Industry Insights

Singapore property boom is just around the corner

isquare

Publish date: Wed, 12 Aug 2020, 06:41 PM

Singapore 2020-Q2 economy plunged 42.9% from the previous three months due to strict border controls, social distancing rules, and foreign worker shortage. Singapore, which is one of the world’s most open economies, is also one of the countries that hurts the most during this pandemic.

In order to blunt the impact of the pandemic, the Singapore government pumped in nearly SGD 100 billion worth of stimulus. Despite the huge stimulus package, the economy remains sluggish. If you would like to know what the future of the Singapore economy is, you could get a hint from the Monetary Authority of Singapore (MAS).

MAS chief economist Ed Robinson said that its monetary policy “stance remains appropriate including and forestalling a broadening or deepening of disinflationary pressures.” He added that MAS’ key currency gauge, called NEER, and had remained near the middle of its policy band since April.

In short, deflation is expected in the near future and MAS will not depreciate its currency to tackle it. It will print more money to tackle this problem.

If you had been keeping an eye on Singapore’s government action, you are surprised that the government had delayed many mega projects. Changi Airport Terminal 5 and MRT construction are delayed. Hence, we can conclude that the government is not going to undertake any fiscal policy to boost the economy.

In fact, what remains on the table for Singapore’s government is loose monetary policy and inflating the property prices. Hence, we believe the Singapore property market will start to pick up after years of cooling measurements. The property sector, which is an industry with many spillover effects, will be the driver for the Singapore economy in the next 2 years. The High level of household debt and sluggish domestic economy could be solved by creating a housing boom.

If you had been keeping an eye on Singapore’s government action, you are surprised that the government had delayed many mega projects. Changi Airport Terminal 5 and MRT construction are delayed. Hence, we can conclude that the government is not going to undertake any fiscal policy to boost the economy.

In fact, what remains on the table for Singapore’s government is loose monetary policy and inflating the property prices. Hence, we believe the Singapore property market will start to pick up after years of cooling measurements. The property sector, which is an industry with many spillover effects, will be the driver for the Singapore economy in the next 2 years. The High level of household debt and sluggish domestic economy could be solved by creating a housing boom.

