Malaysian 14th General Election Special Report

Joe Cool

Publish date: Tue, 06 Feb 2018, 12:40 PM

EITHER positively or negatively, elections will certainly have an impact on a country’s financial market. Or in extreme cases, the results of an election may affect the economy worldwide.

Malaysia is expecting to undergo its 14th General Election anytime within the 2nd quarter of 2018. The uncertainty during the voting season and the results after the election will affect the country’s markets and its economy with many consequences.

These consequences are inevitable. Regardless being a trader or a value investor, your portfolio will definitely be impacted. But the main question that we’re asking here is, how is Malaysia GE14 going to affect the country’s stock exchange?

Elections causes the market to be extremely volatile. Nothing is ever certain. Therefore, investors and traders should cautiously prepare themselves for the journey of uncertainty during this election period and to also bear in mind that the stock market movers are also individual beings with emotions just like you and I.

Past elections and the Stock Market

History is produced by men who are constantly driven by the same feelings and passions throughout their lifetime. Hence, by looking back at past elections, we can identify similar trends that have repeatedly occurred and also identify mistakes that were made during those times to improve ourselves. Generally, stocks that are connected to certain political parties are more likely to escalate prior to the election.

In the 2008 and 2013 elections, the tension was remarkable as both parties had almost equal chances of winning. The political uncertainty had caused major fluctuations in the stock market. According to CNBC, during the GE13 when the ruling coalition won, FTSE KLCI had a major increase reaching a spectacular stock index peak of 1826 points. The sectors that acquired the most benefits were trading and financial services firms.

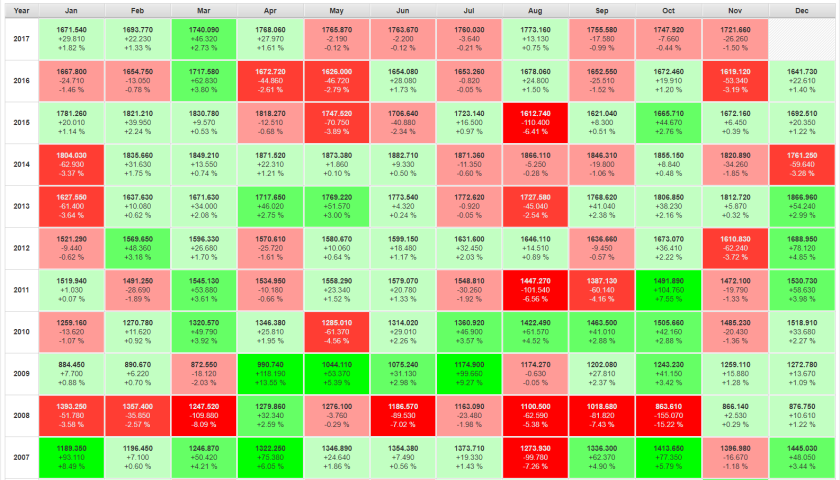

10 Years of KLCI Monhtly Return

Current Malaysian Economy

A rally has started in our stock market ever since Bursa Malaysia released its December 2017 performance that was regarded as the best in the last 5 years due to the upcoming elections and strengthening currency.

Rumours about government-linked companies (GLC) that would benefit from the results of the election contributes to the whirlwind rally. One similar trend that can be seen in this election period is that investors and traders are rushing to purchase GLCs shares. As a result, the KLCI movement have had a spiking increase. However, there are also many other drivers for KLCI:

- The GDP has seen a growth of 5.8% in Q2 2017 since the year 2015. economists have forecasted that the GDP will grow another 5% this year.

- The momentum and uncertainty caused by the GE14 contributes to the increase in KLCI

- According to a report by CIMB, the consumer confidence, business sentiments and corporate earnings lag behind our GDP number. For instance, some large cap stocks are lagging in performance, and lower than expected earnings for BAT, Sime Darby, Digi and Tenaga Nasional.

- MIDF forecasted that FTSE KLCI Target will reach 1900 points in 2018.

- Small and mid-cap are still in focus especially in sectors that are growing such as Rubber, Manufacturing, and Technology

- Last but not least, another main driver for KLCI is that there was huge amount of foreign funds invested into KLCI during the first few weeks of 2018.

Here are our Top 10 Stock watchlist

One of the leading themes for Bursa Malaysia this year would be politics. The expectations for the upcoming elections has ignited a rally and according to The Star News, analysts believes that trading opportunities exist in the pre-election rally. In the past, companies that were government linked were among the big players in the stock market. An analyst stated that “the relationship between politics and the stock market is a bit complex but positively reinforcing.”

You can watch General Election 14th Stock Market Special Report via the URL link: https://s3.amazonaws.com/ivsachart/2018/ge14-week0.mp4

Here are the top 10 stocks selected by Martin Wong, Founder of iVSAChart that are seen to have potential election plays:

1. Axiata Group Berhad (6888.KL)

2. Cahya Mata Sarawak Bhd (2852.KL)

3. Destini Berhad (7212.KL)

4. DRB-Hicom Berhad (1619.KL)

5. Felda Global Ventures Holding Bhd (5222.KL)

6. Maxis Berhad (6012.KL)

7. My E.G. Services (0138.KL)

8. Prestariang Berhad (5204.KL)

9. UEM Sunrise Berhad (5148.KL)

10. Yinson Holdings Bhd (7293.KL)

iVSA Mobile Technology Sdn. Bhd. creates high-quality and unique contents for investors and traders. We prove it by creating educational content and information about companies, updated every week.

Sign up now via the URL link below to receive a series of FREE weekly GE14 newsletter with stock analysis for the next 10 weeks leading up to the GE14 election, where we analyse the major financial news and company background in these GE14 stocks specially just for you.

Interested to learn more?

· Find out more about iVSAChart events via: https://www.ivsachart.com/events.php

· Follow & Like us on Facebook via: https://www.facebook.com/ivsachart/

· Subscribe to our YouTube Channel via: https://www.youtube.com/ivsachart/

· Contact us via: email at sales@ivsachart.com or Call/WhatsApp at +6018 236 9060/ +6018 286 9809/ +6019 645 3376

Disclaimer

All views or opinions articulated in this article and/or related website are expressed in iVSA Mobile Technologies and its writers’ personal capacity and do not in any way represent those of the company, their employers and other related parties.

All published posts and materials made do not constitute as investment advice or recommendations for buy or sell call. iVSA Mobile Technologies and its writers do not take responsibility whatsoever for any loss or damage of any kind incurred from opinion or materials presented in the article and any other materials.

All materials presented are for knowledge sharing purposes and while iVSA Mobile Technologies and its writers will take the best efforts to produce materials that are as accurate as possible based upon publicly available sources that are believed to be reliable, but there is no guarantee as to accuracy of the information provided. All posts may be edited in the future without prior notice.

Conduct your own research and assessment before deciding to buy or sell any stock. If you decide to buy or sell any stock, you are responsible for your own decision and associated risks.

More articles on Malaysia GE14 Stock Special Report

Created by Joe Cool | Mar 11, 2018