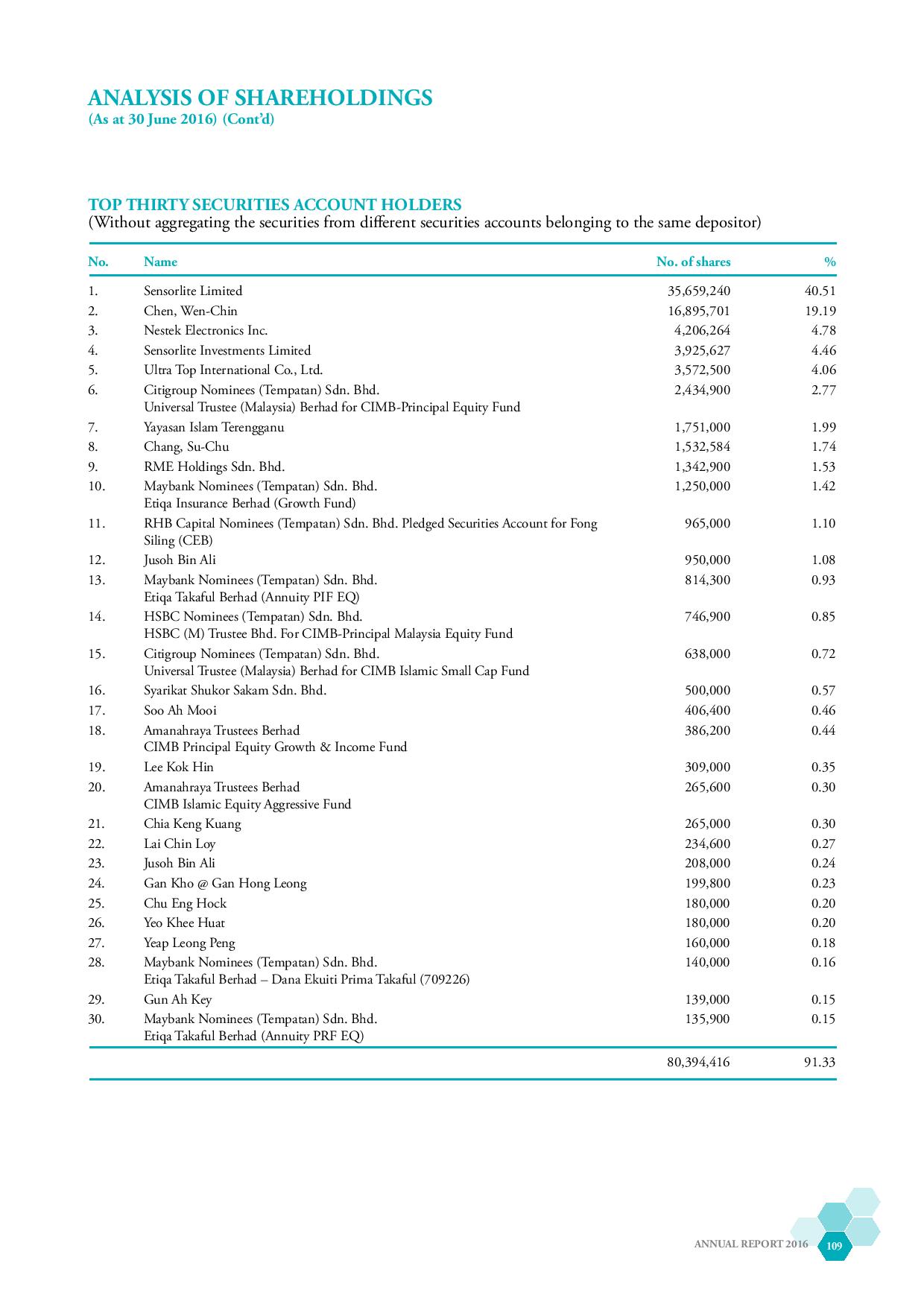

*2015 CIMB RHB Hong Leong Maybank were all buying a stake in IQGROUP..

What about 2016?

*2016 RHB & Hong Leong have left the game..

*CIMB and Maybank are well in it..

*Even Fong Siling (Coldeye) has increased his stake in IQGROUP..

