GE14 Special Report Week 3 - Destini Berhad

Joe Cool

Publish date: Tue, 27 Feb 2018, 11:55 AM

About Destini Bhd

Destini Berhad is a Malaysia-based investment holding company. The Company is engaged in the provision of management services. The Company operates through two segments: Maintenance, repair, overhaul and training, and Recycling of waste.

The Maintenance, repair, overhaul and training segment is engaged in the maintenance, repair and overhaul of aviation, marine, automobile and safety and tabular handling equipment, and provides training for the use of safety equipment.

The Recycling of waste segment is engaged in extraction and recycling of waste tires for the production of carbon black, diesel fuel and scrap metal.

Its subsidiaries include Destini Prima Sdn. Bhd., Destini Armada Sdn. Bhd., Destini Fire Safety Sdn. Bhd., Destini Engineering Technologies Sdn. Bhd., Destini Info Tech Sdn. Bhd., Destini Australia Pty. Ltd., Destini HRTC Sdn. Bhd., Destini Armada Pte. Ltd., Destini Oil Services Sdn. Bhd., Detrac Sdn. Bhd., Green Pluslink Sdn. Bhd. and Land Auto Technology Sdn. Bhd.

The Board of Directors of Destini consist of directors with very strong social and corporate background. Among them are:

- Tan Sri Dato’ Sri Rodzali Bin Daud, currently independent, non-executive chairman of Destini, was formally the Chief of Royal Malaysian Air Force (RMAF)

- Dato’ Rozamujib Bin Abdul Rahman, currently the Group MD & Executive Director is the Co-owner of R Capital and Caprice Development at the same time UMNO Youth Chief for Arau Division in Perlis and Treasurer of Pergerakan Pemuda UMNO Malaysia

- Dato' Sri Dr. Mohmad Isa bin Hussain, non-independent and non-executive director of Destini is also the Deputy Secretary General of Treasury (investment) at Ministry of Finance, as well as being and independent non-executive director in many government linked corporation such as Pelaburan Hartanah Berhad, Telekom, POS Malaysia, Malaysia Airport Holdings and Export-Import Bank of Malaysia Bhd.

Based on Financial Year (FY) 2016 full year results, Destini achieved RM 354 million turnover, which is categorised as a mid-size corporation based on turnover value. Other aspects of the company’s FY2016 financial results are illustrated in the table below.

|

Company |

Destini Berhad (FY Dec 2016) |

|---|---|

|

Revenue (RM ‘000) |

354.76 |

|

Net Earnings (RM ‘000) |

31.09 |

|

Net Profit Margin (%) |

8.76 |

|

Return of Equity (%) |

6.86 |

|

Total Debt to Equity Ratio |

0.18 |

|

Current Ratio |

1.99 |

|

Cash Ratio |

2.90 |

|

Dividend Yield (%) |

0.00 |

|

Earnings Per Share (Cent) |

3.27 |

|

PE Ratio |

20.81 |

Destini’s revenue has been on a remarkable upward trend since 2012, from RM 56.83 million in FY2012 to RM 354.76 million in FY2016, which translates to a 6 times jump in just 4 years. In terms of net earnings, Destini experienced a similar trend, from RM 7 million in FY2012 to RM 31 million in FY2016 which equals to some 4.4 times increase in just 4 years.

Net profit margin wise, Destini scores a reasonable 8.76% as well as an average Return of equity (ROE) value at 6.86%.

On company’s debt, Destini has a low debt to equity ratio at 0.18 and both current ratio and cash ratio are of good values at 2.90 and 0.36 respectively.

Destini had never paid dividend yet since listing.

Moving forward, despite the challenging economic environment, the diversity range of business of Destini enables the group to mitigate cyclical industry risk and sustain its growth momentum over the upcoming years. Destini plans to focus more on sectors that has growth potentials such as marine time, aircraft servicing and transport business. While exploration and production in oil and gas remains modest, Destini plans to concentrate on areas that are still lucrative such as oil field decommissioning.

In conclusion, although Destini does not pay dividend, it is a good growth company based on their strong revenue and net profit growth over the years. Moreover, it has sound financial figures such as low debt to equity ratio and good current and cash ratios.

Next quarterly results announcement is expected to be in the month of Feb 2018.

News on Destini Bhd

Destini has been chosen as a politically linked counter simply because its group managing director, Datuk Rozabil Abdul Rahman is reportedly the Umno Perlis treasurer that owns a 25.4% stake in the company.