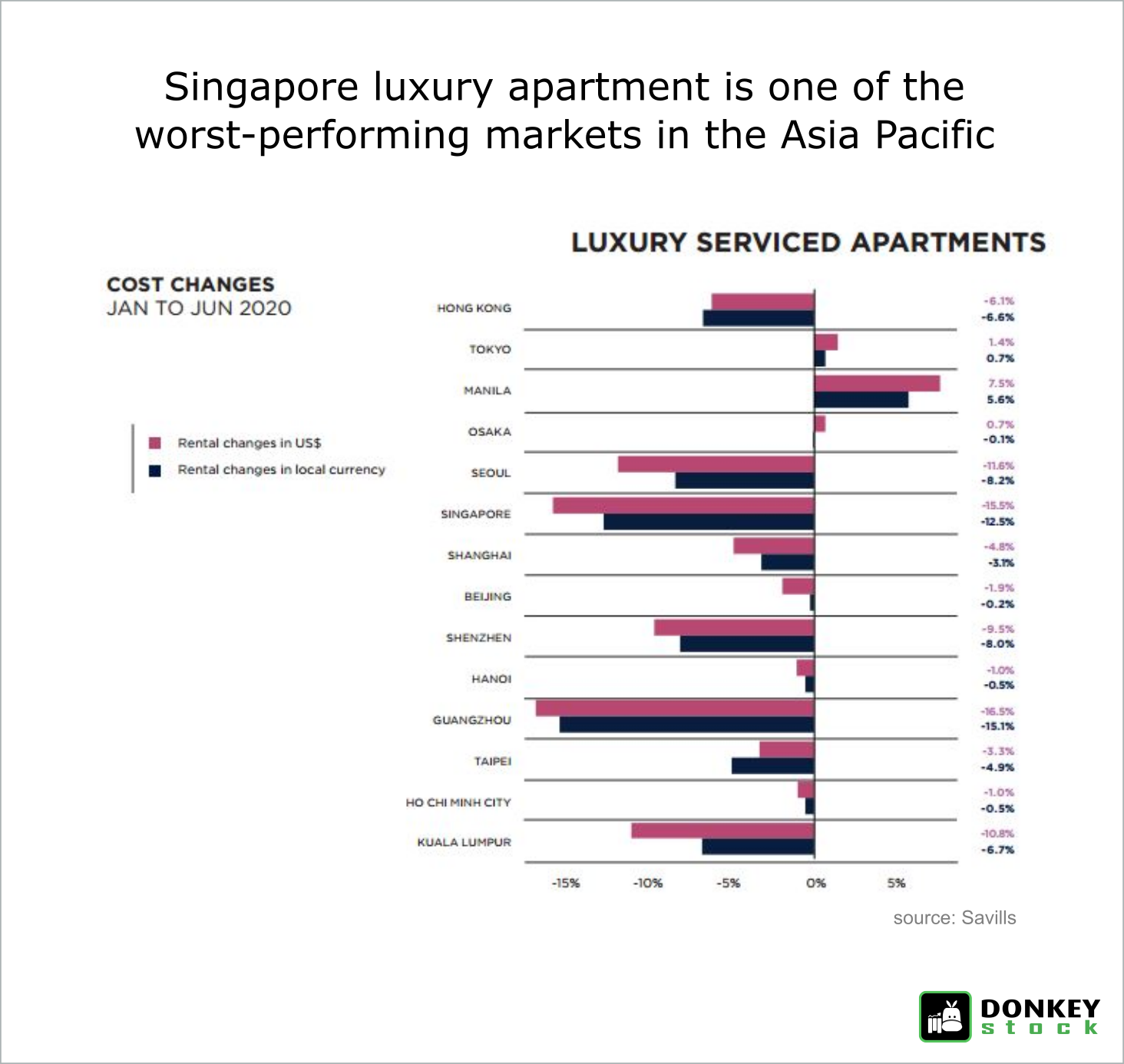

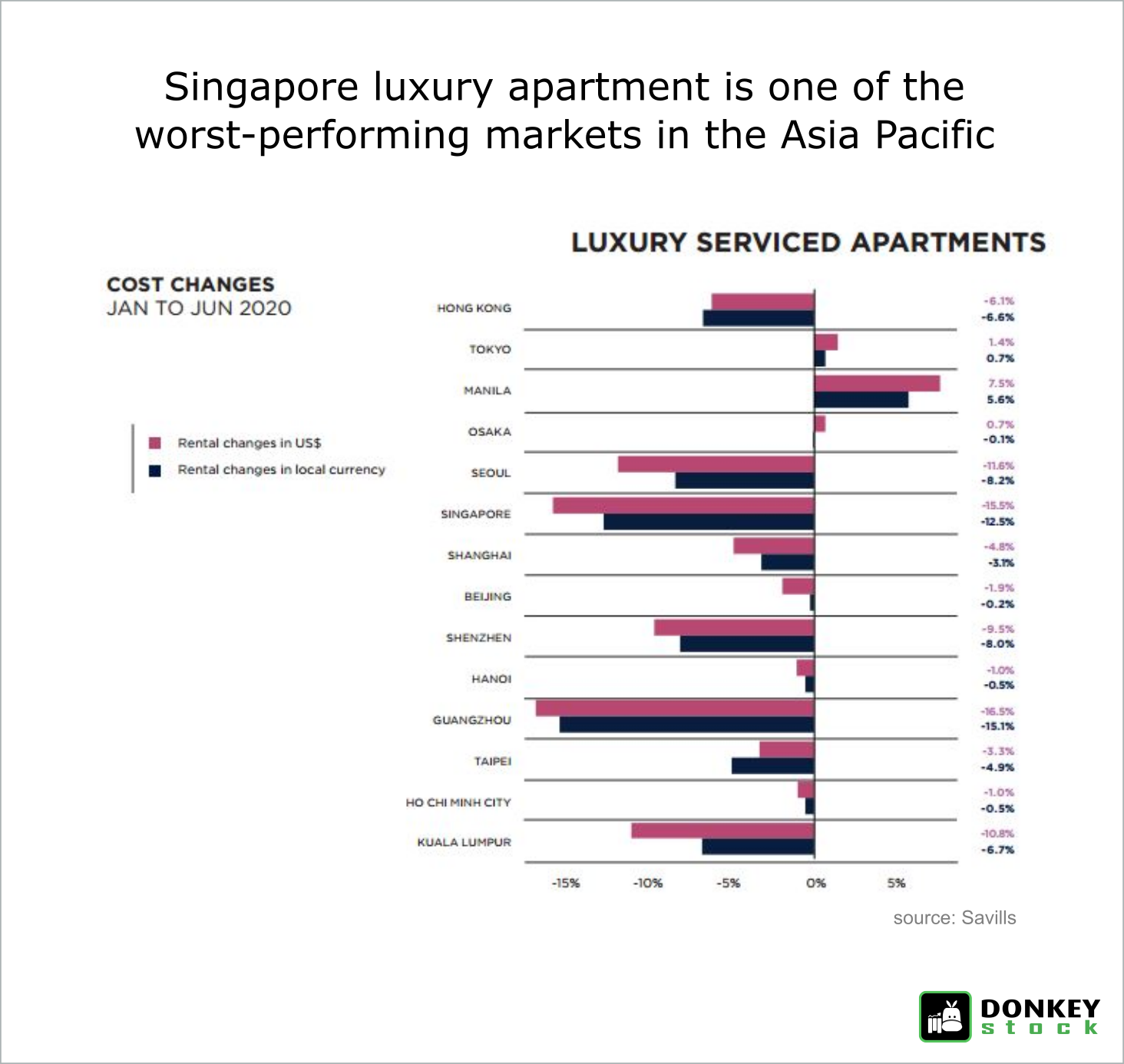

In a report published by Savills Research (Image on top), the rental cost of Singapore luxury apartment is one of the worst-performing markets in the Asia Pacific. This has further given the policymaker an ample space to boost the domestic property market.

Singapore’s efficient government, stable currency, and her military prowess will keep Singapore as the best safe haven in Asia for many of Asia’s high net worth individual. Once the cooling measurement (such as Additional Buyer Stamp Duty) is removed, Singapore property prices will experience what Hong Kong had experienced in the past 10 years.

Take action now!

More articles on Industry Insights

Useful tool to find the next privatized property company on Bursa Malaysia

Created by isquare | Oct 08, 2020

Gold, silver, soybean, wheat, palm oil, all the commodities are in bull run mode.

Created by isquare | Jul 26, 2020

Discussions

Be the first to like this. Showing 0 of 0 comments