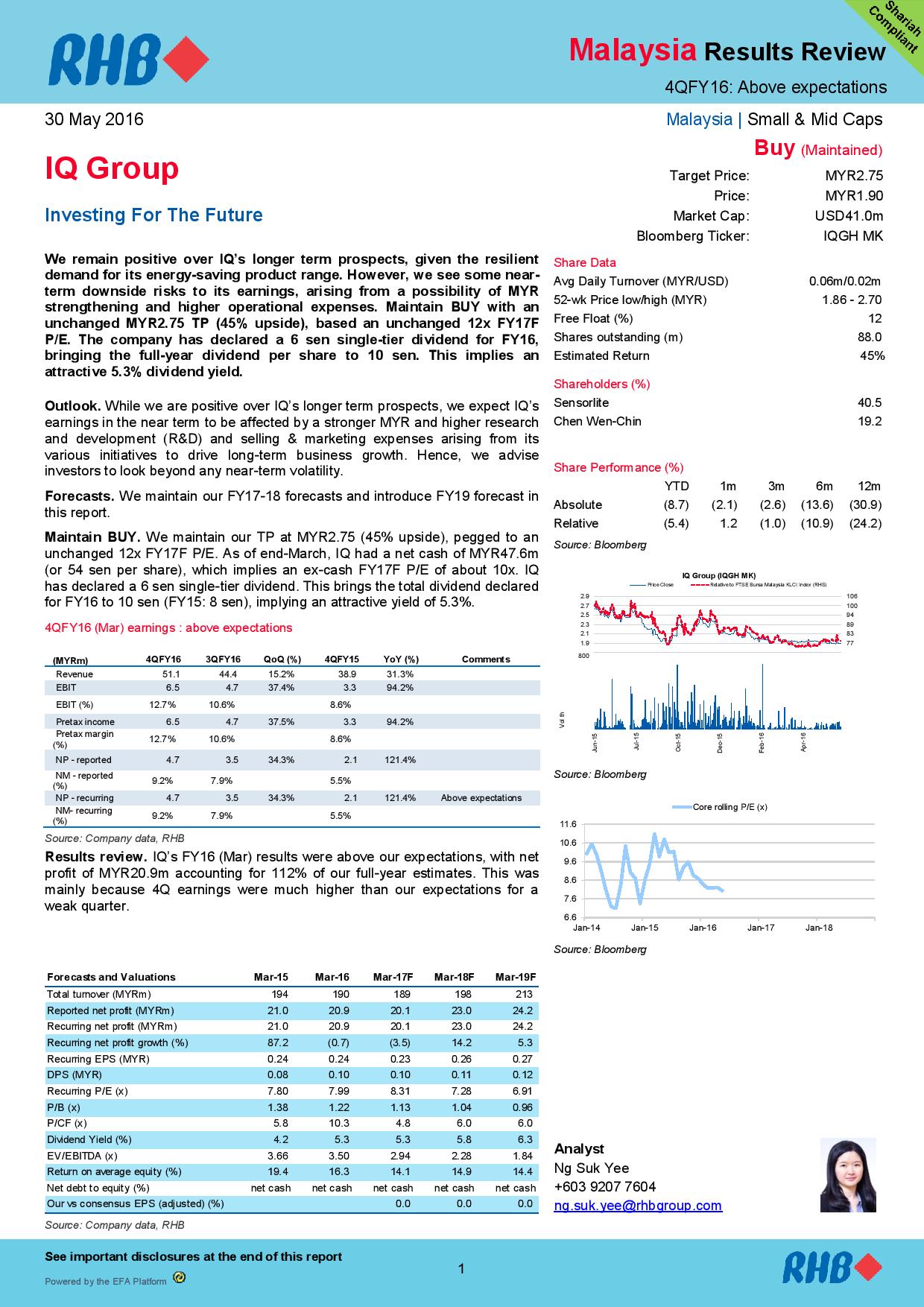

Back in 30th May 2016, RHB has made a Target Price at RM2.75..

Source: RHB

*Resilient demand for its energy-saving products

*Risk on strengthening of RM & higher R&D and selling & marketing expenses

What says the Management?

Thursday, 1 September 2016

Lumiqs brand to generate 30% of IQ revenue by 2020

Beasley said the group spent about 50% of the material cost to import raw materials for its lighting solutions.

“The cost of importation is offset by our sales which are largely in US, allowing use to gain in the foreign exchange,” he added.

Source: TheStar

|

Cash From Financing Activities - |

-6.07 |

-0.53 |

-2.01 |

-2.06 |

|

Financing Cash Flow Items |

-0 |

0.44 |

-0.05 |

2.85 |

|

Total Cash Dividends Paid |

-7.03 |

-3.46 |

- |

- |

|

Issuance (Retirement) of Stock, Net |

0.96 |

2.68 |

0.03 |

- |

|

Issuance (Retirement) of Debt, Net |

- |

-0.2 |

-2 |

-4.91 |

|

|

Foreign Exchange Effects 1.8 |

0.98 |

0.63 |

0.12 |

-0.1 |

|

Net Change in Cash 9.2 |

4.41 |

22.23 |

9.84 |

4.24 |

|

Total Operating Expenses |

45.99 |

44.63 |

39.66 |

36.26 |

|

Selling/General/Admin. Expenses, Total |

11.85 |

10 |

10.42 |

9.98 |

|

Research & Development |

- |

- |

- |

- |

|

Depreciation / Amortization |

1.37 |

1.46 |

1.59 |

1.64 |

|

Interest Expense (Income) - Net Operating |

-0.21 |

-0.22 |

-0.26 |

-0.22 |

|

Unusual Expense (Income) |

- |

- |

- |

- |

|

Other Operating Expenses, Total |

6.47 |

9.02 |

6.74 |

3.08 |

|

*The cost of importation is offset by sales which are largely in USD, allowing to gain in the foreign exchange..

*R&D and selling & marketing expenses is not a problem..

*The group derives most of its revenue from customers in Europe, Japan and the US, and main customers of the firm are said to include big names like OSRAM, OPTEX Co and Hager.

*From OEM ODM..Currently House Branding.. better Profit Margin.. 10% Revenue by 2018.. 30% Revenue by 2020 (Not 10% or 30% current revenue.. 10% 30% of revenue After revenue growth?)

*Will RHB & Hong Leong be back into the game?

*Will other funds buy a stake in IQGROUP?

*Will RHB increase its Target Price for IQGROUP?

*Will there be coverage from other institutions?

http://landofinvestments.blogspot.my/2016/09/iqgroup-from-oem-odm-to-house-branding.html

speakup

when all buy, it's time to SELL!

2016-09-16 17:12