Comparing the past years, the company has been doing well financially. The stock is perceived to have an uptrend due to positive restructuring and also achieving major potential contracts ahead of the coming general election.

Destini secured a contract with Lembaga Tabung Haji-controlled TH Heavy Engineering Bhd worth RM739 million to supply three offshore patrol vessels to the Malaysian Maritime Enforcement Agency early last year. Achieving the contract has supported Destini to rise as a big competition for large defence contracts.

In addition, an ongoing KTM job by Destini to supply 35 motor trolleys and to rail road vehicles is projected to complete by 2019. With negotiations occurring for over a year, Destini could potentially secure new survival and safety maintenance, repair and overhaul (MRO) jobs from KTM in 2018.

In terms of expansion, the company is also looking into mergers and acquisitions (M&A) to expand its commercial aircraft MRO business.

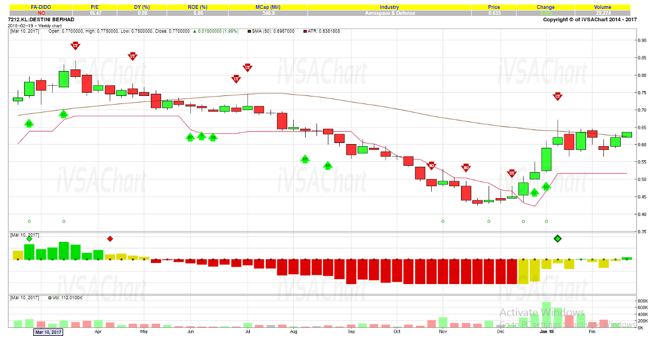

iVolume Spread Analysis Weekly Chart & Comment – Destini

Based on the 1-year weekly iVSAChart above, we noticed some changes in the trend after 9 months of distribution and is currently moving sideways on Stage 1 - accumulation. Bullish volume (green dot circle) started occurring since early November 2017. This is followed by 2 Sign of Strengths and a Green Diamond Buy signal with increasing volume.

We are expecting more Sign of Strengths to be formed in the upcoming weeks to as confirmation that the Smart Money is interested to continue supporting Destini.

Interested to learn more?

Sign up now via the URL link below to receive a series of FREE weekly GE14 newsletter with stock analysis for the next 10 weeks leading up to the GE14 election, where we analyse the major financial news and company background in these GE14 stocks specially just for you.

P.S Upcoming events

1. Market Conference & Investment Outlook 2018

Malaysia is expecting to undergo its 14th General Election (GE14) anytime within the 2nd quarter of 2018. The uncertainty leading up to the 14th general election and the results after the election will affect the country’s markets and its economy with many consequences. But the main question here is, how is Malaysia GE14 going to affect the country’s stock exchange? Featuring high-profile speakers we will share with you How the General Elections this year will Impact the Stock Market and also how you can identify stock opportunities with Growth Potential! Click the link below to find out more!

https://www.ivsachart.com/investconference2018.php

2. Monthly Mini Workshop

Find out more about our iVSAChart mini workshop schedules via: https://www.ivsachart.com/events.php or attend via webinar for the upcoming workshop: https://register.gotowebinar.com/register/5918645092666604803

· Find out more about iVSAChart events via: https://www.ivsachart.com/events.php

· Follow & Like us on Facebook via: https://www.facebook.com/ivsachart/

· Subscribe to our YouTube Channel via: https://www.youtube.com/ivsachart/

· Contact us via: email at sales@ivsachart.com or Call/WhatsApp at +6018 236 9060/ +6018 286 9809/ +6019 645 3376

Disclaimer

All views or opinions articulated in this article and/or related website are expressed in iVSA Mobile Technologies and its writers’ personal capacity and do not in any way represent those of the company, their employers and other related parties.

All published posts and materials made do not constitute as investment advice or recommendations for buy or sell call. iVSA Mobile Technologies and its writers do not take responsibility whatsoever for any loss or damage of any kind incurred from opinion or materials presented in the article and any other materials.

All materials presented are for knowledge sharing purposes and while iVSA Mobile Technologies and its writers will take the best efforts to produce materials that are as accurate as possible based upon publicly available sources that are believed to be reliable, but there is no guarantee as to accuracy of the information provided. All posts may be edited in the future without prior notice.

Conduct your own research and assessment before deciding to buy or sell any stock. If you decide to buy or sell any stock, you are responsible for your own decision and associated risks.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Malaysia GE14 Stock Special Report

Created by Joe Cool | Mar 11, 2018